Nvidia Stock Crashes 11% Lower Amid OpenAI’s ChatGPT 4.5 Launch

The Nvidia stock price has gone through a major crash today, despite better Q4 earnings results yesterday and ChatGPT 4.5 launch today.

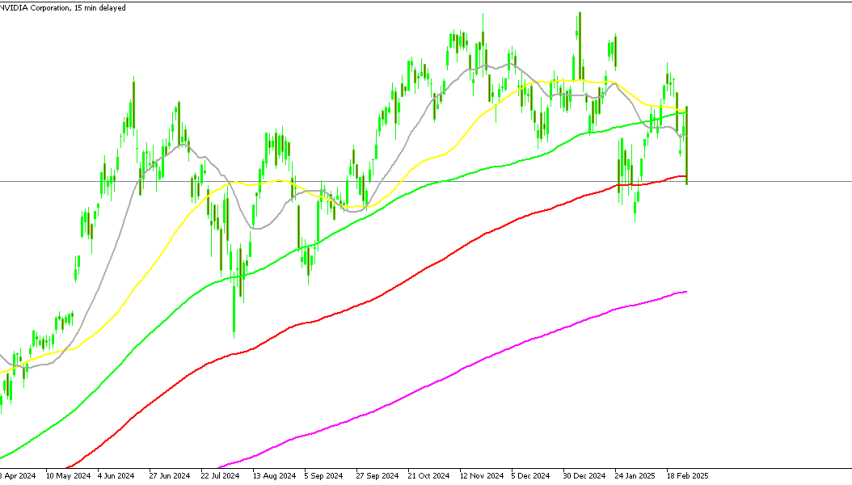

Live NVDA Chart

[[NVDA-graph]]The Nvidia stock price has gone through a major crash today, despite better Q4 earnings results yesterday and ChatGPT 4.5 launch today.

Recent Performance and Nvidia Earnings Report

Yesterday, Nvidia demonstrated impressive financial performance, posting $38.1 billion in revenue and an earnings per share (EPS) of $0.84, exceeding market expectations. This positive announcement initially propelled NVDA shares upward, which climbed to $134.85 before settling at $133.60—culminating in a 5% gain in after-hours trading.

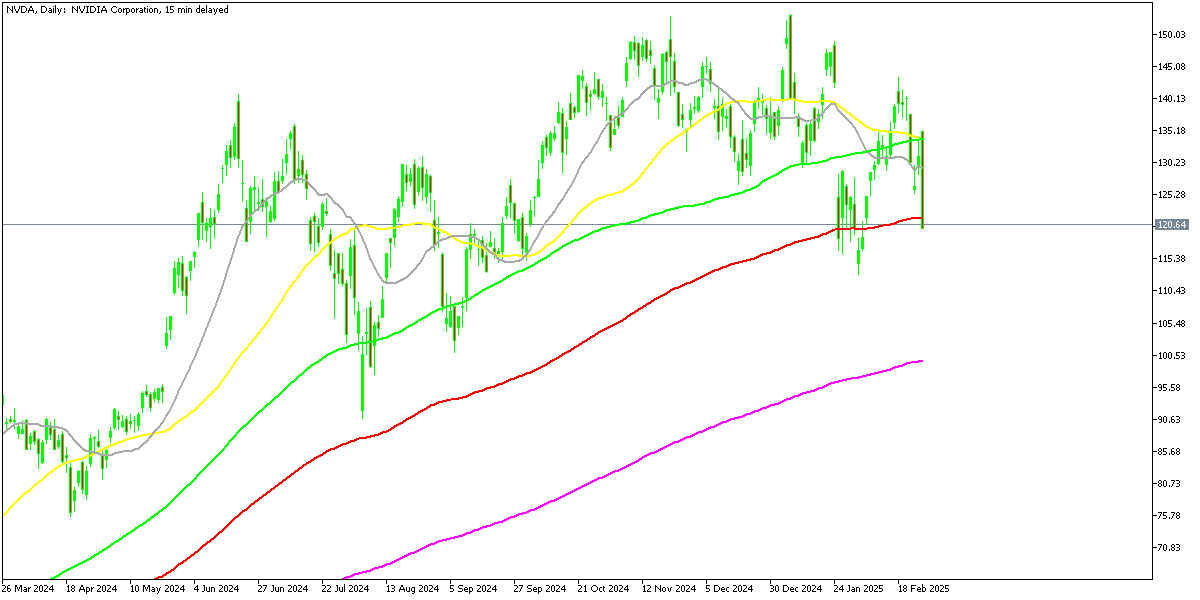

NVDA Stock Chart Weekly – Facing the 50 SMA

However, today marked a stark reversal for Nvidia, as its stock plummeted from $135 to $120, reflecting a loss of over 10%. The shares are currently trading below the critical 100-day moving average at $121, indicating a precarious technical position. This downturn was part of a broader trend, with all major U.S. market indices, particularly the Nasdaq composite, which fell by 2.8%. Nvidia’s stock specifically contributed to this decline as enthusiasm for AI technology appears to be diminishing.

OpenAI’s ChatGPT 4.5 Release

In a significant development, OpenAI is live-streaming the launch of ChatGPT 4.5, which Pro users will access this week, followed by Plus users the next week. OpenAI also teased the upcoming GPT-5, labeling it as the last “non-chain-of-thought model” it will release. This transition may shift market dynamics, leading investors to reassess their positions.

Market Impact and Future Outlook

Despite Nvidia’s impressive earnings, the market response has been underwhelming. The stock’s recent performance seems to illustrate a saturation in investor enthusiasm; better-than-expected results are now seen as routine, contributing to the stock’s drop. Sellers are currently encountering resistance at the 50-day SMA on the weekly chart, suggesting that this decline might soon find a floor. As the competition intensifies and expectations rise, Nvidia faces critical questions about its ability to maintain market share amidst evolving industry trends.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account