Calm Before the Storm As XRP Price Sticks to $2.30-2.50 Range, While BTC Is Down 3%

Bitcoin and Ethereum have reversed lower today, while the XRP price is holding steady in a tight range which is a sign of a bullish breakout

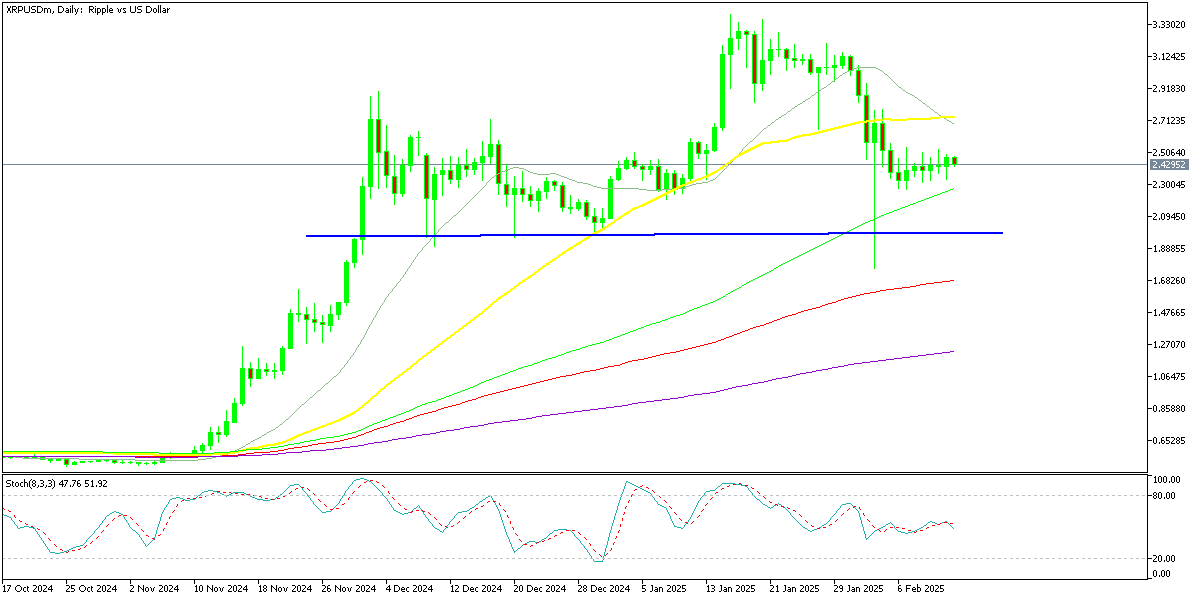

Live XRP/USD Chart

Bitcoin and Ethereum have reversed lower today, while the XRP price is holding steady in a tight range which is a sign of a bullish breakout soon.

XRP surged in November after Ripple’s legal victory against the SEC and continued its bullish run until December’s end. However, the introduction of DeepSeek triggered turbulence in financial markets, leading XRP to retreat from its all-time high of $3.39 in mid-January. Early February saw a flash crash that briefly pushed the price below $2, but buyers quickly stepped in, driving a $1 rebound. Since then, XRP has remained range-bound between $2.25 and $2.55, struggling to break past the 50-day SMA at $2.70, now acting as resistance. A decisive move above this level could see XRP target the psychological $3 mark, especially if an XRP ETF gains approval. While Ripple’s case with the SEC isn’t fully resolved, momentum appears to be shifting in its favor, and legal experts argue that there are no regulatory barriers preventing an ETF launch.

Growing Institutional Interest in XRP and Crypto ETFs

Lawyer Jeremy Hogan recently suggested that a Ripple settlement could precede XRP ETF approval, and optimism in the crypto market has grown following Nasdaq’s filings for XRP and Litecoin ETFs. Institutional appetite for digital asset investment continues to grow, with major financial firms pushing for broader ETF adoption.

Meanwhile, Ripple’s stablecoin, RLUSD, is expanding, with 108.66 million tokens issued across two blockchain networks, contributing to a market value of $225 million. This steady growth reflects increasing institutional engagement in Ripple’s ecosystem despite ongoing regulatory uncertainty.

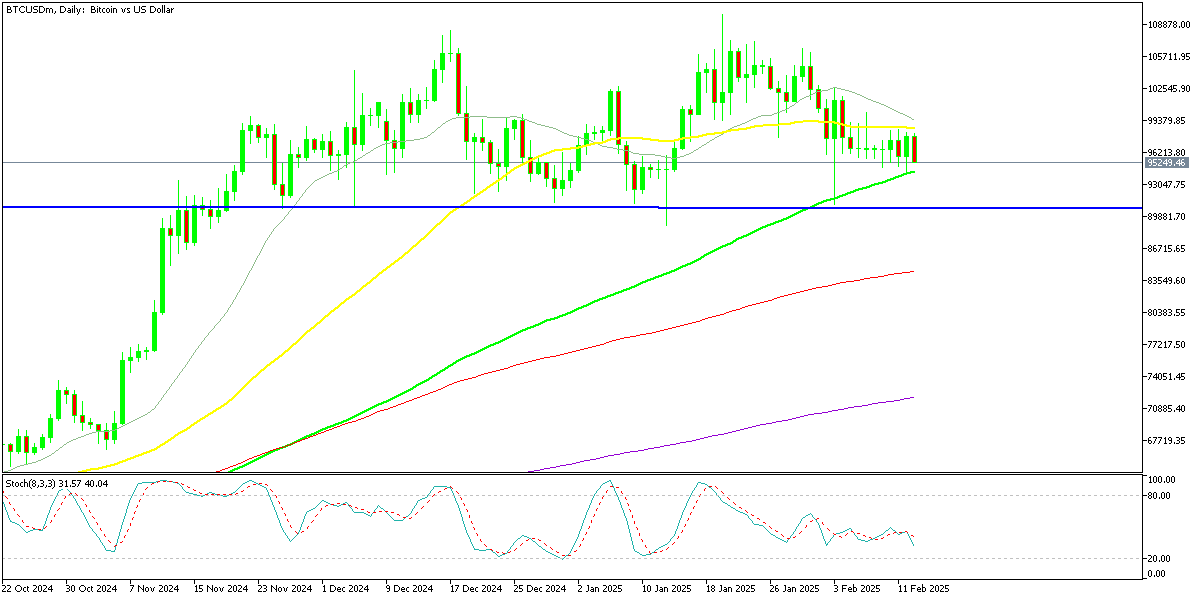

Bitcoin Faces Pressure Amid Market Weakness

BITCOIN experienced strong rallies at the end of 2024 and again on January 20, coinciding with Donald Trump’s return to office. It reached a high of $109,867 but has since struggled to hold key levels. Following Trump’s tariff announcement in early February, BTC/USD briefly dipped below $90,000 before recovering above $100K, though it has since slipped under $95K. To retest January’s peak, Bitcoin must reclaim the 50-day SMA and maintain momentum above $100K.

Support remains at the 100-day SMA, which has held firm twice this month. Meanwhile, 16 US states, including Florida and Texas, are exploring legislation that would allow them to allocate up to 10% of excess reserves into digital assets. If such policies gain traction, Bitcoin’s role as a potential reserve asset could strengthen, further integrating it into global financial markets, which would sned the price toward January highs again.

Ripple XRP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account