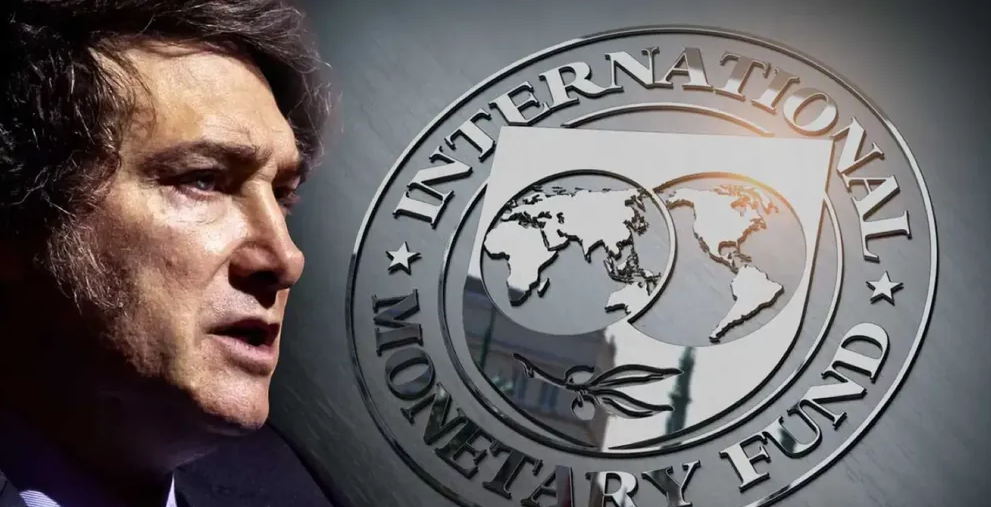

IMF Projects Strong Rebound for Argentina’s Economy

The International Monetary Fund (IMF) anticipates a slowdown in economic activity across Latin America and the Caribbean this year.

Quick overview

- The IMF predicts a slowdown in economic activity across Latin America and the Caribbean, with Argentina expected to experience a significant rebound.

- Regional growth is projected to decline from 2.4% last year to 2% in 2025, before returning to 2.4% in 2026.

- Valdés emphasized the need for countries to strengthen public finances and continue fiscal consolidation while protecting critical social spending.

- The IMF calls for urgent structural reforms to enhance productivity and improve governance in the region.

This outlook was shared by Rodrigo Valdés, the IMF’s Western Hemisphere Director, who noted that Argentina is set to gain momentum while the rest of the region faces a slowdown.

The International Monetary Fund (IMF) anticipates a slowdown in economic activity across Latin America and the Caribbean this year—although it expects “a significant rebound” for Argentina—amid a global context of heightened inflation and downward pressure on growth. This assessment was presented by Rodrigo Valdés, Director of the Western Hemisphere Department, during a press conference held Friday in Washington.

The IMF projects that regional growth will decline from 2.4% last year to 2% in 2025—half a percentage point lower than its October forecast—before returning to 2.4% in 2026.

Valdés explained that economic activity in Latin America and the Caribbean had been largely driven by consumer spending, supported by resilient labor markets. However, he cautioned that “slower global growth, elevated uncertainty, tariffs, and tighter domestic policies in some countries are weighing on the region’s prospects.”

He emphasized that this regional slowdown masks important differences between countries. Mexico’s GDP is expected to decline due to strict macroeconomic policies and its exposure to U.S. trade restrictions. The IMF also continues to forecast “a significant slowdown in Brazil driven by tighter policies.” This presents a challenge for Argentina, whose manufacturing exports rely heavily on the Brazilian market.

In contrast, Valdés stated that “in Argentina and Ecuador, both of which have IMF-backed programs, we expect a strong rebound.”

Inflation Trends

Regarding inflation, the Fund noted that progress toward targets has slowed in 2024, as the effects of global disinflation fade and local currencies depreciate.

Nevertheless, the IMF expects inflation to gradually decline, though “most countries are unlikely to meet their inflation targets before 2026,” Valdés said.

He attributed this outlook to a complex mix of global factors—ranging from tariffs and supply chain disruptions to commodity price volatility, financial market shifts, and political uncertainty—all of which, he noted, “have a broadly negative impact on growth.”

Addressing recent U.S. tariff hikes, Valdés acknowledged that while direct exposure remains limited, “a broader global slowdown could dampen commodity demand and indirectly hit Latin America through falling commodity prices and exchange rate pressures.” As a result, he warned, “we see downside risks to growth and upside risks to inflation.”

Policy Recommendations

On policy, Valdés stressed “the need to strengthen public finances,” adding that “this is not the time to alter policy frameworks or abandon fiscal plans.” He urged countries to continue fiscal consolidation without delay while protecting public investment and critical social spending.

In line with Argentina’s floating exchange rate policy, he noted, “it’s important to allow exchange rates to absorb shocks to fundamentals.”

Finally, Valdés reiterated the IMF’s call for urgent structural reforms to boost the region’s modest growth potential. These include improving governance, enhancing productivity through a better business climate, increasing policy predictability, reducing informality, and fostering greater intra-regional trade.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account