Nvidia and Tesla Stock Plunge Over 5% as S&P 500 Extends Losses

Today the rout in S&P 500 continued as it fell 1.8%, while Tesla stock and the Nvidia stock price ended more than 5% lower...

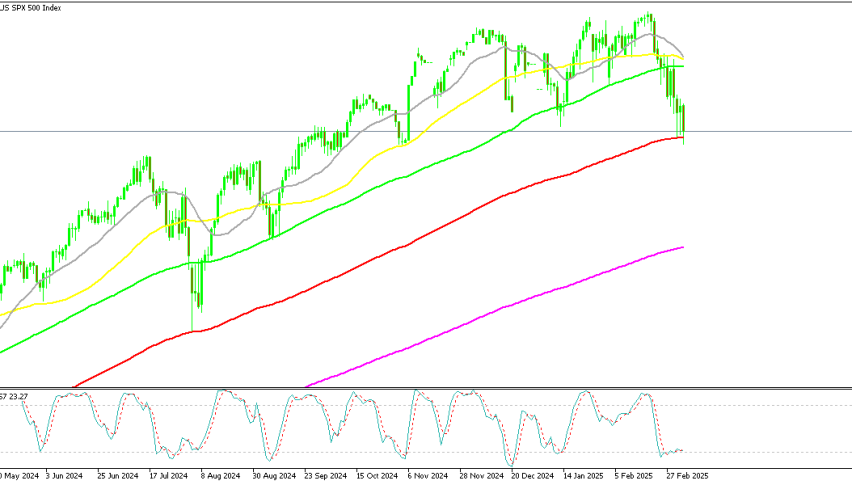

Live SP500 Chart

Today the rout in S&P 500 continued as it fell 1.8%, while Tesla stock and the Nvidia stock price ended more than 5% lower, as AI and big tech continues to suffer.

Stock Market Slumps as Selling Pressure Increases

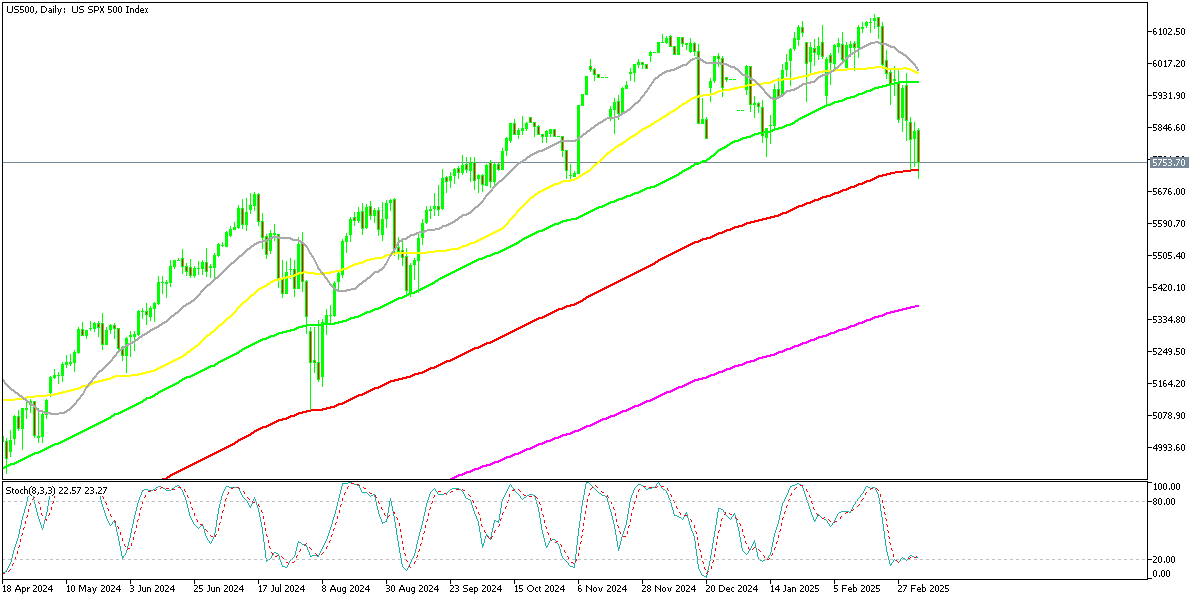

U.S. stock markets faced another sharp decline, with the S&P 500 falling 1.8% to close at 5,738.52, as selling pressure intensified throughout the session. Early optimism faded after Commerce Secretary Howard Lutnick suggested that a tariff rollback was “likely” today, leading to a wave of selling across major indices.

Among the biggest losers were hedge fund favorites like Constellation, Netflix, and Vistra, indicating that deleveraging could be the primary driver behind the sell-off. This suggests that investors may be shifting their capital into stronger-performing markets like China or Europe.

The S&P500 briefly dropped to 5,711, dipping below the 100-day moving average (purple) at 5,733, before recovering late in the session. If the index breaks below this key level, further selling could push it towards the 5,670–5,680 support range, a critical zone where buyers may look to enter.

Nvidia Stock Tumbles as Tech Weakness Persists

Nvidia (NVDA) continues to face extreme volatility, closing 26% lower at $110.57 after breaking below the 50-week SMA (yellow), a key technical support level. The stock, which dominated the equity markets for the past two years, is now under heavy selling pressure as competition in the AI and semiconductor sectors intensifies.

Investor sentiment toward Nvidia has soured due to mounting concerns over trade tensions, slowing revenue growth, and high semiconductor stock valuations. With no clear sign of a reversal, buyers are hesitant to step in, keeping NVDA stock in a highly bearish trend.

Tesla Struggles Amid Weakening Global EV Demand

Tesla (TSLA) has been in a prolonged downtrend, falling 46% from its mid-December high of $488.54. The company is facing growing challenges as EV demand slows worldwide, with European sales dipping two weeks ago, followed by a significant drop in China last week.

Over the past two days, Tesla attempted a reversal after forming a bullish doji candlestick at the 200-week SMA (purple), a potential support level. However, today’s session erased those gains, as TSLA opened with a negative gap, dropped to $260, and closed at $264, marking a 5% decline from the previous session.

The previous close of $279.10 showed some stability, but momentum remains weak, and further downside risk persists unless Tesla can regain key technical levels.

Market Outlook

With Nvidia and Tesla leading the decline, U.S. stocks remain under pressure, as investors rotate out of tech stocks amid trade policy uncertainty and economic concerns.

The S&P 500’s battle with the 100-day SMA will be crucial in determining whether markets stabilize or if further selling momentum pushes prices lower. If support fails, we could see a deeper correction, particularly in high-growth tech stocks.

For Nvidia and Tesla, the bearish trend remains dominant, with no clear signals of a strong recovery. If broader market sentiment remains weak, both stocks could see further downside, while investors continue to seek safer assets amid heightened volatility.

S&P 500 Index Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account