Mastercard increasingly Use Blockchain

Mastercard stated that 30 percent of its transactions in 2024 were tokenized.

Mastercard stated that 30 percent of its transactions in 2024 were tokenized. According to the SEC filing, “about 30 percent of all Mastercard transactions are now tokenized.”

The company acknowledged the increasing competition in the changing payments sector while reaffirming its dedication to digital finance. Mastercard emphasized how the financial landscape is changing due to the speed at which technology is developing.

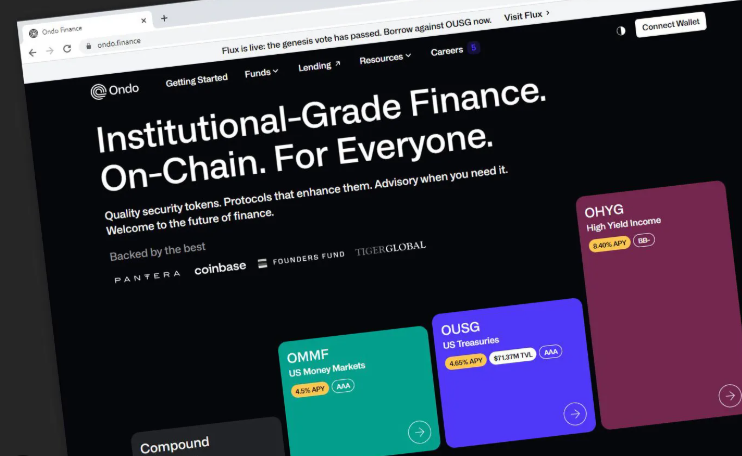

The business points improved cybersecurity and blockchain technology are revolutionizing payment systems. These advancements have the potential to challenge current technologies and offer more effective solutions.

The company claims that these developments could lead to new technologies that outperform or replace the ones we currently employ in our services and programs.

They might also lead to fresh and creative goods, services, and payment options.

“Stablecoins and cryptocurrencies are becoming attractive substitutes for conventional payment methods,’ the company added.

Their effectiveness and 24/7 accessibility have prompted broader adoption, especially in business-to-business (B2B) payments and merchant transactions.

Mastercard may be impacted by regulatory developments that hasten the adoption of digital currencies. The payment behemoth added that governments globally are actively investigating central bank digital currencies (CBDCs), which may develop specialized financial networks.

. Mastercard stated: “[This may] impact the extent of our role in facilitating CBDC-based payment transactions, potentially impacting the transactions that we may process over our network,” if this were to occur. “.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account