Gold’s Bullish Bias Fades – What to Expect on Monday?

The precious metal gold prices consolidate in a narrow trading range around 1,683 levels after rising to the highest level since March 9. On Friday, most of the bullish bias was seen on the back of another stimulus plan announced by the Federal Reserve.

The US President Donald Trump is showing willingness to support the USA fight the coronavirus (COVID-19), which eventually seems to help the risk-tone. This time, the Fed will elevate about $2.3 trillion to promote small and medium-sized companies, districts and workers harmed by the coronavirus break.

Increased volatility driven by COVID-19 has driven GOLD prices higher towards the forecast resistance level of 1,689 and the yellow metal has closed a candle below this level.

The consumer price index in the US declined 0.4% from the previous month and grew 1.5% year, which is extremely lower than 2.3% gain in February. The pair got major as energy prices sank by the most in five years, exhibiting one of the stronger-ever breakdowns in oil prices.

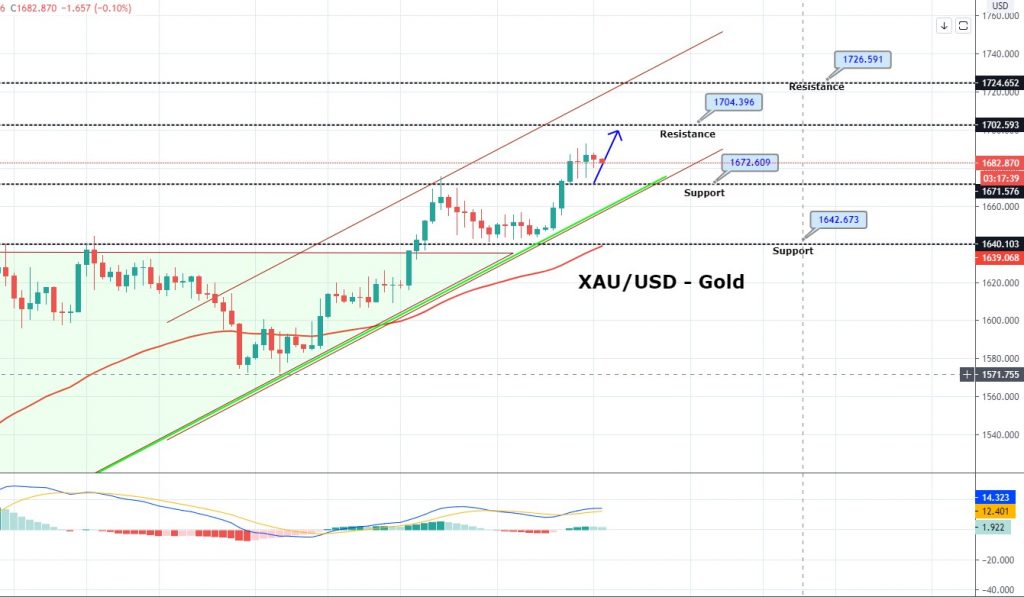

XAU/USD – Daily Technical Levels

Support Resistance

1656.59 1700.91

1629.83 1718.47

1585.51 1762.79

Pivot Point 1674.15

On the four timeframes, the precious metal has formed three white soldiers, which suggest odds of further buying in the pair. Continuation of the upward trend may lead to gold prices towards the next resistance level of 1,702. At the moment, there are odds that gold prices may show correction until 1,676 and 1,669 marks ahead of extending further buying trends today. Good luck!