Bitcoin (BTC) – Bears Still Eye $73,500 As Price Faces A Wall Of Resistance

Quick overview

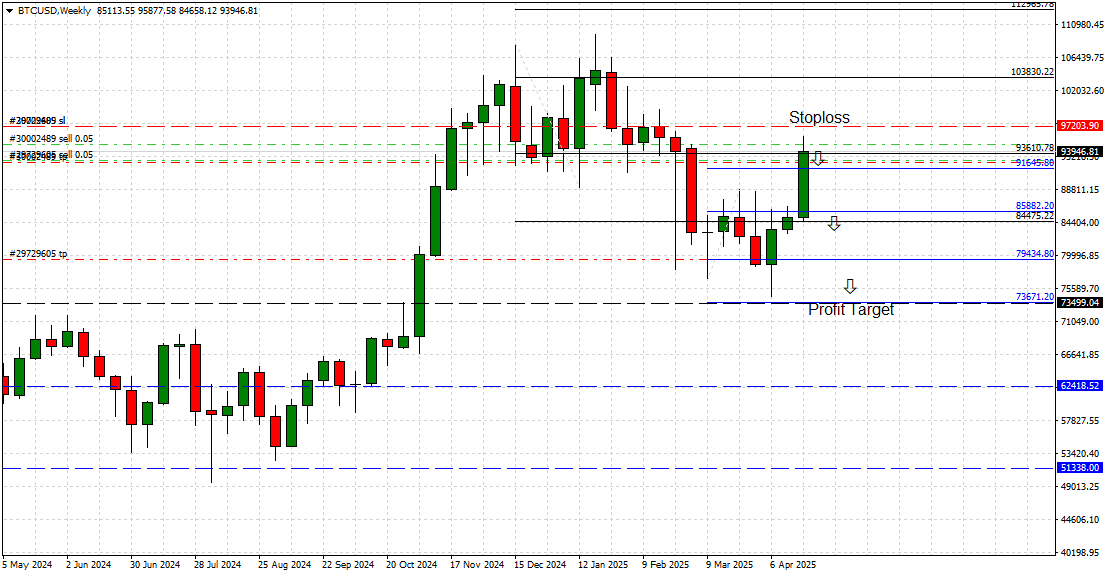

- Bitcoin is nearing a critical resistance zone between $91,645 and $93,610, which will influence its next price movement.

- Failure to maintain above these resistance levels could lead to a decline towards the key support level of $73,500.

- Despite current bearish trends, Bitcoin's long-term potential as a foundational digital asset remains strong due to increasing institutional interest and technological advancements.

- Traders should monitor price reactions at these key levels closely, as they will dictate the market's direction in the near future.

Bitcoin (BTC) is now approaching a decisive inflection point, with price action pressing against a confluence of two major resistance levels at $93,610 and $91,645.

These adjacent zones represent a significant structural barrier that could dictate the next directional move for Bitcoin in the coming days and weeks.

The market’s ability — or inability — to reclaim and sustain above these levels will likely define whether BTC can initiate a meaningful rebound or slip back into the broader correction pattern we’ve been tracking since mid-March.

Technical Outlook: Bulls Facing a Tall Order

Notably, both resistance areas coincide with former high-volume nodes and prior breakdown points — amplifying their relevance as technical barriers. Should BTC fail to generate sustained acceptance above $93,610, the bearish narrative outlined in our earlier forecasts remains firmly intact.

A rejection from this resistance confluence could trigger renewed selling pressure, dragging Bitcoin down toward the major key support at $73,500 — a level aligned with the 38.2% Fibonacci retracement from the Dec 2022 bull run lows to the all-time highs near $110,000.

Key Levels to Watch:

Immediate Resistance: $91,645

Major Resistance: $93,610

Downside Short-term Support: $79,435

- Downside Medium-term Support: $73,500

Bearish Invalidation (Stoploss): Sustained close above $97,225

Until Bitcoin conclusively clears these resistance levels, the prevailing bias leans bearish, with a likely retest of lower supports should bulls fail to assert control.

Bitcoin Technology and Vision

Despite near-term technical weakness, Bitcoin’s role as the foundational digital asset remains unchallenged. With increased institutional allocation, regulatory clarity on the horizon, and growing integration with traditional finance, Bitcoin continues to evolve beyond a speculative asset into a globally recognized monetary network.

Innovations like the Lightning Network are expanding Bitcoin’s utility for microtransactions and instant cross-border payments, while increased adoption of Bitcoin ETFs and futures positions underscore mainstream financial interest.

In the long run, Bitcoin’s vision of a borderless, decentralized financial system remains one of the strongest narratives in the digital asset space.

Conclusion

Bitcoin stands at a technical crossroads. A failure to breach the dual resistance wall at $91,645–$93,610 would confirm ongoing bearish momentum and pave the way for a potential decline toward the crucial $73,500 support zone.

Unless bulls stage a strong breakout, the path of least resistance remains to the downside. Traders should stay alert for price reactions at these key levels in the coming sessions.

Trend Bias: Bearish

Conviction Level: High (if rejection holds below $93,610)

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account