SUI Token Surges 31%: Technical Analysis Points to Potential $4.50 Target Amid Memecoin Boom

Sui (SUI) is one of the most trending tokens in the crypto market today, experiencing a remarkable surge of 31% in the past 24 hours and

Quick overview

- Sui (SUI) has surged 31% in the past 24 hours, currently trading above $2.90, driven by a boom in memecoins on its network.

- On-chain metrics indicate strong growth, with daily active addresses increasing from under 200,000 to over 2 million since February.

- Technical analysis shows SUI has broken out of a descending channel, with potential targets of $4.20-$4.50 if it maintains momentum above $2.20.

- Market sentiment is shifting positively, supported by bullish indicators and a favorable macroeconomic backdrop.

Sui (SUI) is one of the most trending tokens in the crypto market today, experiencing a remarkable surge of 31% in the past 24 hours and holding above $2.90. This explosive growth is also supported by technical indicators suggesting further upside potential.

Memecoin Boom Fuels Sui Network Activity

Memecoins developed on the Sui network seem to be the main driver behind SUI’s amazing surge. Tokens include LOFI, BLUB, MUI, Fartcoin, Zerebro, and DeepBook (DEEP) have shown strong returns:

- LOFI up by 143% in one week.

- BLUB gained 57% over the same time frame.

- Following a surprising launching on South Korean exchange Upbit, DeepBook (DEEP) soared about 97% from $0.0842 to $0.166.

This memecoin craze has greatly raised transaction volume and general network traffic on Sui, therefore increasing the value of the native SUI currency.

Strong On-Chain Fundamentals Support SUI Price Action

Sui’s on-chain metrics show remarkable fundamental strength beyond the price surge:

- From under 200,000 in early February to over 2 million in April daily active addresses have surged.

- Platform user base grew by 7.05% throughout last week alone.

- TVL, total value locked, now stands at $1.53 billion.

- On April 21, stablecoin numbers on the platform reach a record high of $880 million; forecasts to reach $1 billion not too far off.

These metrics show Sui is building a strong ecosystem with actual value much beyond speculative trade.

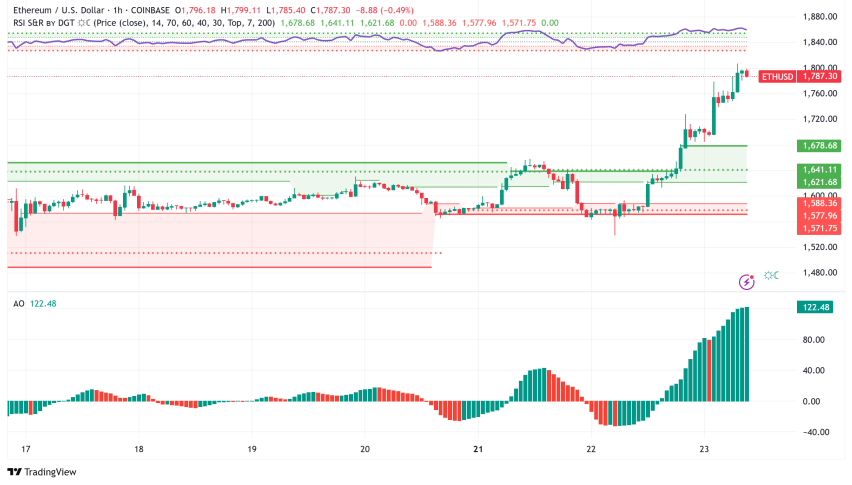

SUI/USD Technical Analysis: Breaking Out of the Descending Channel

Sui’s recent price action reveals a clear breach from a declining channel that had been generating since December 2024. Analyzers and traders both have paid close attention to this technical reversal. Strong buyer demand at reduced price points is suggested by the token’s successful bouncing off of important support levels.

Usually regarded as a bullish reversal indication, technical researchers have found a declining wedge pattern. Many analysts think SUI might target the $4.20-$4.50 zone in the near term if the present breakout remains above the crucial $2.20 mark with continuous volume.

Market Sentiment Shifts Positive

Positive futures market data points to a change in trading mood toward optimism. Rising optimism among derivative traders is shown by the OI-Weighted Funding Rate for SUI moving from negative area (bearish) into neutral and slightly positive territory.

Technical indicators also help to reinforce this positive view:

- RSI (6) reading of 73.58 indicates that the token has entered overbought zone, exhibiting great increasing momentum.

- MACD lately finished a bullish crossover, indicating the start of a steady upward trend.

- Greater low formation at $1.71 verifies the possible fresh uptrend establishment.

Sui Price Prediction and Risk Factors

Although SUI is still 54% below its January high, current price action and fundamentals point to considerable rebound possibility. Market analysts refer to four important levels of observation:

- Immediate resistance at $2.45, with a break over maybe setting off a movement to $2.78 and $3.00.

- Major resistance at $4.50; the next notable obstacle at $5.10

- Establishing critical support at $2.17 should help during any short-term pullbacks.

Investors should however pay attention to the larger market background. Along with President Trump’s criticism of Federal Reserve Chair Jerome Powell for not decreasing interest rates quickly enough, the latest crypto market surge corresponds with improving macroeconomic mood, especially with relation to possible tariff reductions between the US and China.

Should macro conditions continue to favor risk assets, the Fear & Greed Index reading of a modest 39 (fear) still leaves opportunity for sentiment improvement.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account