Ethereum (ETH) – Short-Term Bearish Outlook as Resistance at $1,671 Holds Firm

Ethereum’s recent attempt to break above the short-term resistance zone around $1,671 was once again rejected

Ethereum (ETH) continues to face strong headwinds after failing to reclaim resistance at $1,671. This level has now been confirmed as a short-term ceiling, suggesting that sellers remain in control for now. Although broader sentiment hints that a bottom could be forming soon, this setup still leans bearish in the near term.

Key Technical Setup

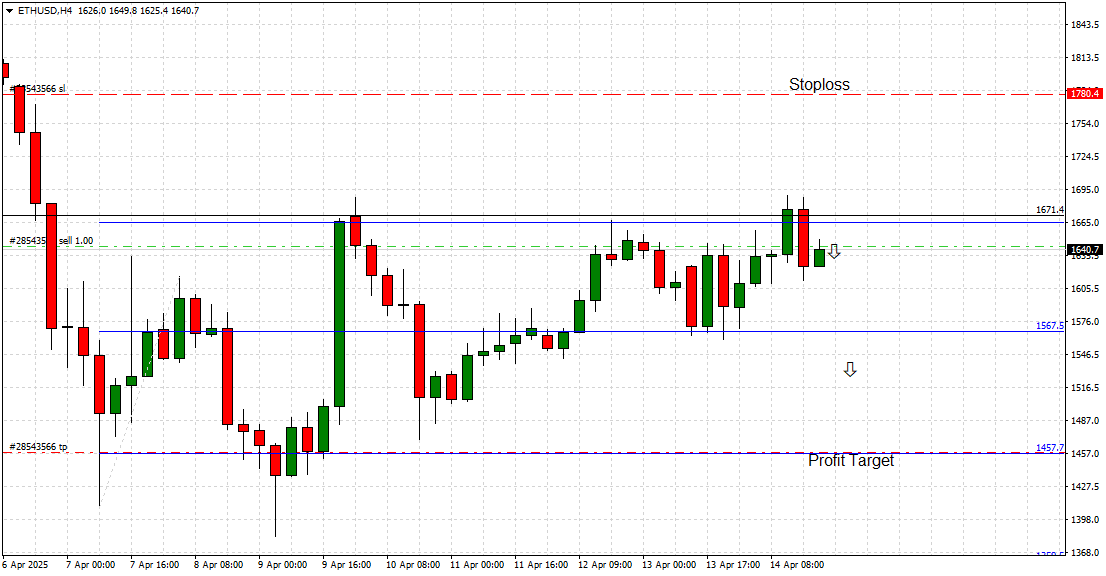

On the 4-hour chart (as of April 14, 2025), Ethereum attempted to break higher but was rejected at $1,671. This level had previously acted as support but has now flipped into resistance. The failed breakout was followed by a weak price response, highlighting a lack of bullish momentum.

ETH is currently trading just below the rejection zone, hovering around $1,640.70. Without a clear close above $1,671, there’s a growing risk of further downside.

Trade Setup Summary

Resistance (Rejected): $1,671

Local Support: $1,567.50

Primary Bearish Target: $1,457

Bearish Invalidation (Stop-Loss): $1,780.40

Bias: Short-Term Bearish

While we remain bearish in the immediate term, this conviction is tactical. Ethereum’s longer-term structure suggests that a bottom could be near. We’ll reevaluate this stance as price action develops around the $1,457 support zone.

Technology and Vision

Ethereum is the foundation of the decentralized web. As the leading smart contract platform, it powers DeFi apps, NFT marketplaces, and next-generation Web3 ecosystems.

Following its transition to Proof-of-Stake, Ethereum now operates with improved energy efficiency and increased scalability potential. Innovations like Danksharding and the growing use of Layer 2 solutions are expected to further reduce costs and increase transaction speed.

Ethereum’s vision remains clear: build a decentralized, permissionless financial future that supports real-world adoption and institutional integration.

Conclusion

The inability to reclaim $1,671 confirms short-term bearish momentum. As long as Ethereum trades below this level, price action favors a move toward $1,457. That support level will be critical in deciding whether this is just another dip—or the end of the current corrective phase.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account