Buy the 6% Pullback in Tesla (TSLA) Stock Ahead of Car Tariffs?

Tesla stock has retreated 6% today after a strong rally in the last two weeks, but this might be a good opportunity to buy ahead of US auto tariffs which will be announced shortly.

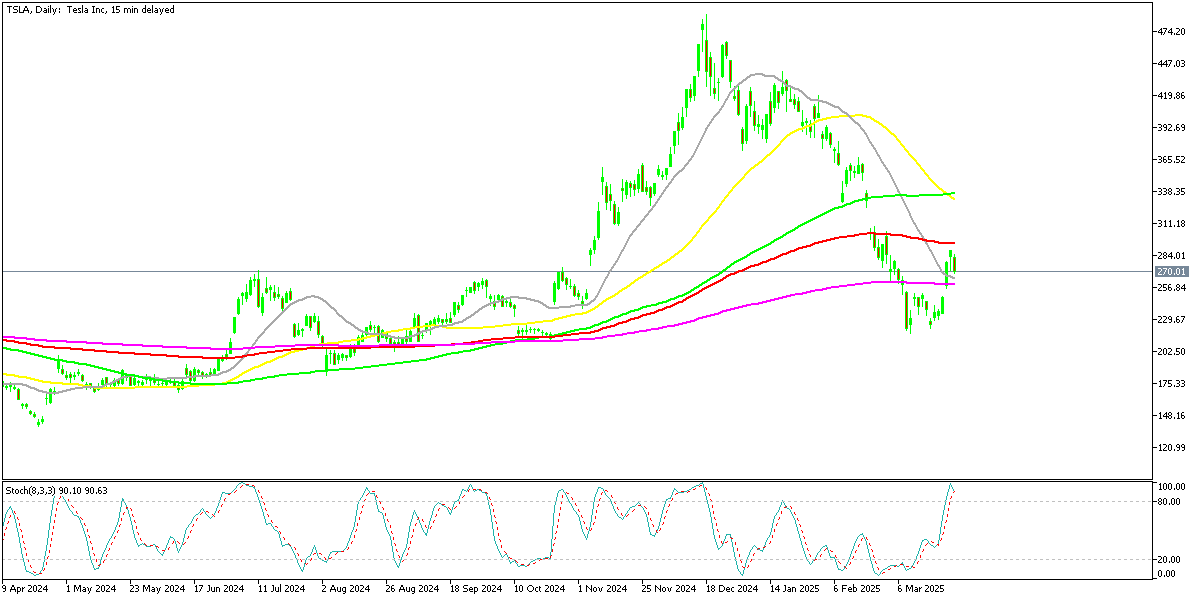

Tesla stock has been on an impressive upward trend in recent weeks, surging 32% from its March lows after testing the critical $220 support level twice earlier this month. This strong buying activity signaled a potential bullish reversal, which we highlighted over the weekend. The momentum carried Tesla shares to a closing price of $288 yesterday, reflecting growing investor confidence.

Tesla’s Stock Chart Daily – Bullish Reversal and Recent Rally

However, today’s session saw a sharp pullback, wiping out yesterday’s gains and bringing the stock down to $270. This marks the end of Tesla’s five-day rally, during which the stock had gained more than 25% on optimism surrounding potential tariff reductions and multiple endorsements from industry figures.

Auto Tariff Announcement and Market Impact

The White House is set to announce its decision on auto tariffs later today, creating uncertainty in the sector. Senator Bernie Moreno (R., Ohio) stated that the administration is considering exempting automotive parts from tariffs while implementing a more targeted approach to trade duties. She suggested that calibrated reciprocal tariffs would protect major trading partners, with the potential for higher levies in the future if foreign governments retaliate with countermeasures.

This approach could provide a temporary reprieve for automakers like Tesla, particularly if China and the European Union respond by lowering or eliminating tariffs on US-made vehicles. If this scenario unfolds, it could create an attractive buying opportunity for Tesla stock at current levels.

Long-Term Prospects for Tesla Remain Strong

Despite a rough start to 2025, Tesla’s long-term outlook remains promising. Some analysts argue that concerns over brand perception and demand are overblown. CEO Elon Musk has recently encouraged Tesla employees to “hold on” to their stock, emphasizing that Wall Street continues to underestimate the company’s true potential.

As Tesla navigates market fluctuations and trade uncertainties, investors will be watching closely to see whether today’s pullback presents another opportunity to buy into the stock before the next leg higher.