10 Best Forex Brokers in Australia

The Top 10 Best Forex Brokers in Australia revealed. We have rated and reviewed the best Forex Brokers accepting Australian Traders.

This is a complete listing of The Ten Best Forex Brokers in Australia. In this in-depth write-up, you will learn:

- Who is the Best Suited Broker for Beginner Australian Traders?

- Pros and Cons of Forex in Australia.

- Australian Dollar Accounts and how they work.

- Best Forex Trading Platform

and much, much more!

10 Best Forex Brokers in Australia (2024*)

- ☑️Pepperstone – Overall, the Best Forex Broker.

- ☑️FP Markets– Low-cost broker in Oceania.

- ☑️IC Markets – Best Trading App for Beginners.

- ☑️CMC Markets – Best Customer Service in Australia.

- ☑️AvaTrade – Best Trading Platform with MT4.

- ☑️ThinkMarkets – High levels of client satisfaction

- ☑️Eightcap – Low forex and CFD fees in Australia.

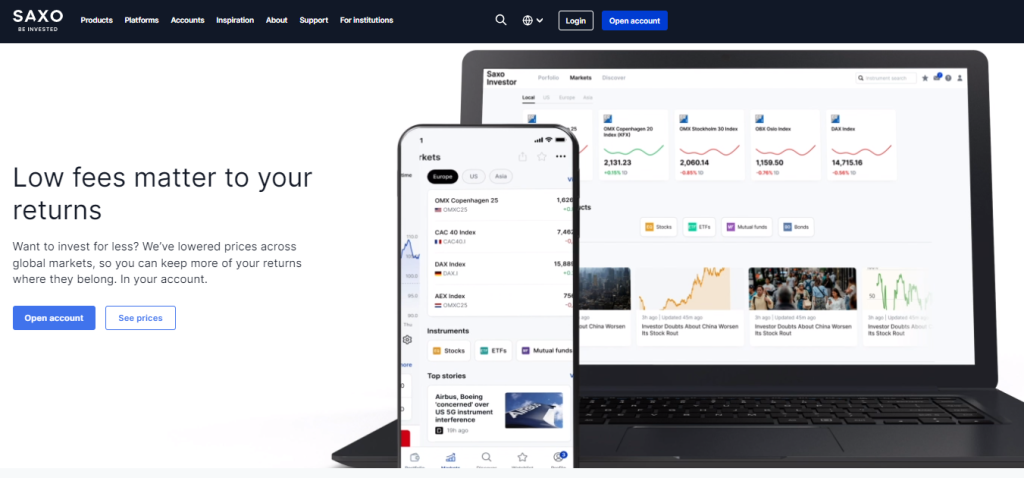

- ☑️Saxo Group – Low Spread Broker in Oceania.

- ☑️Multibank Group – Spread betting opportunities.

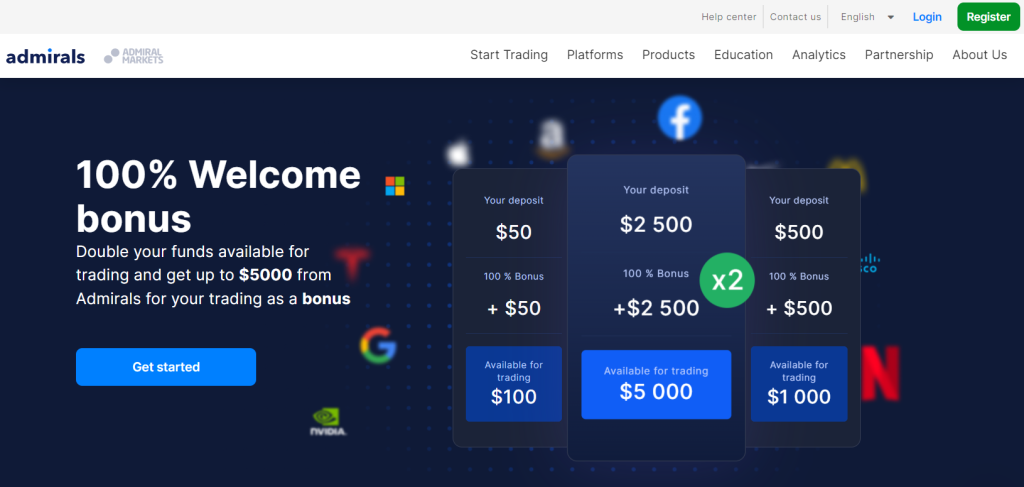

- ☑️Admirals – High welcome bonus in Forex Trading.

Best Forex Brokers in Australia

| 👥 Broker | 👉 Open Account | 💰 Minimum Deposit | ⚖️ Regulation | ✔️ Accepts Australia Traders |

| Pepperstone | 👉 Open Account | 200 AUD | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | ✔️ |

| FP Markets | 👉 Open Account | 100 AUD | ASIC, CySEC, FSCA, FSA, FSC | ✔️ |

| IC Markets | 👉 Open Account | 300 AUD | ASIC, CySEC, FSA, SCB | ✔️ |

| CMC Markets | 👉 Open Account | 0 AUD | BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA | ✔️ |

| AvaTrade | 👉 Open Account | 150 AUD | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | ✔️ |

| ThinkMarkets | 👉 Open Account | 0 AUD | JFSA, CySEC, FSCA, CIMA, FSA, FSC, FCA | ✔️ |

| Eightcap | 👉 Open Account | 150 AUD | CySEC, SCB, ASIC, FCA | ✔️ |

| Saxo Group | 👉 Open Account | 0 AUD | FCA, CONSOB, MAS, FINMA, FSA, FSCA, JFSA, SFC, ASIC, | ✔️ |

| Multibank Group | 👉 Open Account | 80 AUD | ASIC, BaFin, FMA, CNMV, RAK, FSC BVI, CIMA | ✔️ |

| Admirals | 👉 Open Account | 1.50 AUD | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA | ✔️ |

10 Best Australian Forex Brokers

Pepperstone

Who should use Pepperstone?

Pepperstone is great for Australian forex traders who value fast execution times and easy access to various trading products via user-friendly platforms such as MetaTrader 4, MetaTrader 5, and CTrader.

What does Pepperstone do best?

Pepperstone thrives on offering low spreads and costs, making it affordable for scalpers and algorithmic traders. Their customer service is highly regarded, and local support understands the Australian trading environment.

Where can Pepperstone improve?

Pepperstone’s teaching tools could be expanded to provide more in-depth materials for new traders. Furthermore, they might provide more account kinds to accommodate traders with varied investment sizes and tactics.

Pepperstone Pros and Cons

| ✔️ Pros | ❌ Cons |

| ASIC regulates Pepperstone to ensure compliance with Australian trading standards | The product portfolio is limited in comparison to some multinational brokers |

| Low spreads are useful for frequent traders | Beginners could benefit from more extensive educational resources |

| There are no fees for deposits and withdrawals, which reduces transaction expenses | They do not offer banking services because they are solely a Forex and CFD broker |

| Local customer support is provided, providing specialized assistance | Could provide more account types, like a Cent Account for beginners |

| Advanced technology infrastructure designed for high-speed trade |

FP Markets

Who should use FP Markets?

FP Markets is an excellent choice for Australian traders searching for advanced charting tools and a direct market access (DMA) trading environment. They cater to both new and experienced traders, offering a variety of platforms, including Iress, MetaTrader 4, and MetaTrader 5.

What does FP Markets do best?

FP Markets excels at its ECN pricing approach, which offers tight spreads and quick execution times. They also provide various instruments, including currencies, stocks, metals, commodities, and indexes.

Where can FP Markets improve?

FP Markets can improve by expanding their instructional offerings to provide more complete training to novice traders. Furthermore, while they offer a wide choice of instruments, their cryptocurrency offers are limited compared to other brokers.

FP Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| ECN pricing with tight spreads | There are limited cryptocurrency trading possibilities |

| There are limited cryptocurrency trading possibilities | Beginners could benefit from more comprehensive educational materials |

| Offers the advanced IRESS platform for professional traders | There are no forex-specific bonuses or promotional incentives |

| Strong compliance with ASIC regulations | Customer support response time can be improved |

| Competitive commission rates |

IC Markets

Who should use IC Markets?

IC Markets is ideal for aggressive traders in Australia, especially scalpers and algorithmic traders that require tight spreads and quick execution times. It particularly appeals to individuals who use Expert Advisors (EAs) because of its robust infrastructure and support for automated trading.

What does IC Markets do best?

IC Markets excels in providing true ECN connectivity, which results in tight spreads and consistent execution with low slippage. Their significant leverage options and extensive liquidity from diverse global banks and financial institutions set them apart.

Where can IC Markets improve?

IC Markets can improve by expanding its educational offerings to serve beginners who may find the comprehensive platform options daunting. They might also improve their local customer support offerings to provide more personalized assistance to Australian customers.

IC Markets Pros and Cons

| ✅ Pros | ❌ Cons |

| True ECN broker with extremely narrow spreads | More sophisticated instructional resources for beginning traders would be useful |

| Traders have high leverage choices | Customer service could provide greater regional assistance to Australian traders |

| Strong liquidity leads to dependable transaction execution | Beginners may feel overwhelmed by the variety of advanced tools available |

| Support for a variety of trading platforms, including MT4, MT5, and cTrader | There are no supplementary services, such as wealth management or stockbroking |

CMC Markets

Who should use CMC Markets?

CMC Markets is ideal for traders who appreciate diverse financial instruments and a feature-rich customized trading platform. It is ideal for seasoned traders who need complex charting tools and a variety of technical indicators.

What does CMC Markets do best?

CMC Markets’ Next Generation trading platform stands out for its new features, straightforward interface, and rich charting capabilities. They also stand out for their diverse product offering, including a wide range of CFDs for trading.

Where can CMC Markets improve?

CMC Markets can improve by cutting forex trading costs to compete with other low-cost brokers. They could also increase their training offerings to better serve novices in Australia who are new to Forex trading.

CMC Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| A wide range of tradable instruments | Trading costs could be more competitive. |

| An advanced proprietary trading platform with numerous capabilities | Beginners may find the platform too difficult. |

| High-quality research and instructional resources | Limited forex trading bonuses and promotions. |

| A strong regulatory structure and a solid background | |

| Competitive spreads over a wide range of instruments |

AvaTrade

Who should use AvaTrade?

AvaTrade is suitable for traders seeking a regulated broker with a wide selection of trading instruments and an easy-to-use trading platform. It is ideal for individuals new to Forex trading because of its extensive training resources and user-friendly platforms.

What does AvaTrade do best?

AvaTrade provides various automated trading systems, including DupliTrade and ZuluTrade, which enable copy trading and enhanced market analysis via tools such as AvaProtect.

Where can AvaTrade improve?

AvaTrade could improve by expanding its customer service to provide more targeted, 24/7 support. They should also lower their spreads to better compete with other low-cost brokers.

AvaTrade Pros and Cons

| ✔️ Pros | ❌ Cons |

| Regulated in many jurisdictions to ensure a secure trading environment | Spreads are wider than those charged by certain other brokers |

| Provides a variety of automated trading platforms and tools | Customer service is not available around the clock |

| Offers a variety of educational aids to beginner traders | Inactivity fees may be an issue for less active traders |

| User-friendly interfaces for both online and mobile platforms | |

| Offers over 1,260 financial instruments that can be traded |

ThinkMarkets

Who should use ThinkMarkets?

ThinkMarkets is a suitable broker for traders trading Forex, cryptocurrencies, stocks, and commodities. It offers tight spreads and options on popular MetaTrader platforms or the firm’s own ThinkTrader platform.

What does ThinkMarkets do best?

Through its STP methodology, ThinkMarkets offers ultra-tight, ECN-style spreads, diverse trading instruments, and an Islamic account for traders, including those following Sharia law.

Where can ThinkMarkets improve?

ThinkMarkets should strengthen its educational offerings by providing more comprehensive material for beginners. Also, while they provide a choice of trading platforms, certain traders may prefer more advanced platform capabilities.

ThinkMarkets Pros and Cons

| ✔️ Pros | ❌ Cons |

| Provides ECN pricing with tight spreads | Educational resources might be insufficient for beginners |

| A wide range of trading instruments, including more than 3,600 CFDs | Trading platforms offer fewer complex features than some competitors |

| Offers common MetaTrader platforms as well as ThinkTrader, an award-winning custom platform | The ThinkZero account requires a high $500 minimum deposit |

| Competitive commission rates, particularly on the ThinkZero account | ThinkZero account holders incur commission costs on certain trades |

| Charges ECN pricing with tight spreads | ThinkMarkets might not be the best alternative for traders who require considerable platform customization |

| A wide range of trading instruments, including more than 3,600 CFDs |

Eightcap

Who should use Eightcap?

Eightcap provides MT4 and MT5 platforms on desktop, web, and mobile, suitable for beginners and experienced traders, offering user-friendly yet feature-rich options.

What does Eightcap do best?

The broker provides competitive spreads, minimal forex fees, and easy account opening, ensuring traders receive the best market prices through top-tier liquidity providers.

Where can Eightcap improve?

The company could enhance its product range, research, and teaching resources by introducing CFDs, market research, and educational content to cater to its clientele better.

Eightcap Pros and Cons

| ✔️ Pros | ❌ Cons |

| Low trading costs and spreads | Limited financial instruments besides Forex and CFDs |

| Quick and easy account opening | Educational and research tools could be enhanced to provide more support |

| Free deposits and withdrawals | More details are provided for demo account signup than rivals |

| Flexible and user-friendly MetaTrader platforms | Insufficient 24/7 customer service |

| Offers swap-free Islamic accounts | Lacks TradingView integration for charting and analysis |

Saxo Group

Who should use Saxo Group?

Saxo Group is ideal for traders searching for a comprehensive trading experience, with diverse market offers outside currency. It is suitable for traders interested in both domestic and international stockbroking services, as well as Forex.

What does Saxo Group do best?

Saxo Group’s SaxoTraderGO and SaxoTraderPRO are renowned for their reliability, execution speed, and extensive toolset, offering access to over 71,000 instruments and superior equity research tools.

Where can Saxo Group improve?

However, Saxo Group should increase its leverage offers. For retail clients, the leverage rate for forex trading is limited to 30:1, which is lower than some other top forex brokers. Moreover, this may hinder traders looking for larger leverage choices.

Saxo Group Pros and Cons

| ✔️ Pros | ❌ Cons |

| Saxo charges minimal spreads and competitive costs | The leverage available is much lower than that of other forex brokers |

| They offer a wide range of markets, such as Forex, CFDs, stocks, and ETFs | The Platinum and VIP accounts have substantial initial deposit requirements (200,000 USD – 1,000,000 USD) |

| The platforms available, SaxoTraderGO and SaxoTraderPRO, are extremely advanced and ideal for both novice and experienced traders | Trading options and futures carries high fees |

| Saxo pays income on uninvested capital, which is advantageous for traders | Saxo does not provide spread betting services |

| There is no withdrawal fee and a large selection of base currencies |

Multibank Group

Who should use Multibank Group?

Multibank Group is ideal for traders searching for a multi-regulated ECN broker that provides a diverse range of over 2,000 forex and CFD instruments across various MetaTrader platforms.

What does Multibank Group do best?

They offer a variety of trading tools, such as social trading, managed accounts, API connectivity, a free VPS, and the Autochartist software, which is useful for traders seeking detailed market scans and trading recommendations.

Where can Multibank Group improve?

The broker’s basic research and educational resources may be insufficient for beginners, and their product offerings are limited to Forex, CFDs, and cryptocurrencies, with an inactivity fee.

Multibank Group Pros and Cons

| ✔️ Pros | ❌ Cons |

| Charges tight spreads and inexpensive trading fees, particularly for Forex | Charges an inactivity fee after an account has been dormant for several months |

| Provides social trading functionality | Educational materials and research tools are limited |

| A selection of accounts to meet different trading demands and styles, with leverage of up to 500:1 | The broker's product offerings are primarily limited to Forex, CFDs, and cryptocurrencies |

| You can trade on either the MT4 or MT5 platforms | The account opening process can be tedious and time-consuming |

| Traders can get free VPS hosting | Customer care is not available 24/7 |

Admirals

Who should use Admirals?

Admirals (previously Admiral Markets) is a brokerage firm that caters to forex traders who are familiar with MetaTrader platforms and searching for a broker with a wide range of trading tools and training resources.

What do Admirals do best?

Admirals offers a variety of trading products, including Forex, CFDs, and cryptocurrencies. It uses reliable MetaTrader 4 and 5 platforms with advanced technical analysis tools.

Where can Admirals improve?

Admirals’ customer service needs improvement, including 24-hour support, a wider product portfolio, and a more suitable inactivity fee for non-active traders.

Admirals Pros and Cons

| ✔️ Pros | ❌ Cons |

| They provide inexpensive forex CFD costs and a simple account opening process | The product offering is primarily limited to CFDs. |

| Deposits and withdrawals are free and quick | The lack of 24/7 customer service may not suit many traders' schedules. |

| The usage of MetaTrader 4 and 5 provides a high level of trading flexibility and access to multiple markets | |

| Offers a $100 no-deposit bonus to newly registered traders | |

| Well-regulated and has a solid background as a reputable broker |

How to Choose a Forex Broker in Australia

When selecting a Forex broker in Australia, traders must consider characteristics corresponding to local financial norms and legislation.

ASIC Regulation: Prioritize brokers regulated by the Australian Securities and Investments Commission (ASIC) for compliance with local investor protection legislation.

- Risk Management: Australian traders should look for brokers who provide robust risk management solutions such as negative balance protection.

- Market Research: Use brokers who give comprehensive market research and analysis, focusing on Australian economic data and events.

- Australian Dollar pairings: To utilize local market knowledge, look for brokers who offer a wide choice of AUD currency pairings.

- Competitive Spreads: With Australia’s dynamic market, look for brokers with competitive spreads to enhance your trading cost-effectiveness.

- Deposit and Withdrawal choices: To avoid currency conversion fees, prefer brokers that offer local banking choices with AUD accounts.

- Global Access: Ensure they provide access to global currency markets, rather than simply local pairs, to allow for more diverse trading tactics.

- Local Customer Support: Choose brokers with local offices or dedicated Australian customer care teams to ensure assistance is available in your time zone.

- Education and Resources: A broker offering extensive educational content on the forex market and trading tactics is essential for Australian beginners.

- Platform Technology: Ensure that the trading platform matches your strategy, whether MetaTrader for automation or a proprietary platform with specific tools.

Conclusion

Forex Brokers in Australia offers traders a comprehensive selection of reputable and regulated platforms to engage in forex trading. These brokers provide a wide range of features, including competitive spreads, advanced trading platforms, regulatory compliance with authorities such as the Australian Securities and Investments Commission (ASIC), and robust customer support.

Faq

The top Forex broker in Australia varies based on the trader’s unique requirements. However, Pepperstone comes highly recommended for its low spreads, diverse trading platforms, and excellent customer support.

They are praised for their swift execution speeds and strong presence in Melbourne, where they have a dedicated local customer service team.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain the top trading platforms in Australia because of their extensive use, reliability, and interoperability with brokers such as Pepperstone, IC Markets, and others.

Yes, Forex trading in Australia is authorized and regulated by the Australian Securities and Investments Commission (ASIC), providing a secure trading environment.

Beginners in Australia can benefit from firms like AvaTrade and Admirals, which offer user-friendly platforms and educational tools to help them navigate forex trading.

Professional traders in Australia can select brokers like IC Markets or Saxo Bank, which provide minimal forex costs, advanced trading platforms, and a diverse range of currencies and trading instruments.

ASIC regulates forex trading in Australia, ensuring trader protection through measures such as segregation of client money and strict leverage restrictions for retail traders.

Yes, leverage is permitted in Australian Forex trading, with ASIC limiting it to 30:1 for major currency pairs and lower for exotic pairs and other products.

While negative balance protection is not a legislative obligation in Australia, certain brokers may offer it freely. Traders should confirm their broker’s policy for negative balance protection.

It is critical to compare the spreads and commissions of several brokers. Brokers like Pepperstone and IC Markets offer reasonable spreads and commissions.

ASIC-regulated brokers must separate customer funds from firm funds to protect traders’ capital.