Silver Price Bounce—Will $33.65 Be the Next Stop?

Silver is back in focus as investors seek safety in the face of rising geopolitical uncertainty. U.S. President Donald Trump’s

Quick overview

- Silver is gaining attention as a safe-haven asset amid rising geopolitical tensions and trade risks.

- President Trump's tariffs and China's retaliatory warnings contribute to an unstable trade environment.

- Technically, silver is holding above key support at $32.35, with bullish momentum indicators suggesting potential upward movement.

- A cautious trading strategy is recommended, focusing on confirmed price movements and strong volume.

Silver is back in focus as investors seek safety in the face of rising geopolitical uncertainty.

U.S. President Donald Trump’s latest move—reciprocal tariffs targeting key global partners—has added another layer of risk to an already fragile trade environment. China’s sharp response, warning its allies about potential economic retaliation, only deepens the uncertainty.

Meanwhile, tensions between Russia and Ukraine continue to simmer, with both sides accusing each other of violating a temporary Easter truce. Against this backdrop of friction, silver’s safe-haven appeal is on the rise.

Adding to the market unease, President Trump’s renewed criticism of Federal Reserve Chair Jerome Powell has sparked concerns over central bank independence—just as stagflation worries return to the headlines. With all this in play, silver is increasingly being seen not just as a hedge, but as a necessity in times of global stress.

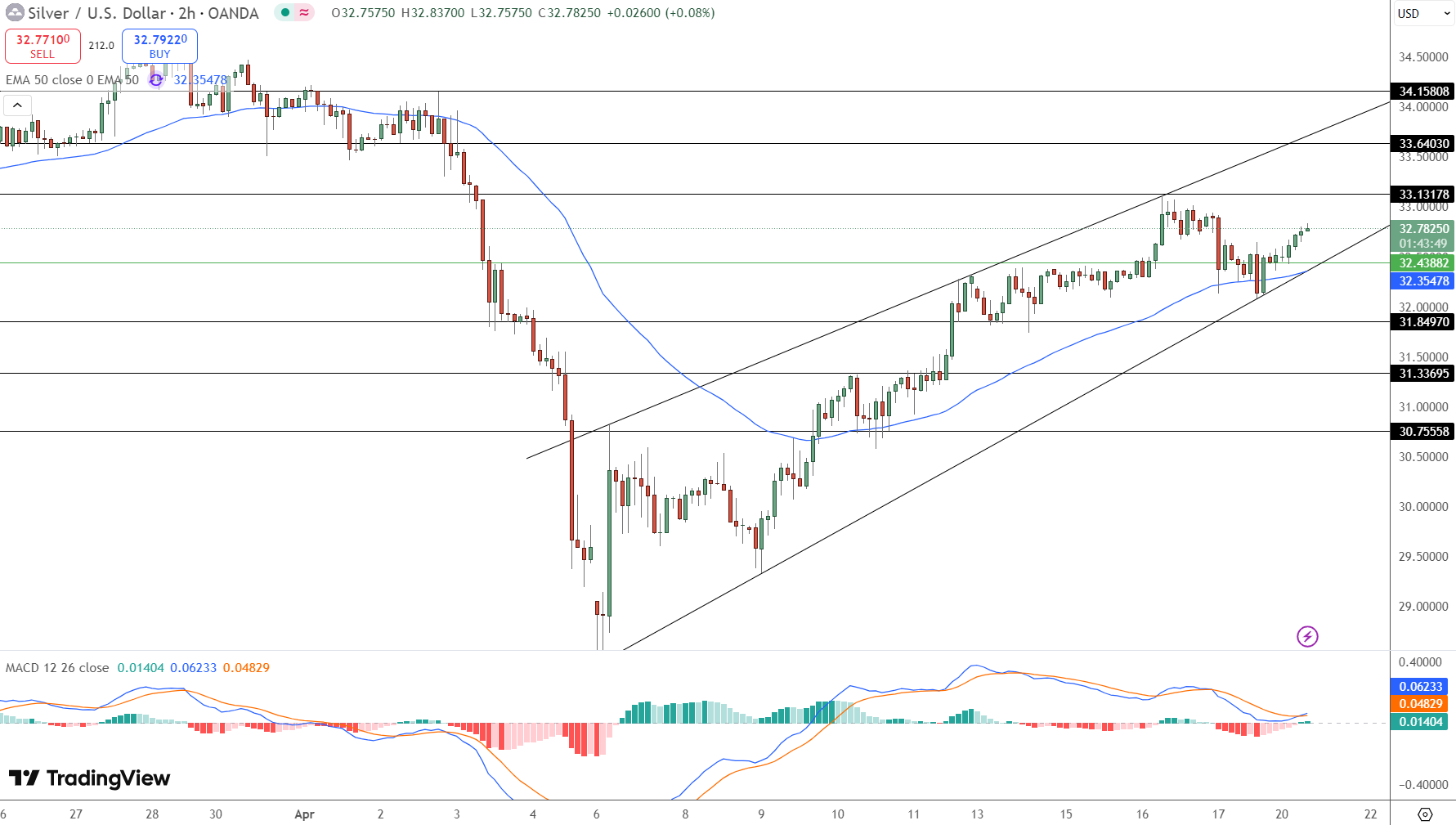

Silver Technical Picture: Bulls Defend Key Support at $32.35

From a technical standpoint, silver (XAG/USD) is holding firm near $32.78 after bouncing off solid support at $32.35. This level coincides with both the lower boundary of an ascending price channel and the 50-period exponential moving average—giving bulls a reliable line of defense.

Momentum indicators are flashing early bullish signs. The MACD has just formed a fresh crossover to the upside, and the expanding green histogram bars suggest growing buying interest. If silver holds above $32.35, the next stop could be $33.15. A breakout there could open the door toward $33.65 and even $34.15 in the near term.

However, if prices slip below $32.35, a retreat toward $31.85—or in a deeper correction, $31.33—remains on the table.

Key Levels to Watch:

Support: $32.35, $31.85, $31.33

Resistance: $33.15, $33.65, $34.15

50 EMA: $32.35

Trade Plan

For those just starting to trade silver, here’s a simple strategy:

Entry: Consider buying on a confirmed bounce above $32.35

Targets: $33.15 (first target), $33.65 (secondary)

Stop Loss: Below $32.00 to protect against downside

Watch for: Strong volume if price breaks through $33.15

Silver is in a strong position both fundamentally and technically. But as with all trades, patience is essential—let the chart confirm your bias before jumping in.

With market risks rising and silver’s role as a defensive asset gaining traction, bulls have a solid case—especially if global uncertainty continues to dominate the headlines.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account