Ethereum’s Identity Crisis: Price Slumps, Pectra Delays, and the Battle to Reclaim Market Relevance

In a cryptocurrency landscape increasingly dominated by Bitcoin’s meteoric rise, Ethereum finds itself at a critical juncture as social sentiment toward the second-largest cryptocurrency hits a yearly low, according to blockchain data platform Santiment.

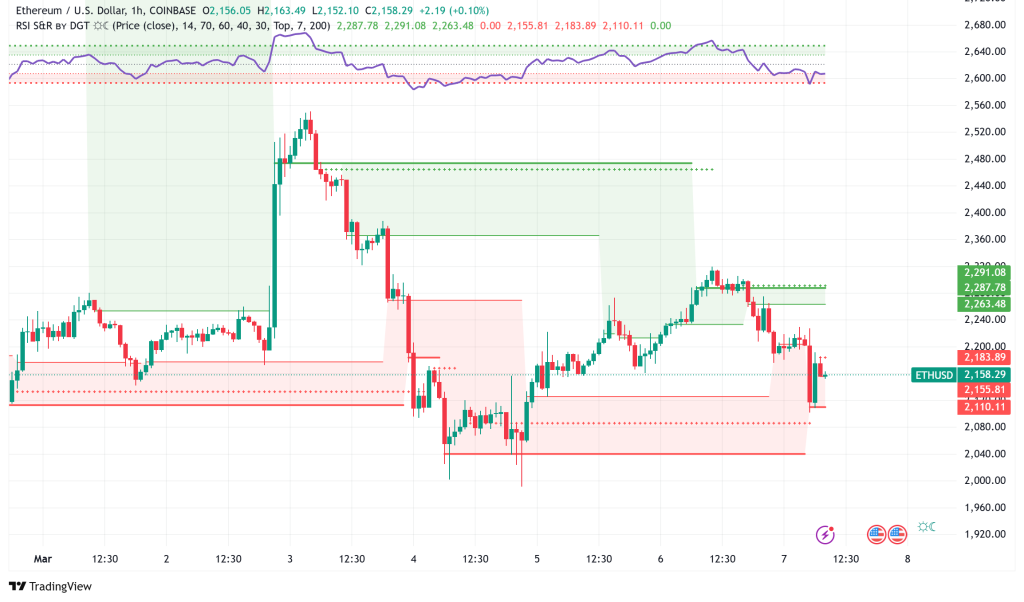

Ethereum’s Market Performance Lags Behind Competitors

While Bitcoin BTC/USD has seen a more minor 10% dip, Ethereum’s ETH/USD price has dropped nearly 20% in the previous month and is presently $2,176. With Bitcoin growing 2.7x from $39,000 to $106,000 in 2024 compared to Ethereum’s relatively meager 1.8x increase from $2,200 to $4,000, the ETH/BTC ratio has dropped to its lowest point since the 2018 ICO bubble crash.

“For those patiently holding their Ether, the bearishness being projected across social media is a good sign of a potential turn-around once crypto markets stabilize,” Santiment said in a recent research.

Emphasizing the need of “separating short-term narratives from long-term fundamentals,” Douro Labs CEO Mike Cahill said, “historically, extreme bearish sentiment has often coincided with market bottoms.” Analyst Dominick John of Kronos Research said that although Ethereum’s performance would deter short-term investors, “extreme negative often means the bottom of a cycle,” therefore perhaps positioning it for “a significant rebound.”

Technical Setbacks: Pectra Upgrade Postponed

Further complicating Ethereum’s situation, engineers revealed on March 6 that following two buggy test runs they would delay the much awaited Pectra upgrade. Through features like EIP-7702, which gives crypto wallets smart contract capabilities, and EIP-7251, which raises validator staking capacity, the upgrade, Ethereum’s most important since 2024, seeks to improve the network’s speed and ease of usage.

Developers concluded further testing was required before deploying Pectra on the main network after doing tests on the Holesky and Sepolia networks found setup problems. With normal operations expected to start around March 28, a temporary “shadow fork” of the Holesky test network will be developed to let stakeholders continue testing while the main Holesky network is being rebuilt.

Ethereum’s Identity Crisis and Brand Positioning

Industry commentators highlighted to Ethereum’s difficulty to effectively present its value proposition in a market where Solana stresses technical advantages and Bitcoin stresses its currency features. The ETH Denver brand hackathon is one of the initiatives the Ethereum community started to change Ethereum’s market image and solve inadequate promotional campaigns.

“The current challenge for Ethereum is how to engage with areas of the crypto space that it has traditionally looked down upon, while staying true to its ideals,” observed one study. Critics contend Ethereum must “re-embrace the cypherpunk culture and reclaim its early rebellious spirit” if it is become “cool” once more.

Several brand slogans have been suggested; “Ethereum – The Internet You Can Own” has the highest chance to connect with consumers since it presents an understandable value proposition.

The Road Ahead for Ethereum

Ethereum has great benefits in decentralization despite present difficulties; most competitive L1 blockchains compromise decentralization and security for scalability. By means of L2 or economic zones, Ethereum’s roll-back solutions can inherit 100% of its underlying security and increase network scale.

Expert in the field advise Ethereum should:

- Clearly define its competitive posture to stand out from Solana and Bitcoin.

- Accept modern memes and media of communication.

- Using efficient incubators helps to strengthen ecosystem cooperation.

- Create a single information portal to get consumers straight forwardly.

- Apply a coherent brand approach akin to Intel’s “Intel Inside” concept.

Some analysts remain cautiously optimistic about Ethereum’s long-term prospects despite present market mood as Trump family-backed World Liberty Financial raises its Ethereum holdings by $10 million over a seven-day period and with Ethereum’s MVRV Z-Score at its lowest level in 17 months—a statistic that historically precedes bull runs.