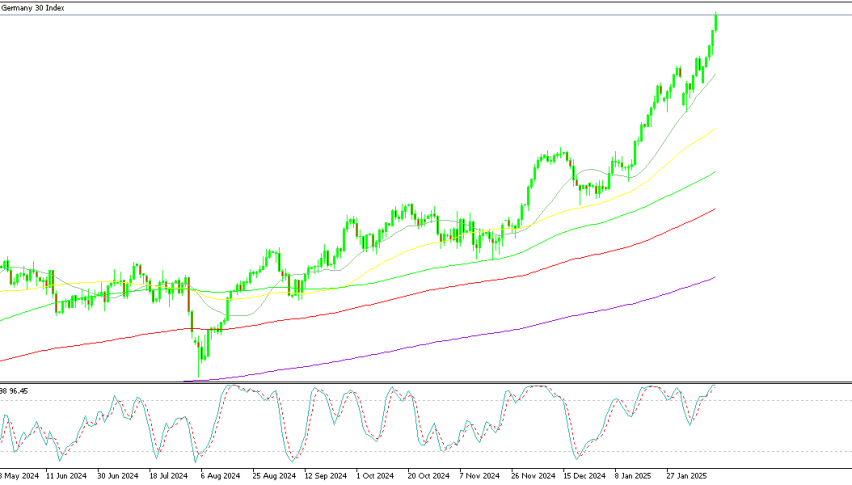

DAX Posts 4 Consecutive New All-Time Highs in 1 Week – Eyes Possible Ukraine Peace Deal

European stocks get a boost from Trump’s efforts to seal a peace deal between Russia and Ukraine. The DAX led the way over the week but profit taking puts the breaks on further highs.

- Trump holds talks with Putin and Zelensky

- Goldman raises 12-month forecast for European stock prices

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The DAX has gained almost 3.5% over this week, today’s price action shows signs of profit taking. The early session took the index higher by 0.44% before retracing lower.

The index has enjoyed a rally fueled by ECB policy hopes, and the latest news of a possible peace deal has given the index extra momentum.

Trump’s Efforts for a Peace Deal

Trump has been negotiating with Russia and Ukraine over week, where the US president has held separate discussions with the leaders of both nations.

The EU has complained that they were sidelined from the negotiations, stating that they should have a say in the talks.

I find that their participation may only hinder a peace deal since the EU has only been advocating extending the war for as long as needed.

I believe the market sees the absence of an institution that was pro-war, making the possibility of a peace deal more likely.

The news is seen as reducing the risk of holding EU stocks due to a possible escalation of the conflict.

DAX Live Chart

Goldman Raises STOXX600 12-Month Forecast by 7.4%

Goldman Sachs strategists stated that European stocks faced potential benefits from a peace deal between Russia and Ukraine.

The analysts see a peace deal as a reduction in risk and that European stocks benefit from lower inflation, lower valuations and improving consumer confidence.

The difference in valuations with US peers is wide, the SPX has an index average P/E of 27 while the STOXX600 has an average of just over 17.

The investment bank sees a peace deal would add as much as 0.2%, even with a simple ceasefire.

Energy costs have also been impacted due to sanctions on trade with Russia for natural gas. A peace deal could reduce energy prices and improve economic outlooks.