Ethiopia raises $24 million selling 10% stake in Ethio Telecom

Ethiopia raised $24 million by selling a 10 percent stake in Ethio Telecom during its four-month-long initial public offering.

Quick overview

- Ethiopia raised $24 million by selling a 10 percent stake in Ethio Telecom during a four-month IPO.

- The country aimed to sell 100 million shares to raise 30 billion birr, but the offer fell short due to restrictions on the Ethiopian diaspora and institutional investors.

- The sale is part of efforts to establish the Ethiopian Securities Exchange and liberalize the economy under Prime Minister Abiy Ahmed's regime.

- Ethio Telecom plans a second round of IPO for the remaining unsubscribed shares, with expectations of up to 50 businesses listing on the new market in the next five years.

Ethiopia raised $24 million by selling a 10 percent stake in Ethio Telecom during its four-month-long initial public offering.

The country purchased 10.7 million shares in Ethio Telecom for 300 birr each. Ethio Telecom stated this in a recent statement on Friday. Ethiopia Investment Holdings, with ownership of 40 state-owned companies, and the telecom firm, intended to sell 100 million shares in hopes of garnering 30 billion birr from the sale.

Ethio Telecom’s Chief Executive Officer, Frehiwot Tamru, stated the offer did not meet the required target as the Ethiopian diaspora and other institutional investors were blocked from participating in the IPO auction.

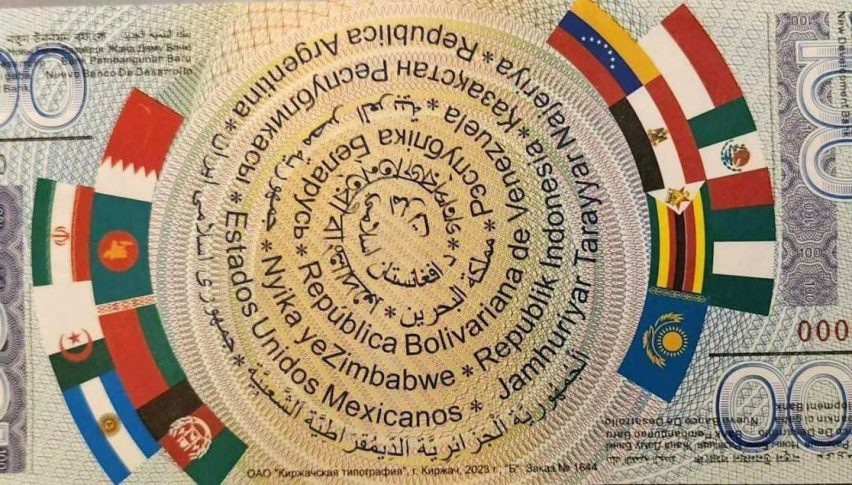

In any case, the sale facilitates the establishment of the Ethiopian Securities Exchange, one of the many efforts undertaken by Prime Minister Abiy Ahmed’s regime to liberate the economy. The country lifted half a century of currency restrictions and relaxed business regulations to attract investment.

“As for shares left unsubscribed, we will inform when we are going on a second round IPO,” Tamru explained. Ethio Telecom had 81 million subscribers in January, and 61.9 billion birr revenue for the six months ending January 7.

The nation had a stock market for 14 years before the military’s coup of Emperor Haile Selassie in 1974 and the subsequent prohibition of share trading.

Up to 50 businesses are expected to list on the new market over the next five years, with some choosing to do so through a procedure called “listing by introduction” that does not require an IPO.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account