On the daily chart, while the EMAs still maintain a golden crossover, confirming a bullish trend in the short- to medium-term, there is a potential for a death cross to form. The MACD lines are already crossed bearishly, and the histogram is ticking lower, signaling downward momentum. Additionally, the RSI is nearing oversold regions. Should NVDA decline further, there is an estimated 17 % downside potential until it reaches major support.

Nvidia Stock (NVDA) Extends Correction Phase: Is More Downside on the Horizon?

Konstantin Kaiser•Friday, March 7, 2025•2 min read

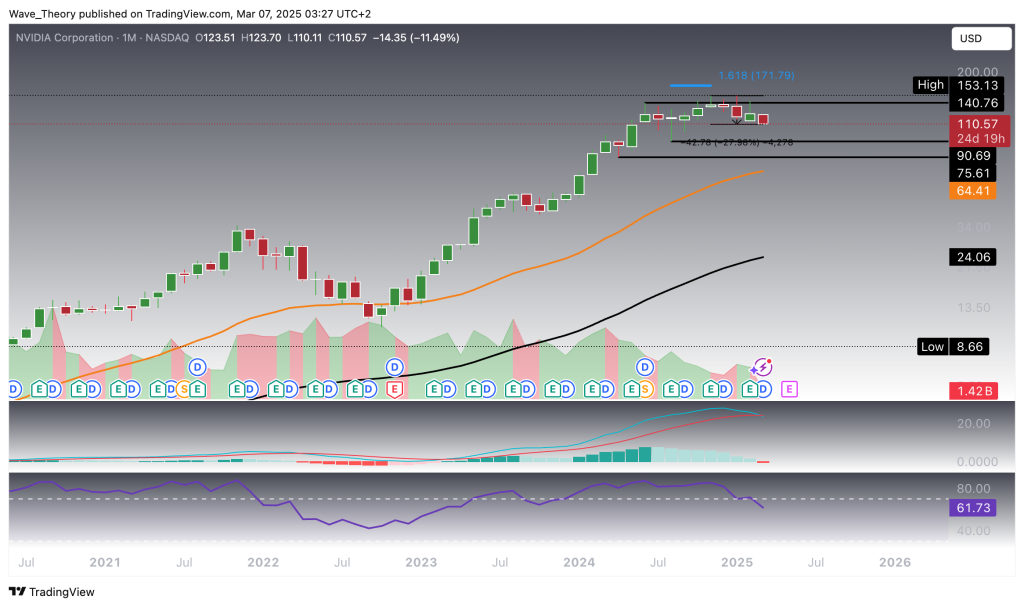

Nvidia (NVDA) stock has been in a steady downtrend for the last five months, facing critical support levels. The key question now is whether this correction will extend further or if a bullish rebound is imminent.

Nvidia (NVDA) Declines by 28%

Nvidia (NVDA) failed to reach the Fibonacci projection level at $171.8, instead closing below the horizontal resistance around $141. Since then, the stock has experienced a 28% decline, with mixed signals from the technical indicators.

Technical Indicators and Trends (Monthly Chart)

MACD (Moving Average Convergence Divergence): The MACD lines are nearing a bearish crossover, with the histogram showing a downtrend.

RSI (Relative Strength Index): The RSI is moving out of overbought territory, heading back to neutral levels.

EMA (Exponential Moving Average): Despite the decline, the EMAs still show a golden crossover, signaling the long-term bullish trend remains intact.

Nvidia Stock Breaks 50-Week EMA Bearishly

Nvidia (NVDA) stock appears to have broken below the critical 50-week EMA support at $117.4. This bearish move opens the possibility for the stock to retrace to the next support zone, between $75.6 and $90.7.

Technical Indicators and Trends (Weekly Chart)

MACD (Moving Average Convergence Divergence): The MACD lines remain bearishly crossed, with the histogram continuing its downward trend since last week.

RSI (Relative Strength Index): The RSI is in neutral territory, giving no clear directional signal.

EMA (Exponential Moving Average): Despite the bearish move, the golden crossover of the EMAs confirms a mid-term bullish trend, hinting at a generally positive longer-term outlook for the stock.

Nvidia (NVDA) Could Retrace Further Amid Bearish Indicators

Death Cross Emerges on Nvidia (NVDA) 4H Chart

On the 4H chart, indicators predominantly signal bearish momentum. The EMAs have formed a death cross, confirming a short-term downtrend. Additionally, the MACD lines remain crossed bearishly, with the histogram ticking lower, while the RSI hovers near oversold territory, suggesting potential for further downside.

Summary

Nvidia (NVDA) has been in a correction phase for the past five months, declining by approximately 28%. The stock is facing significant support challenges, with indicators showing a mixed outlook across different time frames. While the monthly and weekly charts still confirm a mid- to long-term bullish trend with golden crossovers on the EMAs, shorter-term signals are more bearish. The daily and 4H charts show a potential death cross and bearish MACD signals, with RSI approaching oversold levels. If the stock breaks key support levels, there is potential for a further 17 % decline.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments

Sidebar rates

Add 3442

Related Posts

XM

Best Forex Brokers

U have been succesfuly subscribed!