Ethereum Holds Above $1,700 as Accumulation Addresses Hit Record Highs, Technicals Debate Bottom

Ethereum (ETH) is showing signs of recovery, holding steady above $1,700 after enduring weeks of downward pressure. However, ETH/USD faces

Quick overview

- Ethereum (ETH) is showing signs of recovery, holding above $1,700, but faces mixed long-term outlooks due to technical and fundamental factors.

- A record influx of 449,000 ETH into long-term holder wallets indicates strong investor confidence despite many holders being underwater on their investments.

- Network activity has increased with a 10% rise in active addresses, but decentralized finance (DeFi) participation remains low with stagnant transaction volumes.

- Ethereum's network fees have dropped to five-year lows, signaling concerns about demand, while institutional interest appears to be softening amid recent ETF outflows.

Ethereum (ETH) is showing signs of recovery as it holds steady above $1,700 after enduring weeks of downward pressure. However, ETH/USD‘s long-term outlook faces mixed signals. On the one hand technical indicators suggest a potential rebound while, on the other, fundamental on-chain metrics raise concerns about the Ethereum ecosystem’s sustained growth.

Record ETH Accumulation Surges Despite Underwater Positions

With 449,000 ETH (about $785 million at current pricing) entering long-term holder wallets on April 22, Ethereum had its biggest single-day influx into accumulation addresses in its history. This unheard-of build-up points to great investor confidence even with recent price falls.

These accumulation, however, face an uphill fight since their realized price is $1,981, indicating current holders of ETH are underwater on their investments with $1,557. Ethereum’s historical patterns show a clear change because the realized price has usually been below the market price since 2018.

Ethereum Network Activity Shows Signs of Life Amid Weak DeFi Participation

With active addresses rising by almost 10% between April 20–22, from 306,211 to 336,366, Ethereum’s network has shown positive indications of rejuvenation. This increase in user involvement points to developing network interest in line with the most recent price recovery.

Though this is encouraging, activity in decentralized finance (DeFi)—once Ethereum’s strongest application—remains low. With weekly transactions stagnant around 1.3 million, showing weak impetus in this vital industry, decentralized exchange (DEX) volumes continue to fall.

Network Fees at Five-Year Lows Signal Demand Concerns

Long-term bulls may find most alarming the sharp drop in Ethereum network fees, which have dropped to five-year lows of roughly $0.16-$0.31 per transaction. This sharp drop points to much lower base layer demand for block space.

“This significant drop in fees corresponds with less people sending ETH and engaging with smart contracts,” said Santiment’s marketing director Brian Quinlivan. Since the built-in burn mechanism no longer offsets newly minted currencies given for staking rewards, the 95% decline in Ethereum fees since January has produced an inflationary environment for ETH.

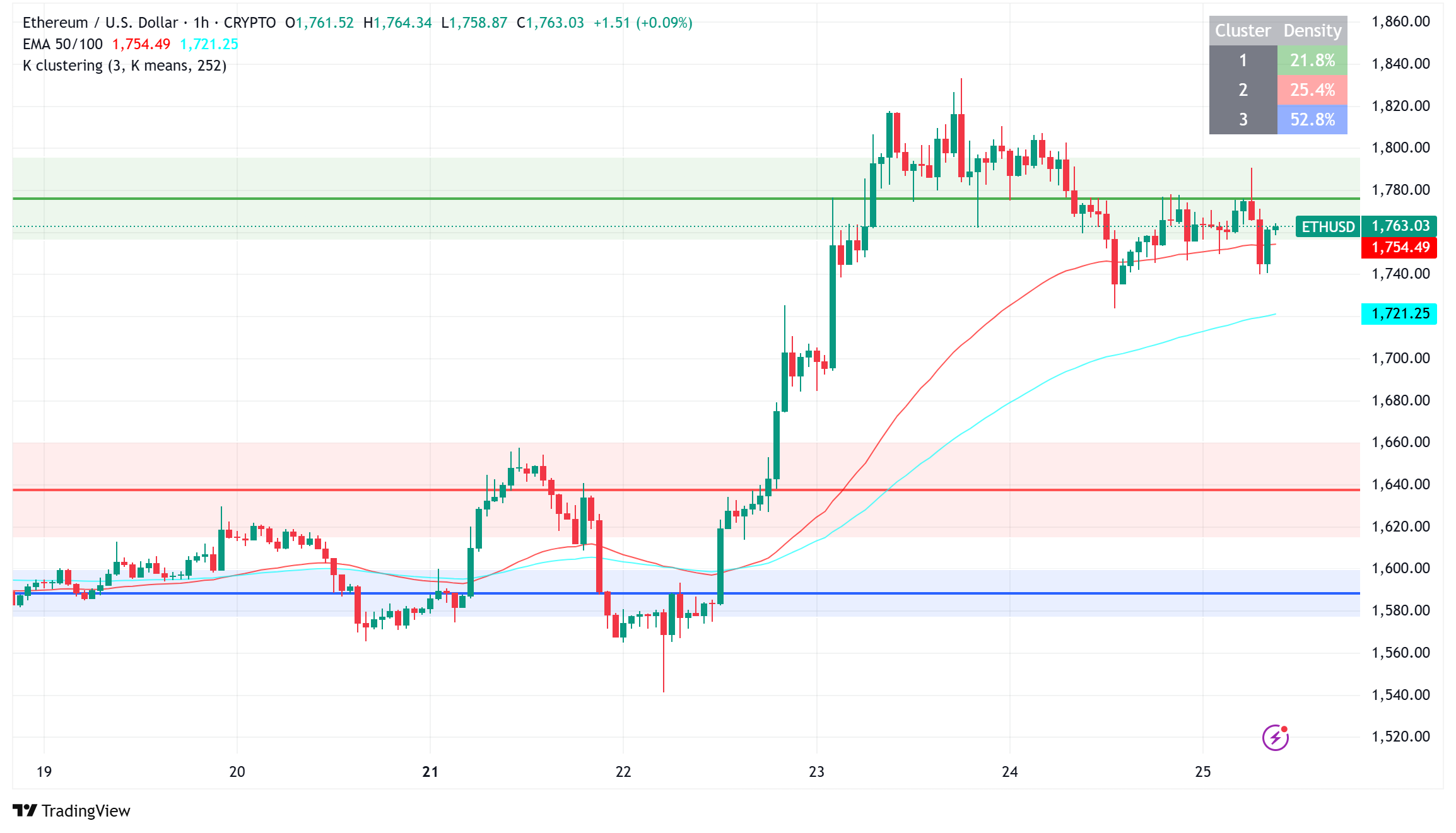

ETH/USD Technical Resistance and Potential Fractal Patterns

Ethereum faces strong resistance at $1,895, a level where approximately 1.64 million ETH is held by investors who purchased in November 2024. The concentration of supply around this level creates a natural selling pressure, especially if investors try to break even or take profits after enduring recent losses.

Ethereum’s position close to the 50-day exponential moving average (EMA) is another critical technical indicator to monitor. A failure to break above this level could indicate ongoing bearish momentum; on the other hand, a sustained upward move over it could provide a road for recovery.

Some traders are also cautious of a possibly bearish fractal pattern developing, a recurring price structure that had already caused notable drops. Based on this technological formation, Ethereum might be rejected and maybe drop below $1,400 should general market mood turn negative.

Will Institutional Interest Be Impacted as More Crypto ETFs Launch?

With US-listed spot Ether ETFs showing $10 million in net outflows between April 21-23, institutional attitude towards Ethereum seems to be softening. This stands in direct contrast to the ETFs for Bitcoin, which saw record-breaking flows during the same period.

Investors in rival networks like as Solana and XRP, however, are still hopeful about possible approvals for their own spot ETFs in the US market, hence lowering institutional demand for Ethereum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account