Bitcoin (BTC): Resistance at $84,475 Holds as Bearish Momentum Looms

Quick overview

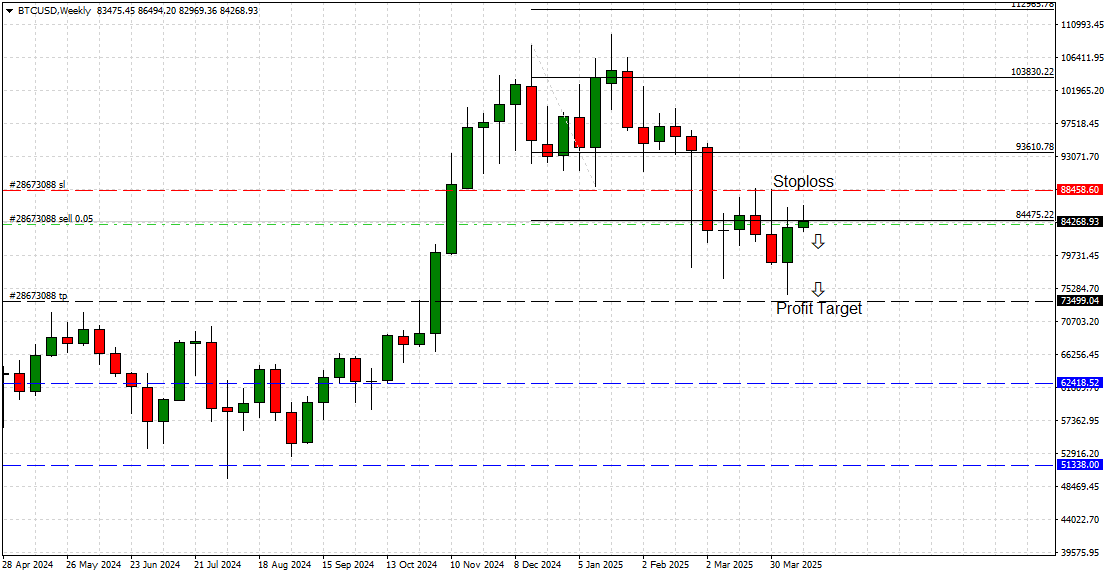

- Bitcoin (BTC) is facing resistance at $84,475, showing signs of rejection after a brief rally above $84,000.

- The bearish outlook remains intact, with a potential downside target of $73,500 aligned with the 38.2% Fibonacci retracement level.

- Market sentiment is fragile, and without a sustained breakout above $84,475, any upward movements may be met with selling pressure.

- Despite current challenges, Bitcoin's long-term fundamentals and innovations continue to support its role as a leading decentralized store of value.

Bitcoin (BTC) is once again facing strong headwinds near a pivotal technical barrier. After briefly reclaiming ground above $84,000, BTC is showing signs of rejection from the significant key resistance and pivot point at $84,475.

This latest rejection aligns with our previous bearish outlook and adds further weight to the downside scenario we’ve been tracking since early April.

Technical Outlook: Resistance Continues to Cap the Upside

The weekly chart of Bitcoin paints a cautious picture. Despite the recent bounce from sub-$80K levels, the bulls have failed to engineer a decisive breakout above the $84,475 resistance area — a level that now appears to be acting as a solid ceiling. This area also coincides with a cluster of prior weekly closes, adding confluence to its importance.

Adding to the downside risk, BTC continues to trade below its March breakdown zone, and the latest weekly candlestick is forming a potential lower high structure — a typical precursor to further bearish continuation.

Unless we see a clean and sustained breakout above $88,458 (stop-loss zone), the path of least resistance remains to the downside.

Bearish Conviction Remains in Place: Targeting the 38.2% Fibonacci Retracement

Our original bearish conviction, established earlier this month, remains valid. Bitcoin’s structure has shown increasing vulnerability ever since it peaked in mid-March. With the rejection at $84,475, the next leg lower could now be in play.

The key downside target remains locked at $73,500, which lines up perfectly with the 38.2% Fibonacci retracement of the major rally from the Dec 2022 lows to the all-time highs near $110,000. This level also represents a psychological threshold that, if broken, could open the door toward deeper correction zones at $62,418 and potentially $51,338 in a prolonged bearish scenario.

Macro and Sentiment: Risk-Off Bias Lingers

With market sentiment still fragile and investors seeking clarity amid shifting macroeconomic expectations, Bitcoin could continue to struggle in the short term. Risk-off themes, reduced liquidity flows, and strong dollar dynamics are all contributing to the broader crypto weakness.

Until BTC reclaims and holds above the $84,475 zone, any rally attempts are likely to be sold into — with lower highs reinforcing the broader topping structure visible across the weekly timeframe.

Bitcoin – Key Technical Levels

Resistance: $84,475 / $88,458

Support: $82,107 / $73,499

Bearish Target: $73,499 (38.2% Fib)

Stop-Loss: $88,458

Trend Bias: Bearish

Conviction Level: Medium – High

Vision & Technology: Bitcoin’s Long-Term Mission Remains Untouched

Despite the current bearish trajectory, Bitcoin’s underlying fundamentals remain resilient. As the world’s leading decentralized store of value, Bitcoin continues to drive innovation in the financial space. Layer 2 solutions like Lightning Network, increasing institutional adoption, and long-term demand from sovereign entities continue to solidify Bitcoin’s role as a monetary revolution in the making.

This short-term weakness, while potentially painful, should be viewed within the broader scope of Bitcoin’s decade-long upward trajectory. A healthy correction could reset valuations and pave the way for a more sustainable and institutional-led rally in the future.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account