Palantir, NVDA and Tesla Stock Help Drag Nasdaq Down

Today the Big Tech crash continued, with Palantir, Nvidia and Tesla stock contributing to drag the Nasdaq index down.

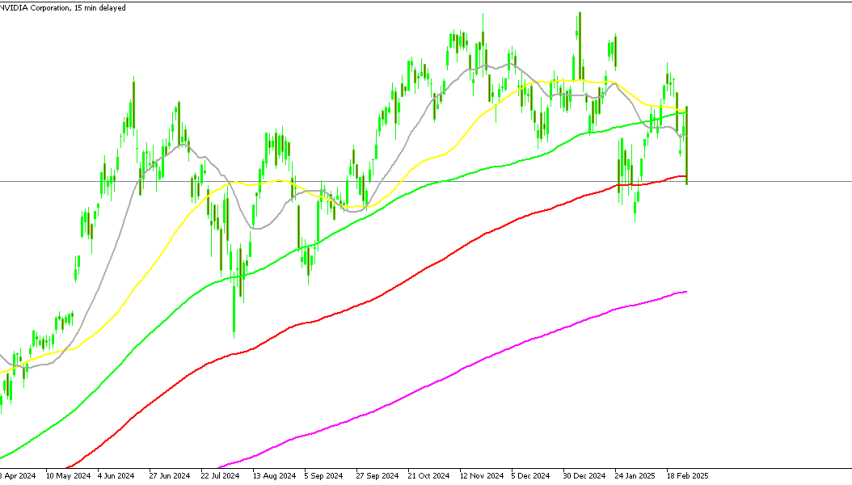

Today’s trading session concluded with a significant downturn across major stock indices, marking a disappointing day for investors. The NASDAQ index experienced its most substantial drop since January 27, which has been referred to as “DeepSeek Day.” Currently, the NASDAQ is 7.5% lower from the highs above $20,000 points. Nvidia’s shares specifically took a significant hit, falling more than 11% today, marking its steepest decline since the DeepSeek statement, which was released just a day after the company posted better-than-anticipated earnings.

In addition to Nvidia, several other high-profile stocks also faced losses. Amazon experienced a decline of 2.6%, while Microsoft fell by 1.8%. Meta (formerly Facebook) saw a decrease of 2.3%, while Palantir’s stock plunged by 5.10%.

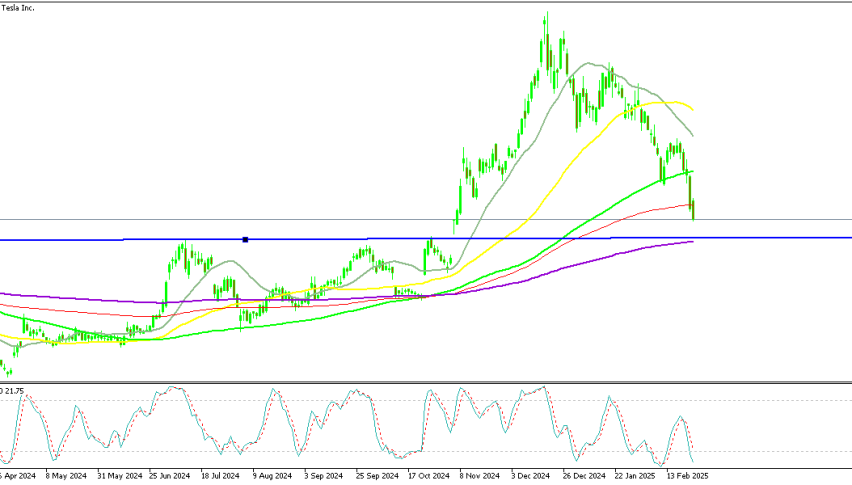

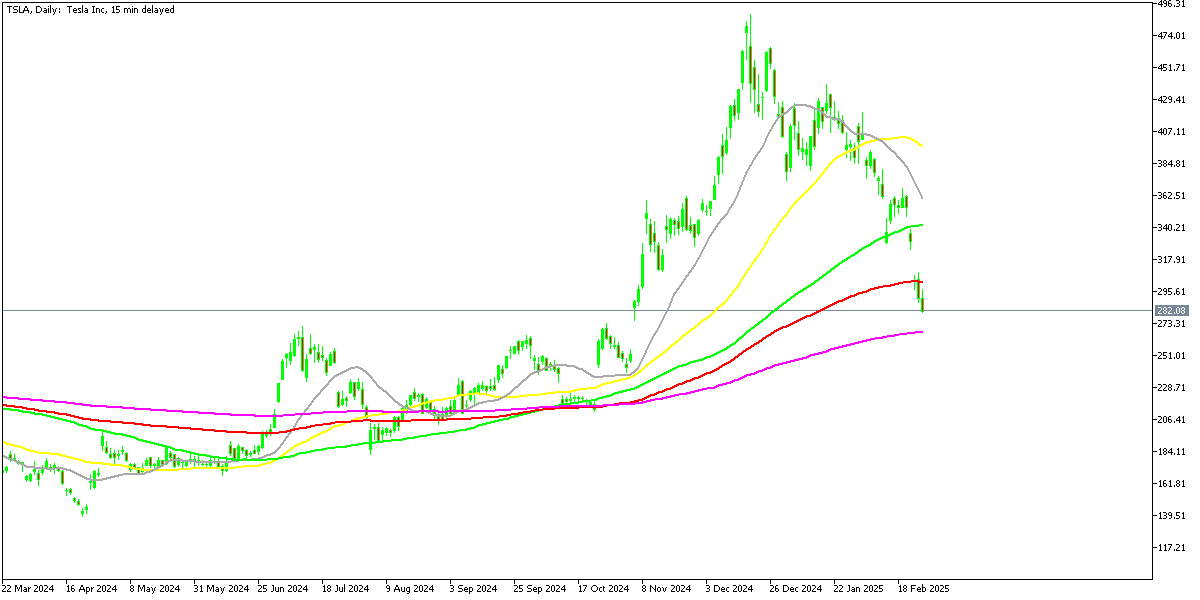

Turning to Tesla, the stock is trading just under three dollars away from its 200-day moving average, closing the day at $282.06, after experiencing a decline of around 3% today. The last time Tesla’s stock price was trading at this level was in the first week of November, when it managed to bounce and open with a major bullish gap after Donald Trump’s victory. Compared to its peak in the middle of December, when it reached $488, Tesla’s stock is now down by more than 40%, reflecting the heightened volatility and challenges within the market.

Palantir Stock Chart Daily – Sellers Will Face the 50 SMA

This confluence of factors indicates a prevailing uncertainty among investors, with major tech stocks leading the decline, and suggests that further scrutiny of market conditions and corporate performance will likely be necessary in the coming days.

Closing Levels for Major US Indices

- Dow Industrial Average:

- Fell by 193.62 points

- Decrease of 0.45%

- Final level: 43,239.50

- S&P 500 Index:

- Dropped by 94.49 points

- Decline of 1.59%

- Final level: 5,861.57

- NASDAQ Index:

- Decreased by 530.84 points

- Drop of 2.78%

- Final level: 18,544.42

- Russell 2000 (Small-Cap Index):

- Fell by 34.5 points

- Decrease of 1.59%

- Final level: 2,139.65

Today’s trading concluded with significant declines across all major US stock indices, reflecting a broader market pullback. The Dow, S&P 500, NASDAQ, and Russell 2000 all recorded losses, indicative of investor hesitance and market volatility. This downward trend may point towards shifting market sentiments, possibly affecting future trading sessions as investors evaluate economic indicators and corporate earnings reports. The notable drop in the technology-heavy NASDAQ, in particular, highlights growing concerns in that sector, suggesting that investors remain cautious in the current landscape.

Nasdaq Live Chart