RWA: Deloitte highlights Tokenized Real Estate could be worth $4 trillion

Real estate tokenization, which used to be an experiment, could soon be how people trade, own, and finance property

Quick overview

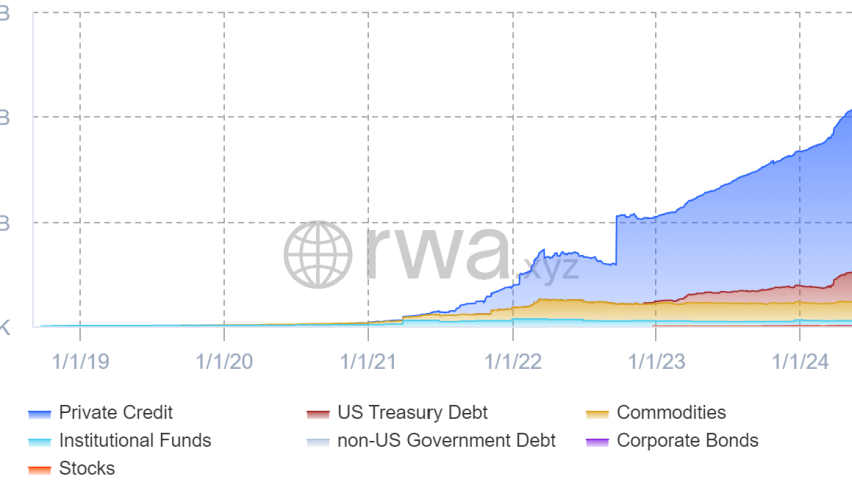

- Real estate tokenization is poised to transform property trading, ownership, and financing, with potential growth to $4 trillion by 2035.

- The sector is expected to grow at a rate of 27 percent annually from its current market size of under $300 billion.

- Tokenization offers operational benefits such as cheaper and quicker settlements, along with wider investment exposure.

- Key shifts in tokenized properties include private real estate funds, securitized loan ownership, and undeveloped land projects.

Real estate tokenization, which used to be an experiment, could soon be how people trade, own, and finance property, as disclosed by the Deloitte Center for Financial Services.

Deloitte has said that the sector of tokenized real estate has the potential to grow to $4 trillion by 2035, with a 27 percent growth rate per year from the current market size of under $300 billion.

Tokenization of real-world assets is one of the hottest sectors that combines cryptocurrency and the finance industry, as it involves creating digital ownership assets on blockchains such as bonds, funds, and real estate.

This approach has operational benefits, cheaper and quicker settlements, and wider investment exposure

The report also explains that regarding real estate, the appeal of tokenization lies in the automation and simplification it offers to intricate financial contracts, like setting rules to manage ownership transfers and capital flows. This can be seen in Kin Capital’s $100 million real estate debt fund tokenization platform, Chintai, with trust-deed-based lending.

The report presents three shifts in tokenized properties: private real estate funds, securitized loan ownership, and undeveloped land projects.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account