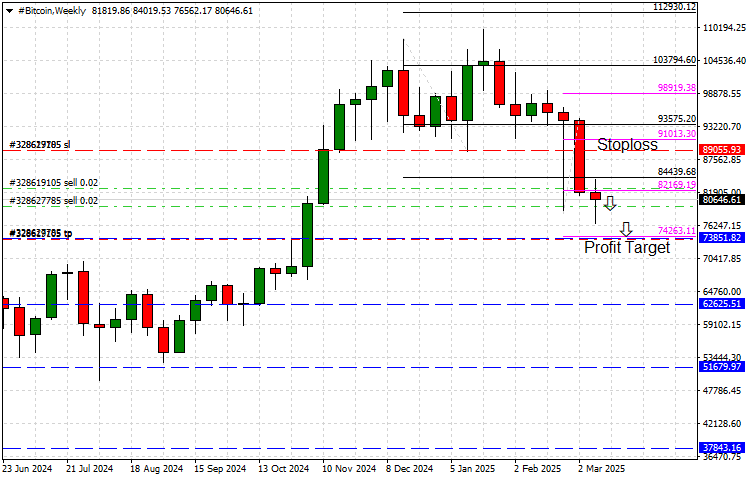

Bitcoin’s Bearish Battle: Watching the Next $73,850 Threshold

As Bitcoin continues to navigate through turbulent market conditions, our previous bearish forecast has proven prescient, with BTC now facing critical support levels that could determine its trajectory in the coming weeks.

The cryptocurrency market has been under sustained pressure, aligning with broader economic uncertainties and a risk-off sentiment that has permeated the financial markets.

Technical Analysis

- Current Price Action: Bitcoin’s price is closing in on the critical 38.2% Fibonacci retracement level at $73,850, which serves as the next major support key-level. This price point is crucial as it represents a potential turning point for Bitcoin’s short-term direction.

- Recent Developments: The technical picture indicates that Bitcoin has faced significant resistance at higher levels, with a clear rejection near the $84,400 mark. Following this, the price has steadily declined, underscoring the bearish momentum.

- Momentum Indicators: The RSI is trending towards the oversold territory, suggesting that while the downtrend is strong, a potential for reversal or stabilization might occur if the oversold conditions are reached. The MACD reinforces the bearish outlook, with its line trending below the signal line, indicating sustained selling pressure.

Key Levels to Watch

- Immediate Support Level: The $73,850 level (38.2% Fibonacci retracement) is pivotal. A break below this could lead to accelerated losses, with the next significant support level of the 50% Fibonacci retracement at $62,625.

- Resistance Levels: On the upside, the local $82,170 and major $84,400 levels represent immediate resistance barriers. These levels could serve as short-term targets for any bullish retracement or as exit points for traders looking to manage their risk on bearish bets.

- Stop-Loss Considerations: Given the volatility, setting a stop-loss well above the $84,400 resistance can protect against potential spikes in price that might occur during sudden market shifts.

Updated Trading Recommendations

- Short-Term Strategy: Traders should maintain a bearish outlook but remain alert to any signs of a bullish reversal, especially as the price approaches the oversold territory. Engaging in short-selling at resistance levels or upon confirmed breakdowns below support levels could capitalize on the ongoing downward momentum.

- Long-Term Considerations: Investors should watch for stabilization or a series of higher lows that could indicate a bottoming process before considering long positions.

Conclusion

Bitcoin’s market behavior remains predominantly bearish as it’s closing in on crucial support levels. The current landscape suggests that the $73,850 mark is more relevant than ever, with potential further downside to the $62,625 level if this support is broken. Traders and investors alike must stay vigilant, monitoring key technical indicators and market news that could affect price action. Risk management remains paramount in these conditions, with clear stop-loss orders and adherence to trading plans essential for navigating the current market dynamics.