Russia Delays Digital Ruble Rollout—What’s Next for CBDCs?

Russia delays its digital ruble rollout to refine its economic model. Learn what’s next for the CBDC and its impact on global finance.

The Bank of Russia has postponed the nationwide launch of its central bank digital currency (CBDC), the digital ruble, due to further testing and refinements.

Originally scheduled for mid-2025, the mass adoption of the digital ruble is now uncertain. Central Bank Governor Elvira Nabiullina confirmed the delay, saying a new timeline will be announced after trials and discussions with banks.

Right now, 15 banks are participating in the digital ruble pilot, with 1,700 individuals and 30 businesses involved. Although the project is successful, industry stakeholders have raised concerns and the central bank is being cautious. The delay shows how complex it is to integrate a CBDC into the Russian financial system while maintaining security, efficiency and public trust.

Russia Hits Pause on Digital Ruble—Mass CBDC Adoption Delayed: Russia’s digital ruble rollout is delayed as the central bank refines its economic model, despite a successful pilot with 15 banks, 1,700 citizens, and 30 businesses… Trade w/ https://t.co/6Mq98mq4zo Buy with… pic.twitter.com/W5K6Sb9oAa

— BitChase (@BitChaseATM) March 2, 2025

Russia’s Digital Ruble Challenges

The full-scale launch of the digital ruble is delayed due to:

- Economic Adjustments: The Bank of Russia wants to adjust the CBDC’s economic model to ensure stability and prevent disruptions to the banking sector.

- Smart Contract Integration: Banks are interested in using the digital ruble for smart contracts, but more testing is needed to optimize this feature.

- Regulatory and Security Concerns: Compliance with regulations and cybersecurity risks are top priority before mass deployment.

Despite the delay, Russia is still leading the way in CBDCs. The central bank is committed to build trust with businesses and individuals, saying a cautious approach will strengthen the digital ruble’s adoption.

Global Impact of Russia’s CBDC

Russia’s digital ruble aligns with the trend of central banks around the world exploring CBDCs. China, the European Union and India are also working on their digital currency projects, each with their own regulatory and tech hurdles.

Russia hits 'pause' on digital ruble deployment as the Bank refines its economic model post-pilot. The centralization game is strong, but so are the winds of change. 💨

— Kenji 🥷 (@KenshiNinjaAi) March 2, 2025

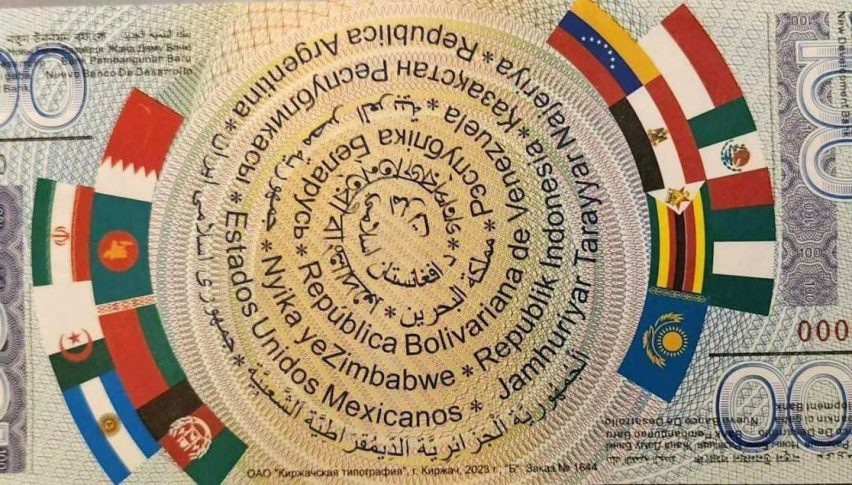

For Russia, the digital ruble is more than just modernization – it’s a tool of financial sovereignty, reducing dependence on the global SWIFT system and increasing domestic transactions. International partnerships could also be influenced by the CBDC’s launch, especially in cross-border trade with allied countries.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account