Intel Corporation (INTC) Surges 21% in Just 24 Hours — What’s Behind the Explosive Rally?

Konstantin Kaiser•Thursday, April 10, 2025•3 min read

Intel (INTC) has been locked in a persistent downtrend for the past five years, steadily losing ground against its semiconductor peers. With prices approaching long-term support levels, the key question now is: Will the downtrend continue, or is a bullish rebound finally on the horizon?

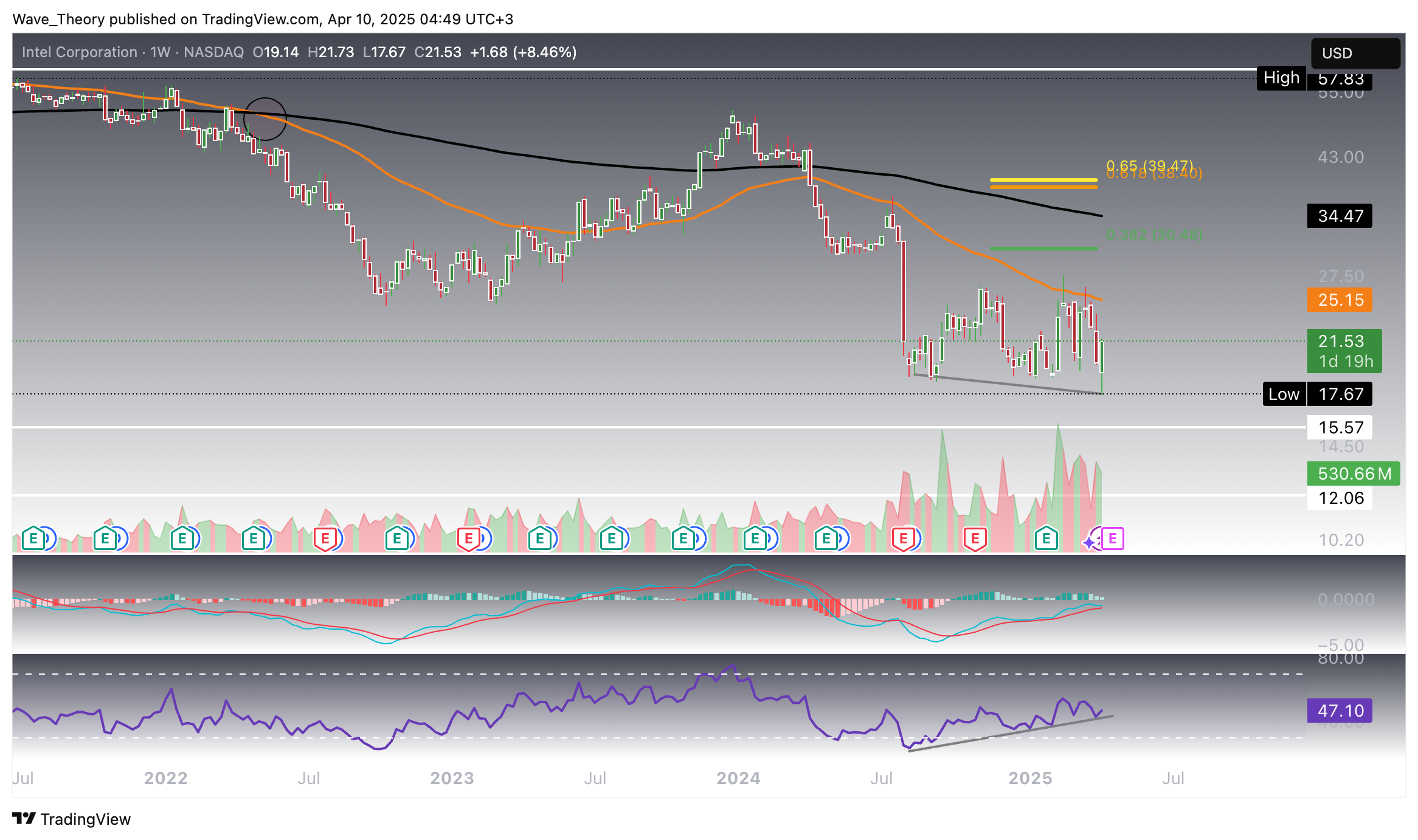

Intel Down 74.5% Over 5 Years — Key Support Zone Approaches

Intel (INTC) has declined by an astonishing 74.5% over the past five years, continuing its long-term downtrend with no confirmed structural reversal to date. However, the stock is now approaching a significant multi-year support zone between $12 and $15.60, a level that may attract renewed buying interest.

Notably, there are early signs of a potential bullish reversal emerging from key momentum indicators. The Relative Strength Index (RSI) is forming a bullish divergence, suggesting weakening downside momentum and increasing probability of a reversal. Additionally, the MACD histogram has been printing higher lows for four consecutive months, with the MACD lines nearing a bullish crossover — a development that would further strengthen the short- to medium-term bullish outlook.

That said, structural risks remain. The Exponential Moving Averages (EMAs) are on the verge of forming a death cross, which would reinforce the prevailing long-term bearish trend. Until that crossover is invalidated or price action confirms a sustained breakout above key resistance levels, Intel’s broader trend remains under pressure.

In summary, while Intel shows short- to medium-term upside potential, the long-term trend remains decisively bearish unless technical confirmation of a reversal emerges in the coming weeks.

Key Fibonacci Resistances in Focus — Weekly Chart at Critical Juncture

On the weekly timeframe, the RSI continues to form a bullish divergence, suggesting that bearish momentum is weakening and a potential reversal could be underway. However, Intel was rejected at the 50-week EMA at $25.15 just two weeks ago, reinforcing this level as a key resistance to watch.

Should Intel break above this barrier, it would open the door to the next significant Fibonacci resistance levels at $30.50 and $39.50. A decisive move above the golden ratio at $39.50 would invalidate the broader corrective phase and signal a full resumption of Intel’s long-term uptrend.

Despite the early bullish signals, the trend remains under pressure. The EMAs continue to display a death cross, confirming a mid-term bearish outlook. Additionally, the MACD histogram has been trending lower for the past three weeks, reflecting weakening momentum. That said, the MACD lines remain in a bullish crossover, offering a degree of support for near-term upside.

In conclusion, Intel shows room for short-term bullish continuation, but a clear breakout above $39.50 is essential to fully confirm a long-term trend reversal.

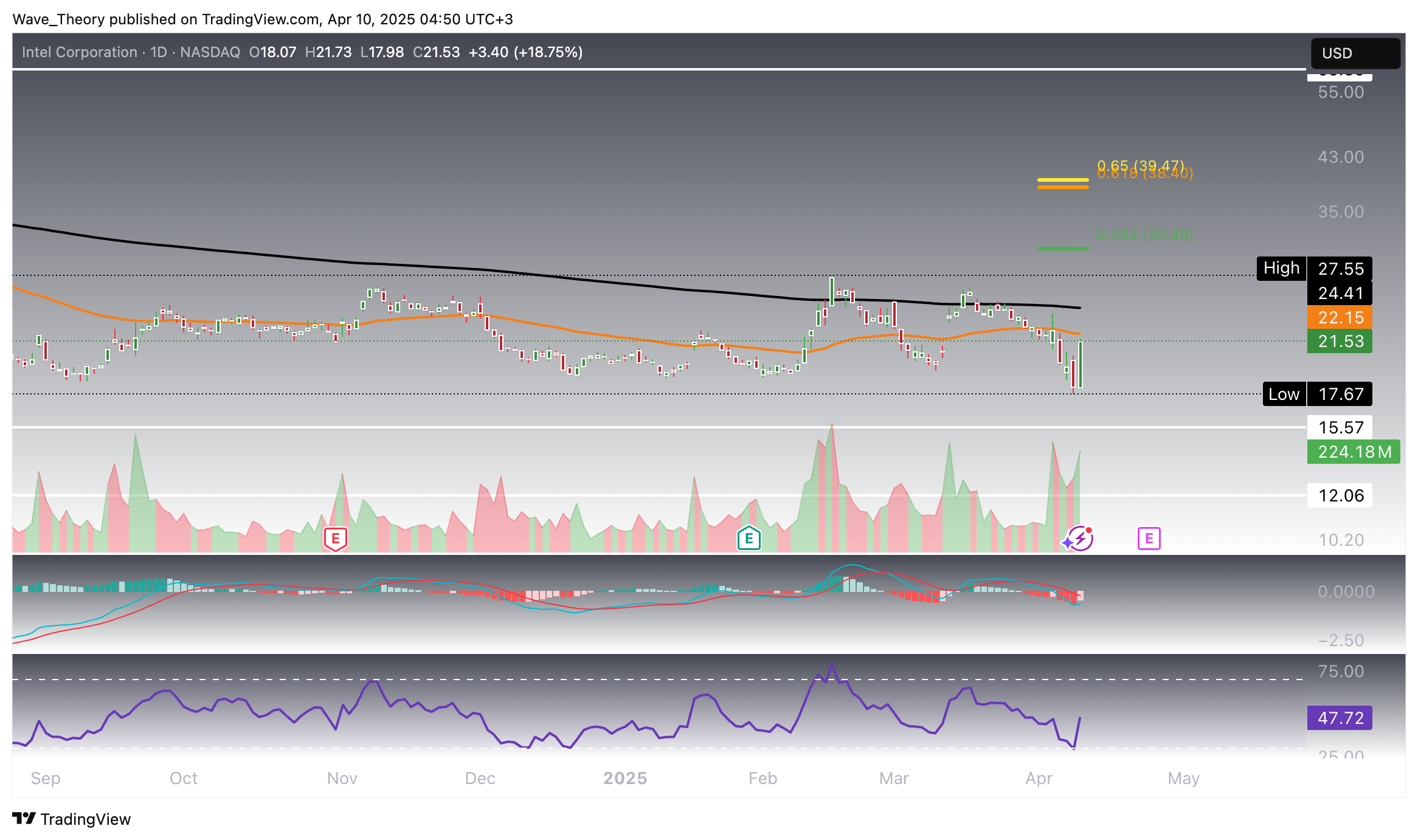

Intel Daily Chart Shows Predominantly Bearish Structure Despite Intraday Strength

On the daily chart, Intel continues to exhibit a broadly bearish technical structure. Both the Exponential Moving Averages (EMAs) and the MACD lines remain bearishly crossed, confirming sustained downward pressure in the short- to medium-term trend.

The Relative Strength Index (RSI) currently trades in neutral territory, offering no clear directional bias and reflecting a balanced—but uncertain—momentum environment.

However, today’s price action introduces a glimmer of bullish potential. Intel is up nearly 21% intraday, and the MACD histogram has begun to tick higher, suggesting early signs of a momentum shift. While this development may hint at a short-term rebound, the prevailing trend remains bearish until key resistance levels are broken and trend-confirming indicators turn decisively positive.

Death Cross Emerges on the 4H Chart — Mixed Signals for Intel

On the 4-hour chart, a death cross has now formed between the EMAs, reinforcing a short-term bearish trend confirmation. This crossover signals continued downside risk unless invalidated by a strong reversal.

That said, there are early signs of potential bullish divergence emerging. The MACD lines are on the verge of a bullish crossover, and the MACD histogram is currently ticking higher, suggesting short-term momentum may be shifting to the upside.

Meanwhile, the RSI remains in neutral territory, providing no strong directional bias at this stage. Overall, the technical picture is mixed—with bearish structure prevailing, but a possible short-term rebound in development.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments