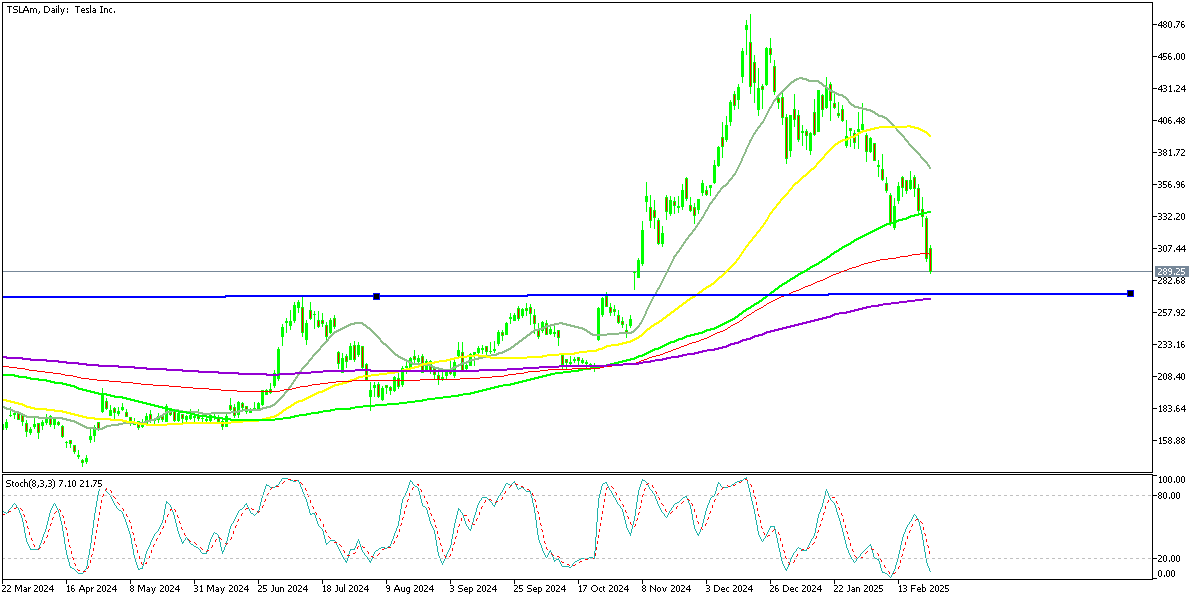

Tesla Stock Drops 5% Amid EV Slowdown – Buying Opportunity Ahead of New Model?

The decline in the Tesla stock continues, as TSLA closed below $290 today, but we’re keeping an eye on the support level to see how the price action will be down there, so we might open a buy signal.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Tesla Continues Downward Slide Amid EV Market Slowdown

Tesla shares extended their losses today, falling below the 200-day simple moving average (SMA) after breaching the 100-day SMA yesterday. The company had an impressive 200% surge in Q4 2024, fueled by optimism surrounding AI-driven advancements and new technologies. However, since reaching a peak of $488 in December, Tesla’s stock has plummeted by over 41%, breaking through critical technical levels.

A significant factor weighing on Tesla’s stock is the slowing EV demand in Europe, which is dampening investor sentiment. The excitement that once surrounded the electric vehicle industry appears to be fading, adding further strain to Tesla’s market position.

New Model Y Rollout and Potential Rebound

In an important strategic move, Tesla began implementing Full Self-Driving (FSD) features in China this week. Additionally, the company started delivering the new Model Y in China today, with plans to roll it out to U.S. and European markets next month. Given that the Model Y accounts for a significant portion of Tesla’s global EV sales, this refreshed version could serve as a crucial growth driver in 2025.

If investor sentiment shifts following these developments, Tesla’s 2024 high of $270—which may now act as a support level—could offer an opportunity for buyers looking for a potential entry point.

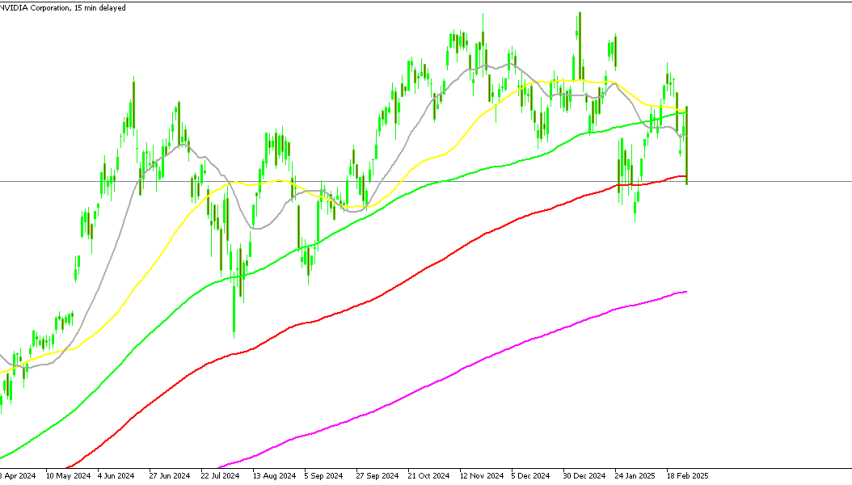

Tech Market Boost from Nvidia’s Strong Earnings

Meanwhile, Nvidia reported $38.1 billion in revenue and $0.84 earnings per share (EPS) after the market closed, surpassing expectations. The announcement initially sent Nvidia’s stock soaring to $134.85 before stabilizing at $133.60, providing a boost to several tech stocks. However, despite the broader market lift, Tesla shares failed to benefit from Nvidia’s strong performance, indicating that sector-specific challenges continue to weigh on the EV giant.

Nasdaq Live Chart

Sidebar rates

82% of retail CFD accounts lose money.