Broadcom AVGO Stock Breakout with 6% Gain as European Markets Climb

With the European indices closing largely in positive territory, Broadcom (AVGO) is leading a tech-driven rally that suggests increased...

Quick overview

- European markets closed mostly higher, with Germany's DAX gaining 0.47% and Italy's FTSE MIB leading with a 0.96% increase.

- Broadcom (AVGO) experienced a significant rebound, surging over 6% and breaking through key resistance levels after a prolonged downtrend.

- The stock's bullish momentum is supported by improved earnings expectations and a broader rotation towards technology stocks.

- Analysts suggest that Broadcom's performance may indicate a shift in investor sentiment towards high-quality tech plays.

With the European indices closing largely in positive territory, Broadcom (AVGO) is leading a tech-driven rally that suggests increased market optimism.

European Markets Show Strength, with One Notable Exception

European equities closed mostly higher on Thursday, extending a recent period of resilience in global markets. Germany’s DAX gained +0.47% to finish at 22,064.51 points, while France’s CAC 40 added +0.27%, closing at 7,502.78 points. The UK’s FTSE 100 eked out a modest gain of +0.05%, and Italy’s FTSE MIB delivered the strongest performance among the major indices, climbing +0.96%. The one outlier was Spain’s IBEX 35, which slipped by -0.22%, reflecting sector-specific weakness and investor caution amid mixed domestic data.

European Indices – Closing Levels Snapshot (April 24, 2025)

🇩🇪 DAX PERFORMANCE-INDEX (Germany)

Closed at 22,064.51 points

Gained +102.54 points (+0.47%)

🇫🇷 CAC 40 (France)

Ended the session at 7,502.78 points

Rose +20.42 points (+0.27%)

🇬🇧 FTSE 100 (UK)

Finished at 8,407.44 points

Marginally higher by +4.26 points (+0.051%)

🇪🇸 IBEX 35 (Spain)

Dropped to 13,179.70 points

Declined −28.60 points (-0.22%)

🇮🇹 FTSE MIB (Italy)

Outperformed with a +0.96% daily gain

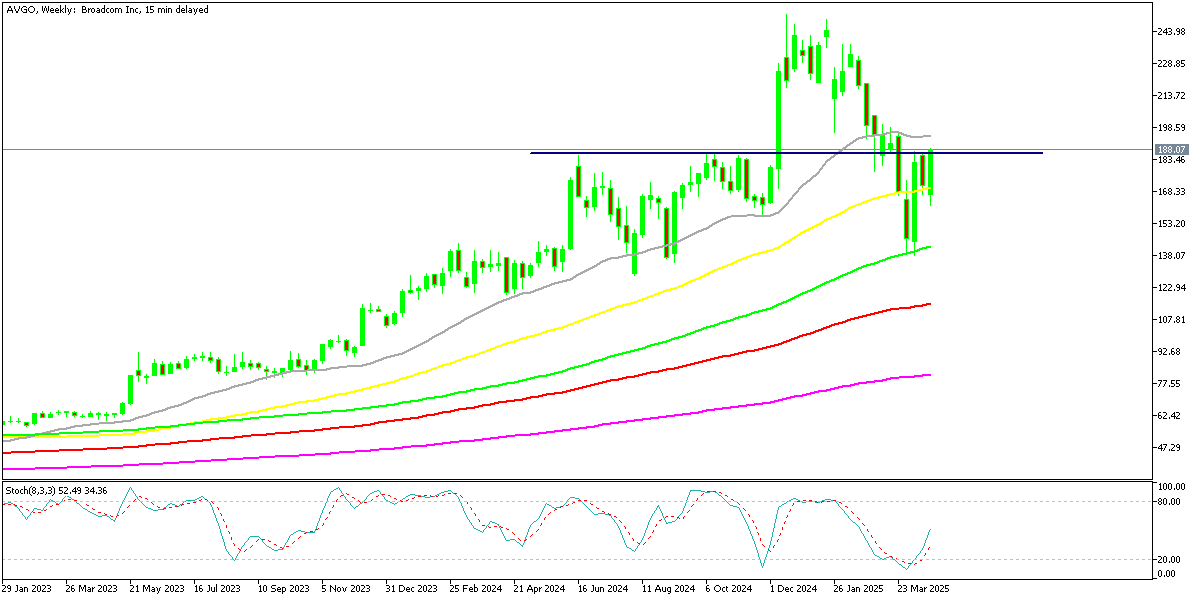

Broadcom (AVGO) Rebounds Sharply with Bullish Breakout

While European indices were largely in the green, attention shifted to the U.S. tech sector, where Broadcom (AVGO) stole the spotlight. The stock surged more than 6% during Thursday’s session, signaling a technical breakout and offering fresh momentum after a prolonged downtrend. Broadcom had previously seen a decline of over 40% since mid-January, but the mood has shifted following today’s strong move.

AVGO stock bounced decisively off its 100-week simple moving average (SMA) and pushed back above the 50-week SMA, which had previously acted as a significant resistance level near the $168–$185 range. The stock’s ability to reclaim and now hold above this zone adds conviction to the bullish outlook, suggesting the potential for further upside.

Technical and Fundamental Forces Align

Last week, Broadcom’s stock retreated after meeting resistance near the $185 zone. However, the 50-week SMA — which had flipped from resistance to support — helped stem the pullback. This week, buyers re-entered the market aggressively, pushing the stock well above that key resistance area. This breakout indicates a reversal of momentum, supported by both price action and renewed investor interest.

Alongside this technical strength, Broadcom’s fundamentals are also drawing attention. Analysts have started to revise their earnings expectations higher, citing improvements in enterprise demand and AI-related infrastructure spending. There is growing consensus that the company’s profitability trajectory may outperform previous estimates, further validating the current move higher in the share price.

Global Context and Market Rotation Favor Tech

Thursday’s rally in AVGO occurred in the context of broader global rotation toward technology and growth stocks. As European traders reduced exposure to regional equities, many sought opportunities in high-growth U.S. tech names, adding fuel to Broadcom’s breakout. The NASDAQ, heavily weighted with technology firms, jumped 2.5% on the day, illustrating renewed appetite for risk in the tech sector.

The timing is especially notable given that many large-cap European and U.S. stocks have faced pressure in 2025. Broadcom’s performance stands out as a potential early signal of changing sentiment and possibly a broader revaluation of high-quality tech plays.

Conclusion: A Strong Breakout with Room to Run

Broadcom’s 6% surge — confirmed by a break above resistance and supported by fundamental upgrades — suggests that its recent slump may be behind it. With the stock now trading above key technical levels and analysts turning increasingly bullish on its earnings potential, AVGO could be poised for a period of sustained recovery. Combined with a broader uptick in global risk appetite and tech sector rotation, the stock’s breakout may offer more than just a short-term bounce — it could mark the beginning of a longer-term bullish phase.

German Index Dax Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account