Nikkei Bounces Off Support Again Despite Higher Japan Inflation, USD/JPY Below 150

Last night the CPI inflation from Japan showed another increase, which helped the Nikkei bounce off support, while USD/JPY slipped below 150.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Last week, USD/JPY rebounded close to 155, but buyers failed to sustain the momentum, leading to a pullback near 152 by the week’s close. The pair has been under pressure due to a combination of rising Japanese inflation, increased household spending, and overall USD weakness, which have strengthened the yen.

USD/JPY Chart Daily – The 200 SMA Has Been Broken

Over the past month, USD/JPY has declined nearly 10 cents, driven by the Bank of Japan’s (BOJ) hawkish stance and rate hike, which further boosted the yen. This decline follows a strong rally from below 140 in September to nearly 159 in January, marking a 20-cent gain before sellers took control in mid-January. Yesterday, the pair dropped below 150, breaking the 200 SMA (purple) support level on the daily chart, signaling continued downside pressure.

Japan Inflation Data – January 2025

The Japan CPI report for January, released last night, showed a continued rise in inflation:

Headline Inflation:

- 4.0% (up from 3.6% in the previous month).

Core Inflation (Excluding Food):

- 3.2%, surpassing expectations of 3.1%.

- Previous reading: 3.0%.

Core-Core Inflation (Excluding Food and Energy):

- 2.5%, in line with forecasts.

- Previous reading: 2.4%.

Japan’s inflation continues to rise, with headline inflation reaching 4.0%, marking an increase from the previous month. Core inflation exceeded expectations, suggesting that price pressures are becoming more persistent beyond just volatile food costs. The core-core measure, which strips out both food and energy, also edged higher, indicating underlying inflationary trends remain intact. This data could impact Bank of Japan’s (BOJ) monetary policy as it assesses whether to maintain its ultra-loose stance or gradually shift towards tightening. With Japan’s inflation remaining well above the BOJ’s 2% target, the central bank may continue its policy shift toward tighter monetary conditions. This would further support the yen and add to the bearish outlook for USD/JPY in the near term.

Nikkei225 Chart Daily – The Ascending Channel Continues to Hold

Japan’s Nikkei 225 index has been in a strong uptrend, following an ascending channel since September last year. The 100 SMA (red) on the daily chart has consistently provided support, while the trendline resistance at the top has limited upside movements. Despite a month-long bearish phase, driven by expectations of BOJ rate hikes, the 100 SMA has held firm as a key support level. Earlier this month, the index rebounded from this moving average, and yesterday’s decline also found support just above it, signaling continued strength in the long-term trend.

Conclusion

With Japan’s inflation data remaining strong and the BOJ maintaining a hawkish stance, the yen is likely to stay firm, exerting further downward pressure on USD/JPY . The Nikkei 225 remains in a broader uptrend, with key support levels holding, suggesting that despite short-term corrections, bullish momentum in Japanese equities could persist. Traders will closely watch BOJ policy moves and global risk sentiment for further direction in both the forex and stock markets.

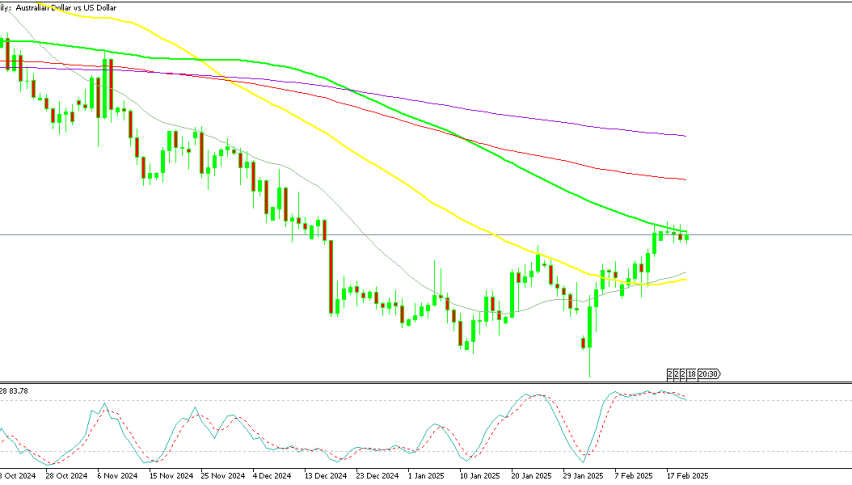

USD/JPY Live Chart

Sidebar rates

Related Posts

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |