Monero (XMR) Explodes 40%, Dumps 20% as $220M Flows In

Monero surged 40% to $320 before dropping back 20%. Find out why XMR’s wild moves matter and what key technical levels traders are now watch

Quick overview

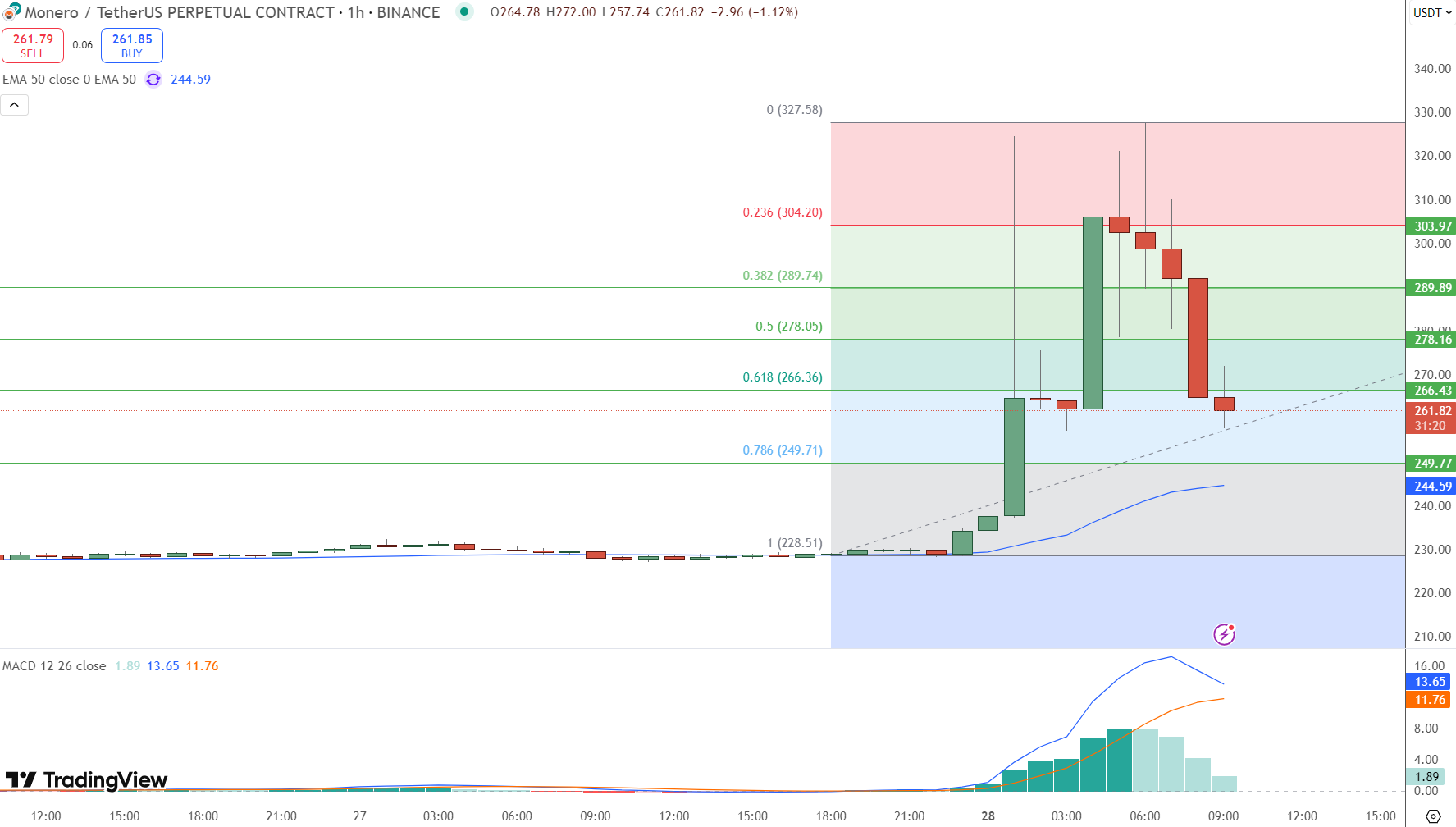

Monero (XMR) surged 40% on Sunday, hitting $327.58—the highest since May 2021. But it was short lived. Within hours XMR gave back almost 20% of those gains and dropped to around $261 by Monday morning.

The move was fueled by a massive increase in trading volume which quadrupled from a 7 day average of $50 million to over $220 million in 24 hours. With no fundamental news behind the move many think it was speculative momentum and thin order books that drove the initial move higher—and the quick reversal that followed.

Monero’s privacy first design is still a big draw but the whipsaw action is a reminder of the volatility that can hit lesser liquid altcoins when there is high interest.

Bitcoin Holds Steady While Crypto Markets Calm Down

While Monero stole the weekend headlines Bitcoin (BTC) was relatively quiet. BTC is still above $93,000 and showing strength despite the broader market turmoil. Positive sentiment around US-China tariff easing and consistent inflows into spot Bitcoin ETFs is helping to cushion the downside.

Elsewhere Ethereum (ETH) and XRP are up modestly as more institutional crypto products are expected to launch in the coming months.

XRP Leads Altcoin Gains Ahead of ETF Launch

XRP is up 4% today as ProShares XRP Futures ETF is set to launch on April 30. Other altcoins like Cardano (ADA) and Solana (SOL) are up smaller but the overall market is still at key resistance.

Investor attention is divided between new ETF approvals, regulatory discussions and macroeconomic news so volatility is high across the major tokens.

Monero Technical Analysis: $266.40 Is Key

After the wild ride Monero (XMR/USDT) is consolidating at $261.80. The price is holding just below the 61.8% Fibonacci retracement at $266.40. The 50 hour EMA ($244.59) is providing support below.For newbies this is a “retracement retest”—where price tries to find a new floor after an overbought move.

Trade:

- Buy Rebound: Above $266.40

- Targets: $278.00 and $289.80

- Support: $249.70

- Stop: Below $249.00

Be patient—wait for a clean retest of $266.40 before looking to long.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account