Daily Crypto Signals: Bitcoin Holds Firm as Ethereum ETF Staking Faces Delay and Solana ETFs Debut in Canada

The cryptocurrency market displayed a mixed landscape today, with Bitcoin maintaining its position above $84,500 amidst significant developments for major altcoins Ethereum and Solana. While the SEC postponed a decision on Ethereum ETF staking, Canada is set to launch spot Solana ETFs, marking a notable divergence in regulatory approaches.

Crypto Market Developments

This week the bitcoin market offered contradictory signals as certain altcoins encountered major difficulties while Bitcoin appeared to be recovering. The partial import tariff relief made by President Trump momentarily raised market mood, but excitement faded as it was evident the relief was just transient. Concurrent with this, debate arose surrounding Mantra’s OM token crash, with CEO John Mullin vehemently refuting claims of insider trading despite on-chain evidence pointing to significant token transfers prior to the fall-off.

Complicating regulatory issues, Wall Street-backed cryptocurrency company Anchorage Digital Bank allegedly under investigation by the El Dorado Task Force of the US Department of Homeland Security, focused on transnational money laundering operations.

Bitcoin Holds Above $84,500 Amid Tariff Uncertainties

Opening the week strong, Bitcoin BTC/USD rose to $85,800 as the market reacted favorably to Trump’s declaration of possible import tariff relief. On April 14, the top cryptocurrency recovered the $84,500 mark..

Under Michael Saylor’s direction, Strategy took advantage of recent market declines to buy 3,459 Bitcoin for $285.5 million at an average price of $82,618, therefore increasing the company’s total assets to 531,644 Bitcoin. Nevertheless, given Bitcoin futures contracts indicate a premium of about 5%, close to the neutral-to-negative level, this positive action has not been sufficient to completely rebuild market confidence.

Particularly with the S&P 500, which has reduced hopeful euphoria, the relationship between Bitcoin and conventional stock markets remains strong. Further erasing possible sentiment recovery, Bitcoin spot ETFs noted $277 million in withdrawals between April 9 and April 11.

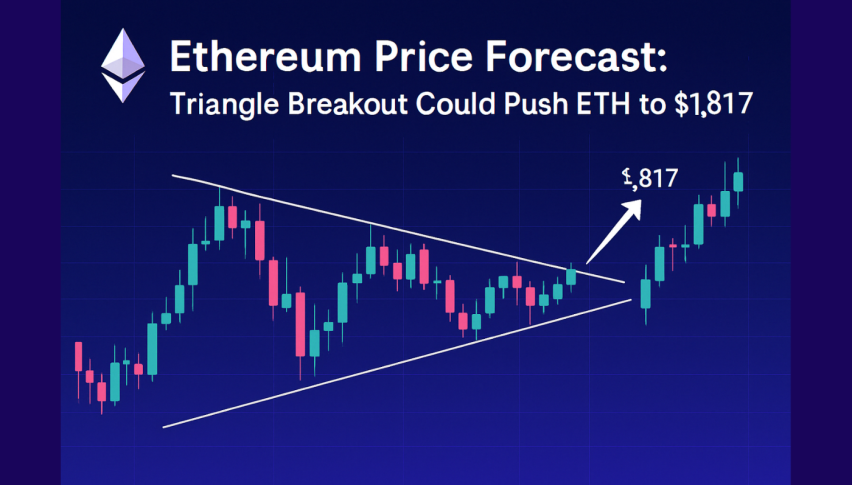

Ethereum Struggles with Resistance at $1,722

Currently trading at $1,624, Ethereum ETH/USD keeps struggling, far below its recent highs. With considerable selling pressure shown from the long wick on April 14’s candlestick pattern, the second-largest cryptocurrency faces resistance at the 20-day exponential moving average ($1,722).

The SEC deferred a ruling on Ethereum staking in two Grayscale funds until June 1, even although it lately permitted options trading for other spot Ethereum ETFs including funds from BlackRock, Bitwise, and Grayscale. The end of October 2025 still serves as this decision’s last date.

Comparatively to other assets, Ethereum’s performance throughout this bull market has been unsatisfactory. Currently trading much below the $2,000 barrier, the 52-week high of $4,112 fell short of its November 2021 all-time high of $4,666.

Spot Solana ETFs to Start Trading in Canada

Resilient in face of market volatility, Solana trades at $128.62 as buyers keep pressure close to the 50-day simple moving average ($130). Should SOL close above this important level, it might find itself in the $147-$153 resistance zone. A breach above this zone might set off a surge towards $180.

Bloomberg analyst Eric Balchunas reports that several spot Solana ETFs scheduled to open in Canada on April 16 are in major development news. The Ontario Securities Commission apparently has approved asset managers Purpose, Evolve, CI, and 3iQ to create ETFs containing Solana. These ETFs will notably be allowed to stake some of their SOL holdings for yield, so providing investors with another income source.

This represents the first significant institutional investment vehicle just for Solana, maybe paving the path for such approvals on the US market. Balchunas pointed out, however, that present US-based Solana futures ETFs have received mixed reviews and draw just about $5 million in net assets.

Top Altcoins to Watch Today

Based on the recent price analysis, several altcoins are showing interesting movements:

- XRP XRP/USD: XRP turned down from the 50-day SMA ($2.24) on April 13, indicating active selling at higher levels. Currently trading at $2.12, XRP faces a crucial test at the $2 support level. A break below could send it toward $1.72, while success in pushing above the 50-day SMA might signal a potential rally to its resistance line.

- BNB BNB/USD: Binance Coin is confronting resistance at its downtrend line while trading at $585.87. The limited downside movement suggests potential for a breakout above the downtrend line, which could push BNB toward $645.

- Cardano ADA/USD: Cardano struggles to break above its 20-day EMA ($0.65), trading at $0.6332. Buyers need to push the price above the 50-day SMA ($0.71) to signal a potential end to the downtrend, which could propel ADA toward $0.83 and eventually $1.03.

- Dogecoin DOGE/USD: DOGE traders are attempting to start a recovery, but face resistance at moving averages. Currently priced at $0.1581, a breakthrough above these averages could signal a rally toward $0.20, completing a double-bottom pattern with potential targets near $0.26.

The overall cryptocurrency market remains cautious as investors digest ongoing regulatory developments and trade policy uncertainties. Institutional outflows, with CoinShares reporting $795 million leaving digital asset ETPs last week, highlight continued concerns despite Bitcoin’s recent price recovery.