Gold Pumps as CPI Miss Fuels Fed Cut Hopes—Breakout Loading?

The latest US Consumer Price Index (CPI) report surprised markets on Thursday, with inflation cooling faster than expected and reshaping...

The latest US Consumer Price Index (CPI) report surprised markets on Thursday, with inflation cooling faster than expected and reshaping Fed policy expectations.

Headline CPI for March fell -0.1% month-over-month, missing estimates of +0.1% and reversing February’s +0.2% gain. Year-over-year inflation came in at 2.4%, down from 2.8% and below 2.5% consensus. Core CPI, which excludes food and energy, was soft at +0.1% vs 0.3% estimate.

This across the board deceleration means inflation is easing faster than expected. Add to that weekly jobless claims staying at 223,000 and we have a cooling inflationary environment within a strong labor market – exactly what the Fed has been hoping for to justify rate cuts.

Markets reacted quickly. Fed Funds futures now imply a 70% chance of a rate cut by June, a big pivot from just a week ago. Bond yields fell and the US Dollar Index (DXY) dropped below 102.50, as the market believes the next move from the Fed will be to ease not tighten.

Equities rallied on the dovish inflation and Bitcoin and gold gained as real yields fell and the policy environment became more accommodative.

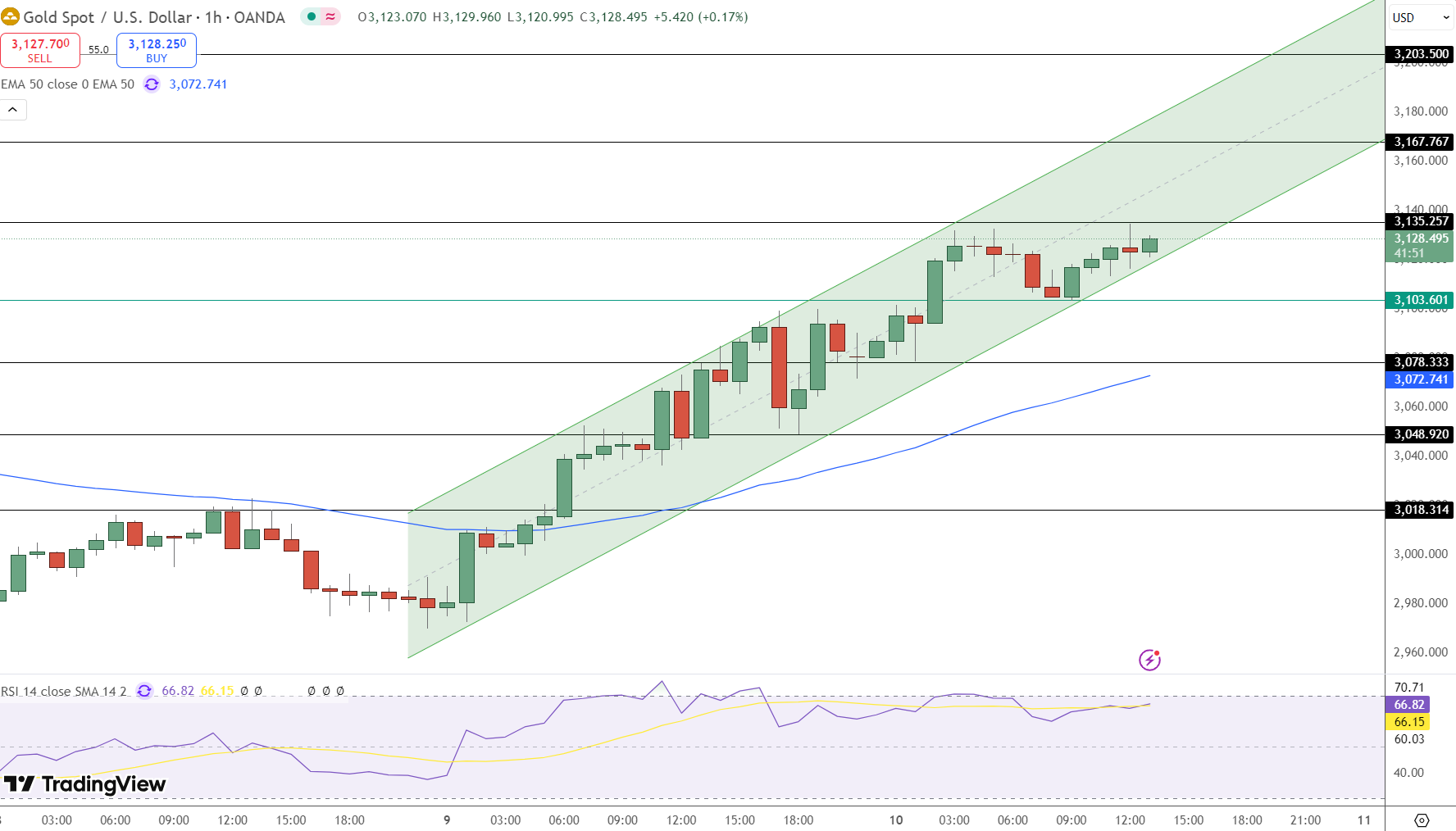

Gold Price Outlook: Bulls Target $3,135 Breakout

Gold (XAU/USD) is still bullish and trading near $3,128 after reclaiming the $3,103 support. The metal is in an uptrend and supported by the 50 period EMA at $3,072 which is still holding near-term structure.

Immediate resistance is at $3,135 which is the level to watch for a breakout. A sustained move above this could see further gains to $3,167 and possibly $3,203 if momentum holds.

Downside risk is to $3,103 and then $3,078 or even $3,048 but the overall trend is still bullish. The RSI at 66.8 is strong but getting overbought so we need to be cautious.

Key Technical Levels:

Support: $3,103 • $3,078 • $3,048

Resistance: $3,135 • $3,167 • $3,203

50 EMA: $3,072

RSI: 66.8 (Bullish but near overbought)

Bottom Line: As long as gold holds above $3,103 the technicals are in our favor. A clean break above $3,167 and 3. The 50 EMA is $3,072.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account