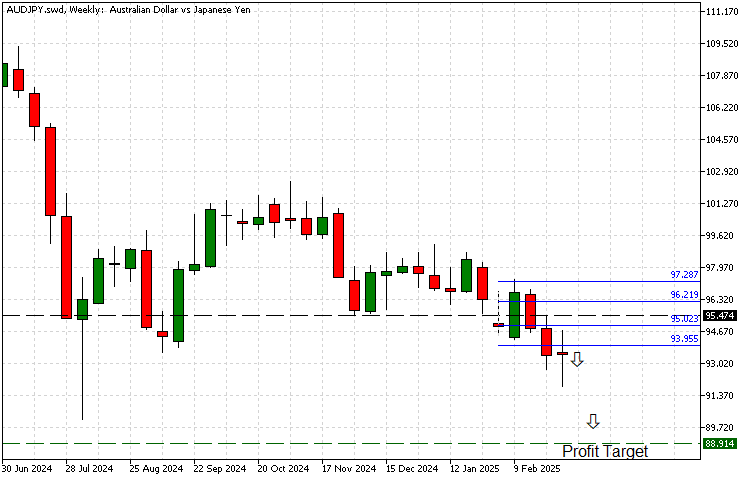

AUD/JPY Bearish Breakdown Confirms More Downside Potential

AUD/JPY has shifted into a confirmed bearish trend after breaking below key support level of 93.95

This breakdown, coupled with the prior breach of 95.47, suggests further downside potential, with 88.92 as the next major support and official profit target. Read on for key insights and updated targets.

The AUD/JPY currency pair has entered a clear bearish cycle after decisively breaking below 93.95, a critical level that had previously acted as strong support. This move follows the earlier breakdown of 95.47 a few weeks ago, which was the first major signal indicating a shift toward bearish momentum. The failure to reclaim these levels suggests that selling pressure remains dominant, paving the way for further downside.

As of today [06.03.25], AUD/JPY is trading at 93.40, confirming bearish control. The next significant downside target is 88.92, which marks a major support zone and serves as our official profit target for this updated bearish outlook.

AUD/JPY Market Dynamics

Despite recent macroeconomic developments, the Australian dollar has faced sustained weakness against the Japanese yen, primarily due to shifting risk sentiment and central bank policy divergence. The Bank of Japan’s monetary stance and investor flight to safe-haven assets have further strengthened JPY against AUD. Meanwhile, Australia’s economic outlook remains under pressure from global growth concerns and commodity market fluctuations, adding to AUD’s downside risks.

Fundamental Catalysts

- Major Support Breakdown: The break below 93.95 confirms the bearish structure and strengthens downside potential.

- Bear Cycle Confirmation: The earlier failure at 95.47 signaled the beginning of a broader downtrend.

- Market Sentiment Weakens: Increasing risk aversion has strengthened JPY as a safe-haven asset while weighing on AUD.

Key Price Levels

- Previous Support (Broken): 95.47

- Current Key Breakdown Level: 93.95

- Next Major Support: 88.92

- Bearish Profit Target: 88.92

Looking ahead, AUD/JPY’s inability to reclaim lost support levels suggests that selling momentum will likely persist. As long as 93.95 remains unchallenged, the bearish outlook remains in effect. The upcoming test of 88.92 will determine whether the downtrend extends further or if buyers attempt to stabilize the pair at this crucial level. Traders should monitor key resistance levels and sentiment shifts for confirmation of further downside potential.