Gold Surges Past $3,278—Here’s Why Bulls Are Targeting $3,381 Next

Gold is back in the spotlight. On Wednesday, prices broke above $3,278 per ounce, a new all-time high as investors piled into safe-haven...

Gold is back in the spotlight. On Wednesday, prices broke above $3,278 per ounce, a new all-time high as investors piled into safe-haven assets.

What’s behind the surge? U.S.–China trade tensions, a weaker U.S. dollar and a global economic slowdown.

The trigger this week? U.S. restrictions on AI chip exports are hitting American tech giants hard—Nvidia expects $5.5 billion in losses from blocked China sales. China has paused new Boeing jet orders, deepening investor unease. With risk off, gold is once again the financial “safe harbor.”

“Gold is benefiting from dollar depreciation and risk aversion,” said Tim Waterer, chief market analyst at KCM Trade.

Bulls in Control: $3,381 Next

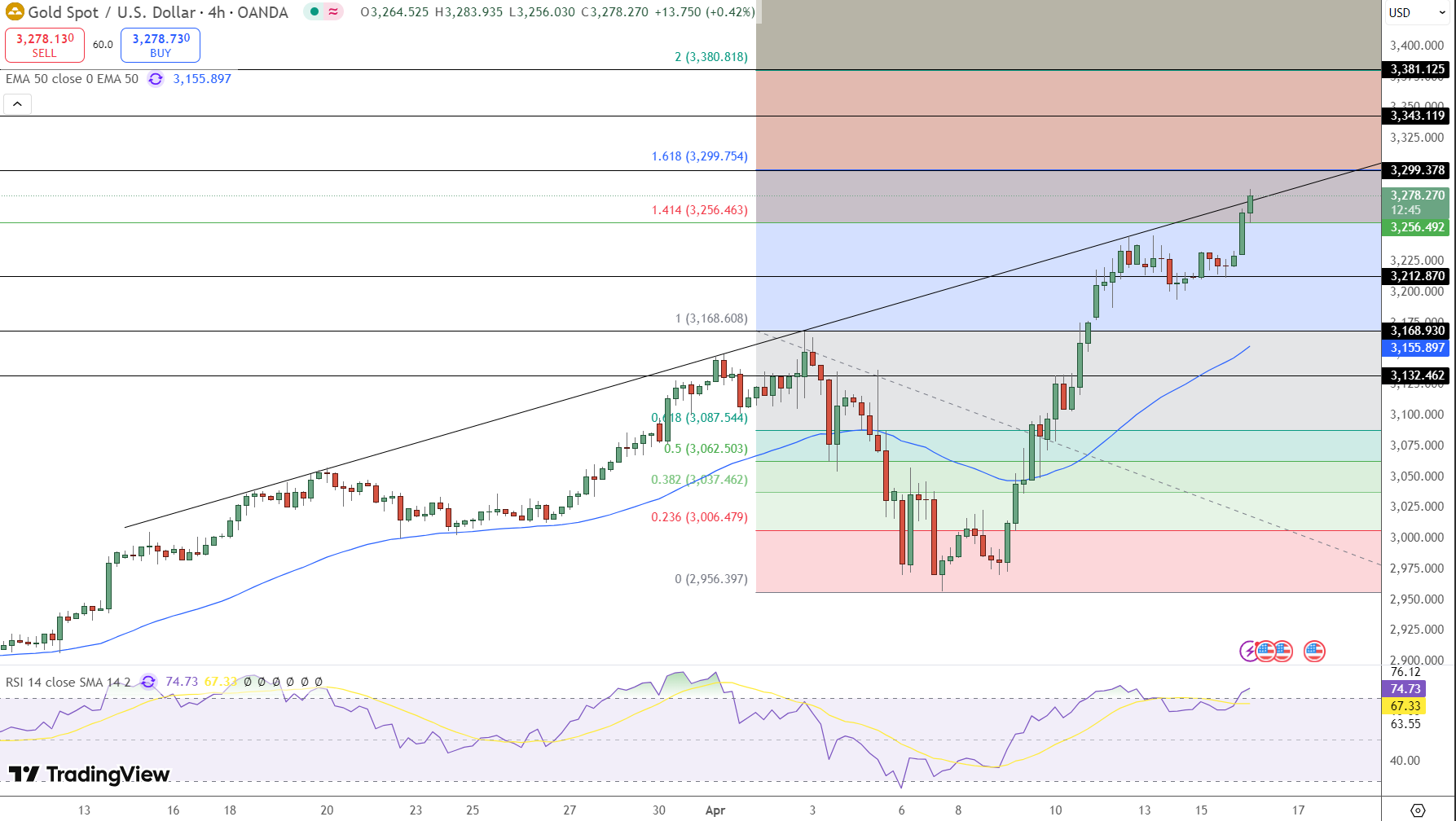

On the charts, gold (XAU/USD) is in a clear breakout. It’s broken $3,256, the Fibonacci extension level and is grinding higher at $3,278. With momentum strong and sentiment bullish, traders are targeting $3,299, $3,343 and $3,381.

The RSI is at 74, strong momentum but getting overbought. But price is well supported above the 50-period EMA at $3,155 and the trend is up.

Key Levels

Support: $3,256 and $3,155

Resistance: $3,299, $3,343, $3,381

Momentum: RSI at 74 — getting overbought

What to Watch

Next big catalyst? U.S. retail sales and Fed hints on interest rates. Traders are pricing in 90 basis points of rate cuts by year-end which could fuel more gold if confirmed.

“Gold will stay strong as long as there’s uncertainty,” said Brian Lan, Managing Director at GoldSilver Central.

From geopolitical headlines to central bank policies, this environment has investors looking for stability and gold is delivering.

Trade Setup

Entry: Buy above $3,300 on strong volume

Targets: $3,343 – $3,381* SL: $3,248

Classic buy-the-breakout. Be aware and manage your risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account