Bitcoin Price Prediction: Whales Buy 300% Supply as BTC Battles $85K

Bitcoin whales are buying 3x the daily mined supply while BTC flirts with $85K. Will this accumulation trigger the next breakout?

Quick overview

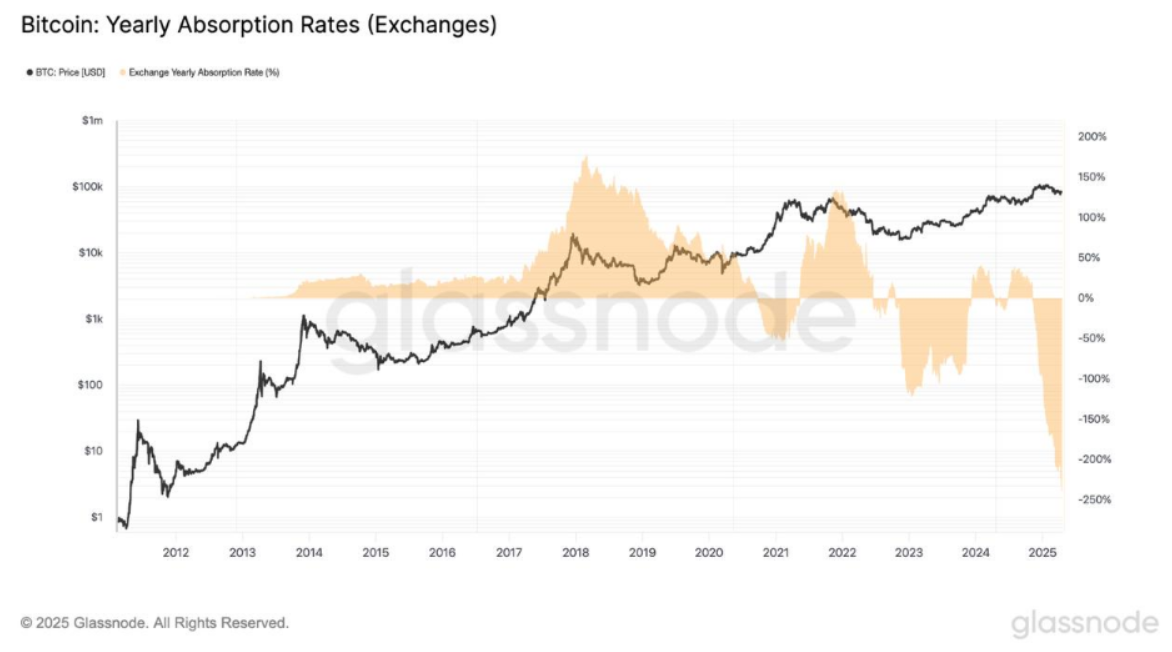

Big players—wallets holding 100-1,000 BTC—are buying the dip. Glassnode shows they’re taking in 300% of the daily Bitcoin supply, more than miners produce each day.

This isn’t speculation. It’s a long term play.

At the same time exchange outflows are rising, whales are moving their coins to cold storage instead of keeping them on exchanges. That’s a bullish sign—it reduces selling pressure and shows increasing confidence in Bitcoin’s future.

Key Points:

- Large holders are buying 3x the daily BTC supply

- Exchange balances are shrinking

- Long term holding sentiment is growing

Bitcoin Technical Resistance Caps Short-Term Gains

Right now Bitcoin is at $85,120, stuck beneath the resistance zone around $86,000. This level has capped upside moves for weeks. Price is coiling into a tighter range, bounded by support around $84,300.

Technically the 50 EMA ($84,200) and 200 EMA ($84,180) are below, the short term floor. A break above $86,000 could open up $87,300 and possibly $88,500 but buyers need to be convinced.

Current Key Levels:

- Immediate Resistance: $86,000

- Next Resistance: $87,300 → $88,500

- Support: $84,300

- Deeper Support: $83,100 → $81,500

Bitcoin Market Setup: Cautious Bullish

This is the same setup as 2020—whale accumulation, exchange supply dropping and resistance squeeze. While the MACD is slightly bullish, volume is missing.

A clean break above $86,000 with volume could trigger the move. On the flip side a drop below $84,300 would test $83,100 support. For now it’s about patience and positioning.

Trade Setup:

Entry: Buy above $85,500 on breakout confirmation

Targets: $87,300 → $88,500

Stop Loss: Below $84,000

Conclusion:

Bitcoin’s fundamentals are strengthening with whales doubling down—but technically, price is still locked in consolidation. Watch for volume and breakout confirmation before calling the next move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account