VanEck’s Spot BNB ETF Sparks 42% Volume Surge—Is a Breakout Imminent?

In a move that’s turning heads across the crypto world, asset management giant VanEck has officially filed for a spot BNB exchange-traded fund (ETF) in Delaware.

The filing, made public on April 1, has already had a noticeable impact on the market—BNB’s trading volume jumped 42%, surpassing $2.12 billion within hours of the announcement.

VanEck, which oversees more than $115 billion in assets, has steadily expanded its crypto ETF lineup, previously seeking approval for funds tied to Bitcoin, Ethereum, Solana, and Avalanche. This latest move underscores a growing appetite among institutional investors for exposure to BNB, currently the fifth-largest cryptocurrency by market cap.

BNB Defies Market Trend, Shows Relative Strength

While major cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP posted double-digit declines in March, BNB stood out, slipping just 1% over the month. That resilience has turned heads—and positioned BNB as one of the top-performing altcoins in the current landscape.

Technical analysts are particularly encouraged by a cup-and-handle pattern forming on BNB’s chart—a classic setup that often precedes strong upward moves. The token is also trading comfortably above its 50-day moving average, adding to the bullish narrative.

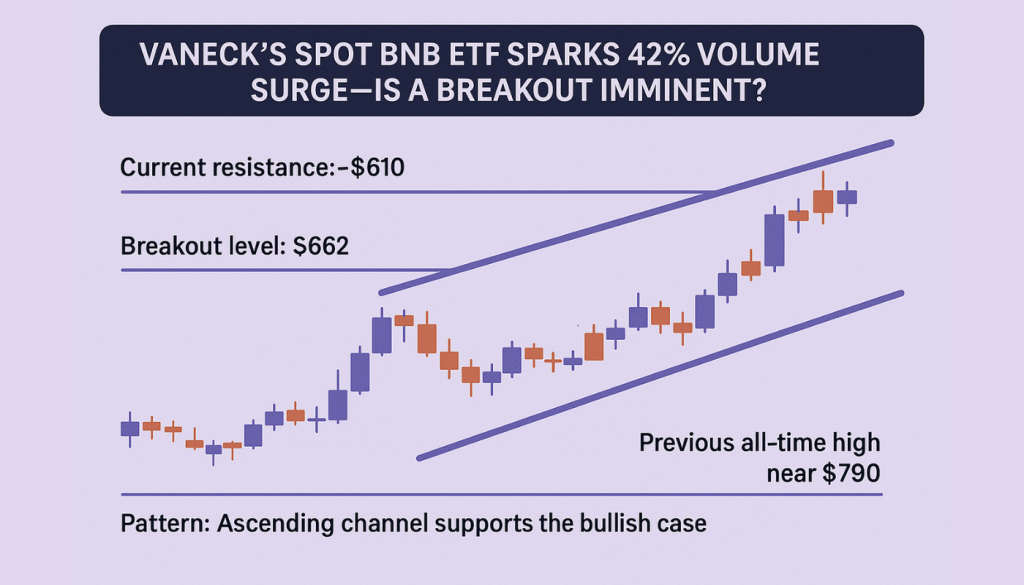

Technical Snapshot:

Current resistance: ~$610

Breakout level: $662

Target: Previous all-time high near $790

Pattern: Ascending channel supports the bullish case

For BNB to challenge its former highs, it will need to complete the handle formation and sustain momentum above $662—a level that could trigger the next leg higher.

Tokenomics and Network Upgrades Add Fuel

Beyond technical strength, BNB’s fundamentals remain compelling.

The token’s deflationary model—driven by a real-time burn mechanism—removes a portion of transaction fees from circulation permanently. Just last week, 951.85 BNB (worth over $571,000) was burned, contributing to a lifetime burn value near $160 million, according to BNBBurn data.

Meanwhile, the recent Pascal hard fork improved BNB Chain’s interoperability with Ethereum, a key step in boosting developer adoption and long-term network value. With more upgrades on the horizon, including improvements to transaction speed and scalability, the fundamentals continue to strengthen.

Why BNB May Be Just Getting Started

Add it all up: a major institutional player filing for an ETF, solid price action, deflationary supply, and rising on-chain activity—BNB is flashing signals that it may be on the verge of a major breakout.

Bullish Catalysts to Watch:

VanEck’s ETF Filing: Adds institutional legitimacy

Burn Mechanism: Steadily reduces supply

Network Growth: Interoperability upgrades and rising meme coin activity

Technical Setup: Cup-and-handle with room to $790 and beyond

Still, a move toward new highs will depend on sustained volume and renewed institutional interest. But with momentum building, BNB’s breakout potential is very much alive.