Ethereum Holds Steady Above $1,600 Amidst Deflation Debate and Bullish Pattern Formation

Down by around 60% from its December highs, Ethereum continues to navigate challenging market conditions even as it above the key $1,600 mark. Despite burning over 4.5 million ETH since the London Hard Fork in August 2021, the second-largest cryptocurrency by market capitalization, ETH/USD, has had conflicting signals since its monetary policy fails to achieve continuous deflationary status.

Ether’s Burn Mechanism Falls Short of Deflationary Expectations

According to data from ultrasonic.money, Ethereum’s supply has really increased by 0.805% yearly after the update, adding around 3.5 million ETH to the market. This goes against the initial assumptions that the burn process would cause ETH to always be deflationary. Although the network has burned around $7.3 billion worth of ETH to date, this has not been enough to offset new token issuance, particularly when recent enhancements like the Dencun upgrade in 2024 have lowered transaction costs and, hence, burn rates.

With 374,298 ETH burned, ETH transfers have sparked burning activity; NFT marketplace OpenSea (230,051 ETH) follows next, then Uniswap V2 (226, 501 ETH). Ethereum’s claim to “Ultra Sound Money” status remains aspirational rather than realized even during sporadic deflationary times amid peak network activity.

Ethereum Ecosystem Strength and Value Proposition

Notwithstanding the recent bearish price action in the ETH token, Ethereum’s ecosystem remains remarkably resilient. Over the past week, the network handled decentralized exchange (DEX) trading volume of over $17.2 billion, surpassing rivals Solana ($15 billion) and BNB Chain ($5.9 billion). Ethereum continues to dominate the DeFi sector with $46 billion in total value locked (TVL) and $123 billion in stablecoin market cap.

With a Z-score of -0.832, the Market Value to Realized Value (MVRV) Z-score suggests Ethereum might be underpriced relative to its past average. As investors consider buying the dip in ETH, this statistic, which helps ascertain if an asset is cheap or expensive, suggests a potential rebound.

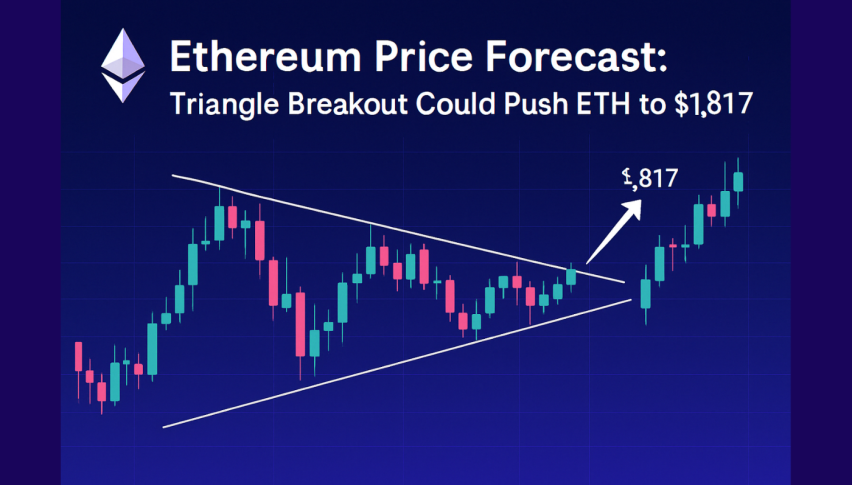

ETH/USD Technical Analysis Hints at Potential Recovery

Technical indicators show Ethereum may have a comeback despite the general bearish mood in the crypto market. Usually a positive indication, ETH/USD has shown a declining wedge formation in both the daily and weekly charts. Should ETH deviate from this trend, it might retest the $2,140 resistance level, therefore reflecting a 35% rise from present levels.

Rising at 42, the Relative Strength Index (RSI) has bounced from oversold territory and is now signaling waning bearish momentum. A daily close above $1,700 might prolong the surge until the next resistance at $1,861; a break below $1,449 could set off a fall toward $1,300.

Following after establishing a base above $1,500 and attaining a recent high of $1,668, short-term price movement suggests Ethereum stabilizing. With support between $1,600 and $1,575, Ether now faces immediate resistance around $1,640. While the RSI stays above the 50 zone, the hourly MACD shows declining positive momentum, therefore offering a mixed short-term picture.

What’s Next for Ethereum: Buterin’s Privacy Roadmap

Co-founder Vitalik Buterin has revealed a “maximally simple” Layer 1 privacy strategy, adding another dimension to Ethereum’s future. With an emphasis on private payments, partial anonymizing of in-app activities, private blockchain reads, and network-level anonymization, Buterin’s latest proposal seeks to improve transaction privacy without fundamentally changing the Ethereum network’s consensus model.

Buterin advises against building a separate privacy chain and instead of merging current technologies like Railgun and Privacy Pools into the wallet experience. Although institutional adoption depends mostly on regulatory conformity, this approach could conceivably address one of Ethereum’s major drawbacks.