Ethereum Price Jumps Over 12% Towards $1,800 as Macro Optimism Aligns with Bullish Signals

Ethereum (ETH) has surged by over 12% in the past 24 hours, trading just under the $1,800 mark. Ethereum's latest rally past key resistance

Quick overview

- Ethereum (ETH) has increased by over 12% in the last 24 hours, nearing the $1,800 mark due to positive macroeconomic sentiment and reduced selling pressure.

- A significant decline in CME futures basis has contributed to Ethereum's price surge, reversing earlier arbitrage positions that negatively impacted prices.

- Despite recent outflows from U.S. spot Ethereum ETFs totaling $1 billion, whale investors continue to accumulate ETH, indicating strong support.

- The upcoming Pectra upgrade on May 7th is expected to add upward momentum to Ethereum, which faces increasing competition from other smart contract platforms.

Ethereum (ETH) has surged by over 12% in the past 24 hours, trading just under the $1,800 mark. Ethereum’s latest rally past key resistance levels is a result of positive macroeconomic sentiment, a drop in selling pressure in ETH derivatives markets, and bullish ETH/USD technical indicators.

CME Basis Compression Signals End of Arbitrage Pressure

The sharp decline in CME futures basis from 20% in November 2024 to almost 5% in April 2025 has been a key driver behind Ethereum’s recent price movement. This compression captures the reversal of arbitrage positions that had earlier caused ETH prices to drop.

Market data indicates that institutional traders bought spot ETH ETF shares and simultaneously shorted ETH futures on the CME, therefore creating substantial arbitrage positions. When the basis exceeded US Treasury yields, this approach proved very appealing. But these ideas have been mainly eliminated in line with President Trump’s trade policies and hawkish Federal Reserve language.

“A lot of those arbitrage positions that dominated our agenda 2-3 months ago have now closed,” said a CryptoQuant analyst, pointing out that basis levels had dropped to roughly 4-5%, very in line with current Treasury rates.

Whale Accumulation Provides Support Despite ETF Outflows

Based on on-chain statistics, whale investors appear to have been gradually building Ethereum despite recent market volatility. One well-known whale bought more than 48,000 ETH from markets since mid-February; right now, she has paper losses of almost $21 million.

This accumulation trend persists despite steady outflows from U.S. spot Ethereum ETFs, which since mid-February have reached $1 billion. Recent low of $5.21 billion for total net assets in these ETFs suggests ongoing institutional reallocation away from the asset class.

Ethereum Pectra Upgrade Set for May 7th

Following effective deployment on the Hoodi testnet, Ethereum is expected to release its Pectra update on May 7th adding possible upward momentum. The upgrade coincides with the Ethereum ecosystem’s continued growth beyond simple transactions to include DeFi applications, NFTs, and tokenization of real-world assets.

Ethereum is under more competition as it strives to keep its leading position in the smart contract platform industry, especially from Solana, which has lately been acquiring market share.

Market volatility remains high as traders position themselves ahead of possible catalysts; futures liquidations totaling $91.62 million over the past 24 hours split between $35.73 million in longs and $55.90 million in shorts.

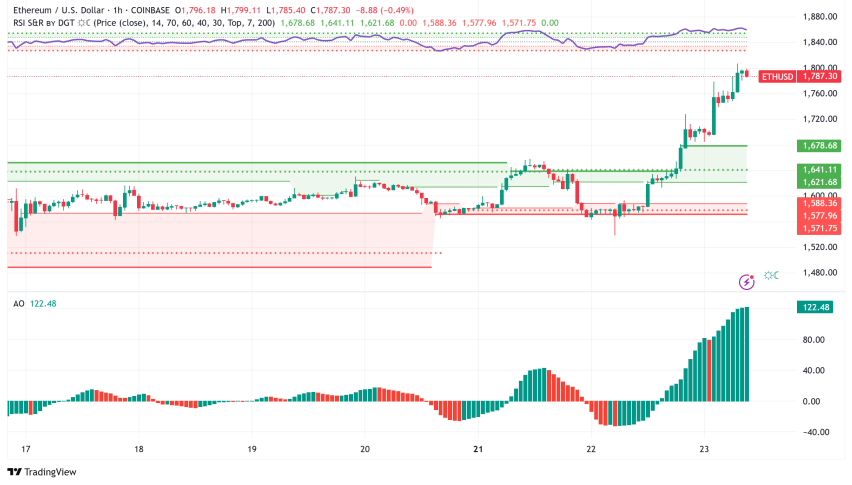

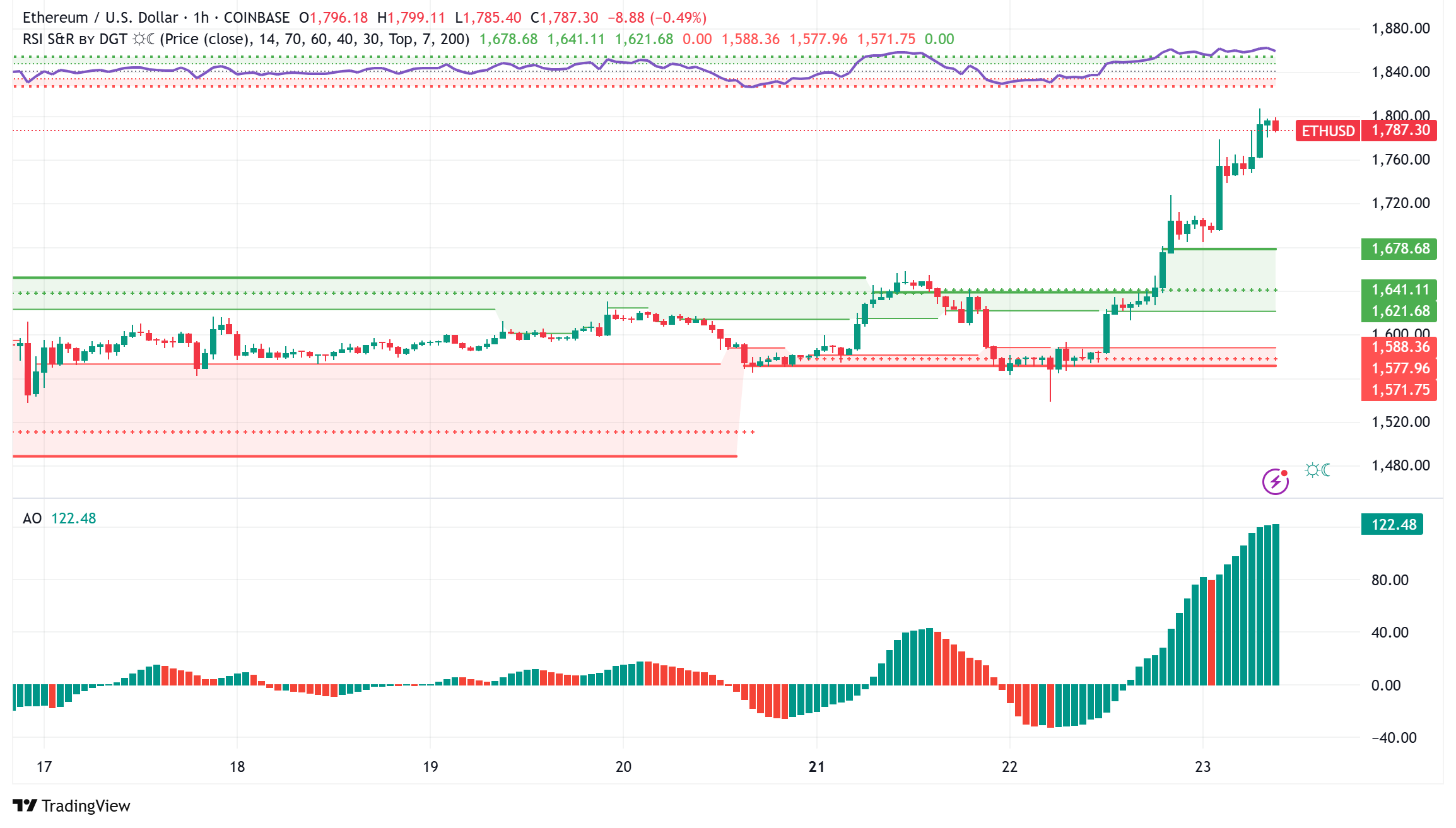

ETH/USD Technical Outlook: Critical Resistance at $1,800

Technically, Ethereum has broken over the $1,688 resistance level that had restricted prices since April 9 and rallied off a declining trendline going back to March 25.

With the Relative Strength Index (RSI), Awesome Oscillator (AO), and Stochastic Oscillator all going upward, the daily chart displays hopeful momentum building. ETH must, however, cross the psychologically important $1,800 level and translate the top border of its declining channel into support if this rally is to develop into a prolonged upswing.

Should one fail to hold over $1,688, the cryptocurrency may revert to its pattern of declining downside consolidation, so perhaps hitting the crucial $1,550 support that has lately attracted much attention. Some technical experts believe a more significant failure would potentially allow testing range lows down to $800.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account