Amazon Stock Faces Volatility Despite Strong Earnings

Amazon’s stock has experienced significant volatility over the past month, dropping nearly 20% from its early February peak. Despite reporting impressive Q4 2024 earnings, AMZN has been under pressure due to broader market weakness, AI-related costs, and trade concerns.

The initial sell-off intensified following the launch of DeepSeek, which shook AI and semiconductor stocks. However, Amazon remained relatively unaffected until Donald Trump announced trade tariffs on Canada and Mexico, triggering another leg lower. Even though the White House later delayed and scaled back the tariffs, AMZN stock continued its decline.

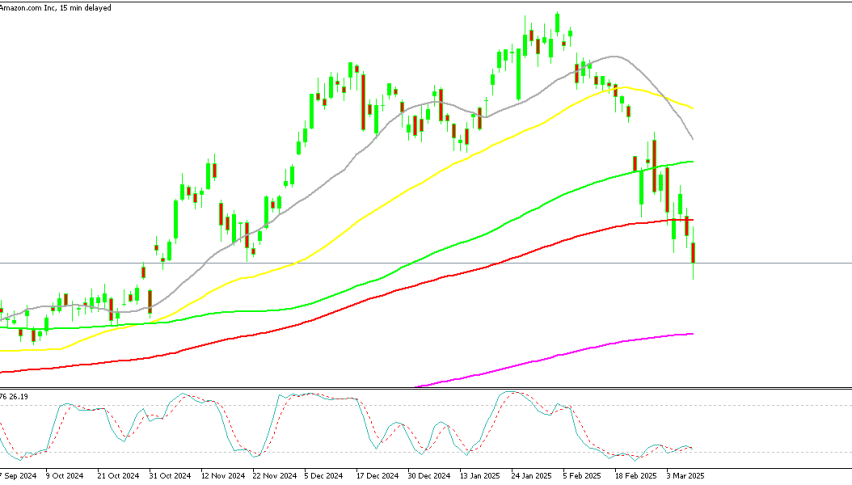

Last week, Amazon fell below $200 and the 100-day SMA (red) on the daily chart, accelerating its bearish momentum and reaching a low of $192.40 by midday Friday.

AI Expansion and Capex Weigh on Investor Sentiment

Despite the pullback, Amazon’s stock has tripled in value over the past two years, rising from $80 at the end of 2022 to $242 in early February 2025. The company’s Q4 earnings on February 6 exceeded expectations, with operating income surging 86% year-over-year to $68.6 billion.

Amazon Web Services (AWS) was the standout performer, with net revenues climbing 19% to over $100 billion. However, AI-driven expansion is now the primary focus, requiring significant capital investment.

To stay competitive in AI cloud computing, Amazon has allocated a record $100 billion in capital expenditures (capex) for 2025, most of which will go toward AI infrastructure for AWS. While this investment is expected to drive long-term growth, some investors worry about its short-term impact on profit margins, contributing to the stock’s recent decline.

Technical Rebound: A Bullish Signal?

Despite the drop, Friday’s price action suggested a possible reversal. AMZN fell to $192.54, but buyers stepped in late in the session, pushing the stock back up to close the week at $200. This formed a doji candlestick, a potential bullish reversal signal, while the 100-day SMA (red) held as support.

Market Outlook: Is Amazon a Buy Now?

Amazon’s long-term fundamentals remain strong, but concerns over AI spending and broader stock market weakness have weighed on sentiment. The S&P 500 and Nasdaq are both down over 5% from their highs, adding to selling pressure across major tech stocks.

If Amazon holds above the 100-day SMA and continues its rebound, it could signal a buying opportunity for long-term investors. However, if selling pressure resumes and AMZN breaks below $200 again, the stock could face further downside risk in the short term.