Bitcoin Dips to $94K After Hot CPI Data, While States’ $23B Reserve Plans Could Push BTC to $400K

Following higher-than-expected U.S. inflation figures, Bitcoin (BTC) saw a substantial decline of 1.8% on February 12; nonetheless, experts disagree on the direction the cryptocurrency will travel toward ambitious pricing ambitions.

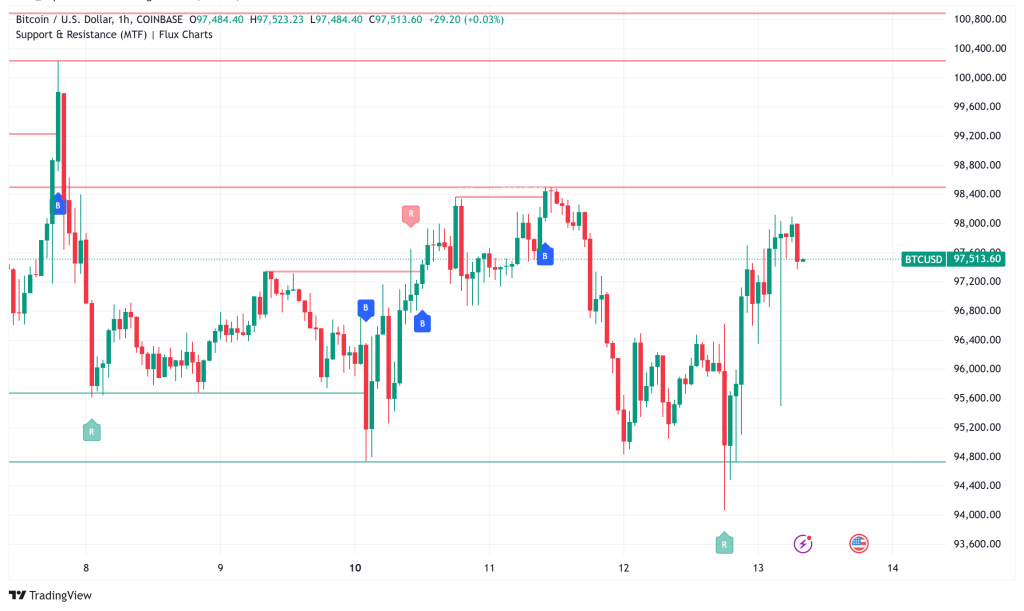

Having tested support at $94,200 following the Consumer Price Index (CPI), which revealed a 3% year-over-year increase in January, the leading digital asset BTC/USD is now trading under $97,500.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

S&P 500 Correlation Hits 65% as Dollar and Treasury Yields Surge

The S&P 500 futures also withdrew from recent advances, hence the declining value of the bitcoin aligns with wider market reactions to the inflation announcement. With a 40-day correlation with the S&P 500 of 65%, Bitcoin’s shows the ongoing relationship between digital assets and conventional markets. Higher inflation, some economists contend, usually helps rare assets like Bitcoin over the long run.

SoftBank’s $2.4B Loss Adds to Market Pressure

The reported $2.4 billion Q4 loss by SoftBank and growing safe-haven assets provide more challenges to the market. Indicating a move toward risk-off attitude, the U.S. Dollar Index (DXY) rose from 107.90 to 108.40 as 10-year Treasury rates surged from 4.54% to 4.65%.

Miners Face Profitability Squeeze Ahead of Halving Event

Declining profitability of the hashrate price index indicates difficulties for the bitcoin mining industry. Lower transaction fees resulting from reduced demand for block space have sparked questions about miners with greater running costs perhaps being compelled to stop operations. This scenario becomes especially pertinent before the forthcoming Bitcoin halving event, which will lower mining earnings even more.

Twenty U.S. States Consider $23B Combined Bitcoin Reserve Plans

Institutional interest in Bitcoin keeps rising even under temporary market challenges. With VanEck research indicating possible group purchases of over 247,000 BTC (worth roughly $23 billion) should all suggested state-level laws be passed, several U.S. states are contemplating laws to create strategic Bitcoin reserves.

Wyoming Highway Patrol Association Pioneers Law Enforcement Bitcoin Adoption

Examining the inclusion of Bitcoin to its balance sheet via the “Get Off Zero” project, the Wyoming Highway Patrol Association has become a shining example of institutional adoption. Notables include Senator Cynthia Lummis have backed this action.

Taker Buy-Sell Ratio Signals Possible Trend Reversal

Technical indicators look good; the Bitcoin taker buy-sell ratio exhibits a bullish reversal trend. Based on the 14-day moving average of this indicator, buyers seem to be recovering strength in the futures market, so maybe setting up a breach above the present range of consolidation.

Analysts Project $400K Bitcoin Price on Three Key Catalysts

Some analysts maintain optimistic long-term price targets, with predictions reaching as high as $400,000. This bullish outlook is supported by several potential catalysts:

- The possibility of U.S. Federal Reserve rate cuts

- Increased corporate adoption

- The implementation of state and federal Bitcoin reserves

- Historical market cycle patterns

Although short-term volatility is still there, institutional adoption and even government intervention seem to be strengthening the basic argument for Bitcoin. Notwithstanding present macroeconomic obstacles, the mix of state-level interest, conventional finance participation, and technical indications points to the market maybe being set for more upside.

Resolving present issues including inflation worries, mining sector profitability, and larger market mood will probably determine the route to higher price targets. The price action of Bitcoin in the next months will be vital in deciding whether the aspirational $400,000 forecasts come true as the market absorbs these several elements.