JSE Top 40 Drops 560 Points—Can 81,300 Hold?

After the big run up from the April lows the JSE Top 40 Index took a breather on Wednesday and slipped 0.67% to 82,719.

Quick overview

- The JSE Top 40 Index fell 0.67% to 82,719 after reaching near resistance levels, prompting profit-taking among traders.

- Technical indicators suggest a potential short-term pullback, with key support levels identified at 82,300 and Fibonacci retracement zones below.

- Recent corporate activities include significant gains for several stocks and the launch of new ETFs, indicating investor interest in structured products.

- The market outlook remains bullish if the index can reclaim the 83,130 level, potentially leading to new highs.

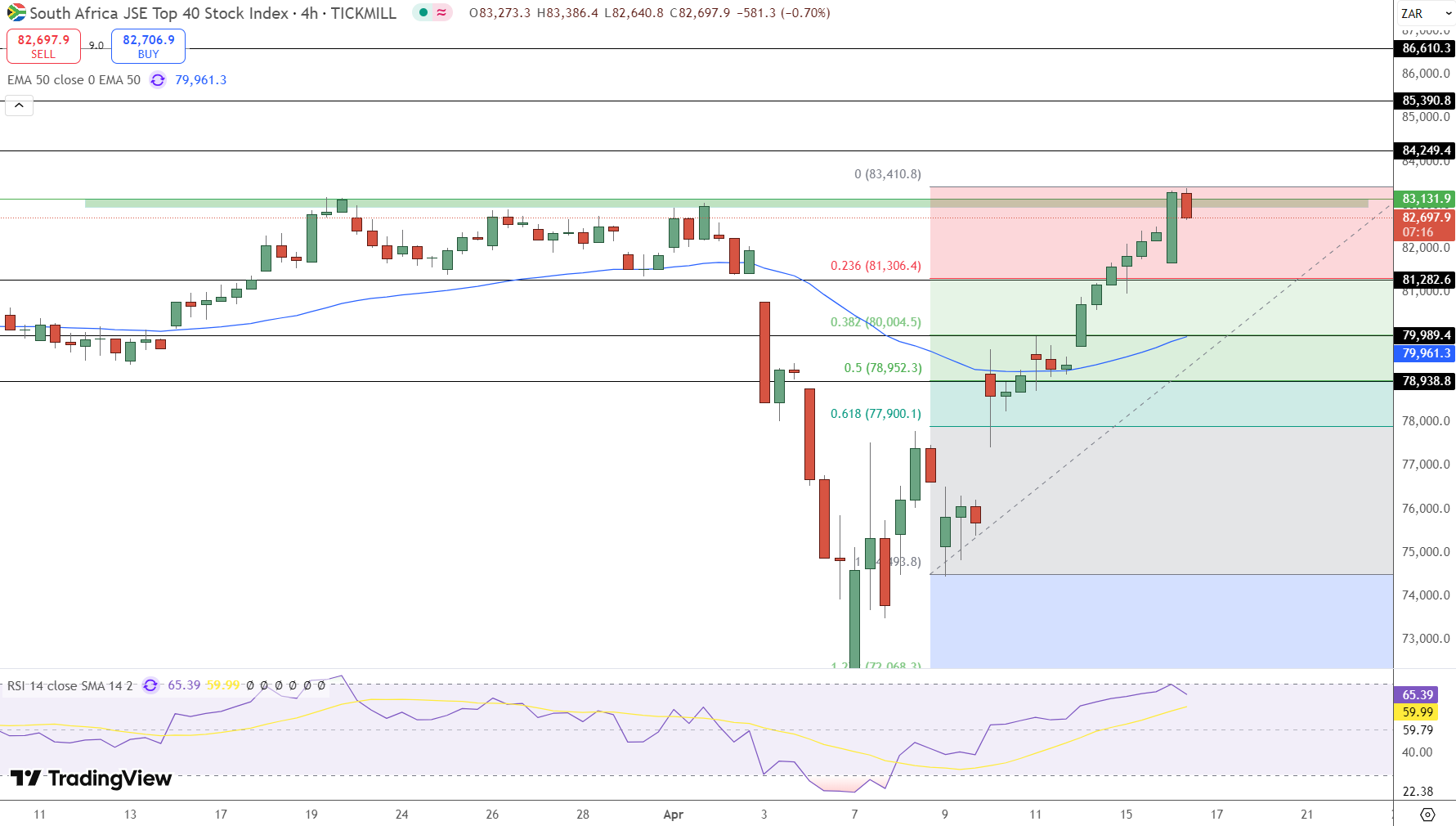

After the big run up from the April lows the JSE Top 40 Index took a breather on Wednesday and slipped 0.67% to 82,719.

It just missed the March high of 83,410.8 as traders took profits at the key resistance zone.

The RSI is at 65.54 and heading towards overbought. So while the bigger picture is still bullish short term exhaustion may be setting in.

The run from 74,000 to 83,000 has been steep. Now prices are bumping against the resistance band of 83,000-83,410 and traders are watching for a possible retracement especially as the technicals start to cool off.

Key Levels: Can 81,300 be a Bounce Zone?

If the index breaks below short term support of 82,300 the next levels of interest are the Fibonacci retracement zones:

Immediate Support: 82,300

23.6% Fib: 81,306

38.2% Fib: 80,004

50% Fib: 78,952 (aligned with prior consolidation)

The 50 period EMA is at 79,962 and adds more technical weight at the 80,000 level which could be a “buy the dip” zone if the pullback deepens.

Trade Idea: Short Term Pullback Play

For new traders this could be a short opportunity – but only with confirmation.

Trade Setup:

Entry (Short): Below 82,300 with strong bearish candle

Target: 81,300 – 80,000

Stop Loss: 83,250

Tip: Don’t pre-empt the move. Wait for a clean break below 82,300 on strong volume and momentum before entering.

If the bulls reclaim 83,130 the index could resume its up trend to 84,249 and even 85,390 in the coming weeks.

What Else Is Moving the JSE?

Beyond the index action on Wednesday there was a lot of corporate activity, ETF launches and stock specific moves that got investor attention:

Top Gainers:

PRXSBV: +108.33%

LAB: +33.33%

NCS: +17.50%

CKS: +14.15%

QFH: +11.82%

Biggest Decliners:

VIS: -33.33%

PMV: -12.00%

TGASBA: -10.00%

NVETNC: -8.43%

Corporate News Highlights:

ArcelorMittal SA (ACL): Released FY2024 financials and AGM notice

Nedbank: Listed new bonds (NELN16 & NELN17)

FirstRand Bank: Launched FRS411 & FRS412 with updated rate guidance

Resilient REIT: Reported director dealings

ETF & Structured Product Launches:

FNB: Rolled out 16 new Exchange Traded Notes (ETNs)

Reitway Global: Introduced an income-focused ETF

RealFin: Debuted a fixed-income actively managed ETF

This shows that both retail and institutional investors are looking for structured and passive products during volatile times.

Bottom Line:

The JSE Top 40 has retreated from resistance now we are watching the 81,300–80,000 zone for the next buy opportunity. But if the bulls reclaim 83,130 we could see a move to new highs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account