Who Missed the Jump in McDonald’s Stock Price After Q4 Earnings?

McDonald’s (NYSE: MCD) reported earnings yesterday before the market opened, and the reaction was strong, with the stock jumping 4.5% and then holding onto its gains, signaling strength and making it an attractive buy candidate.

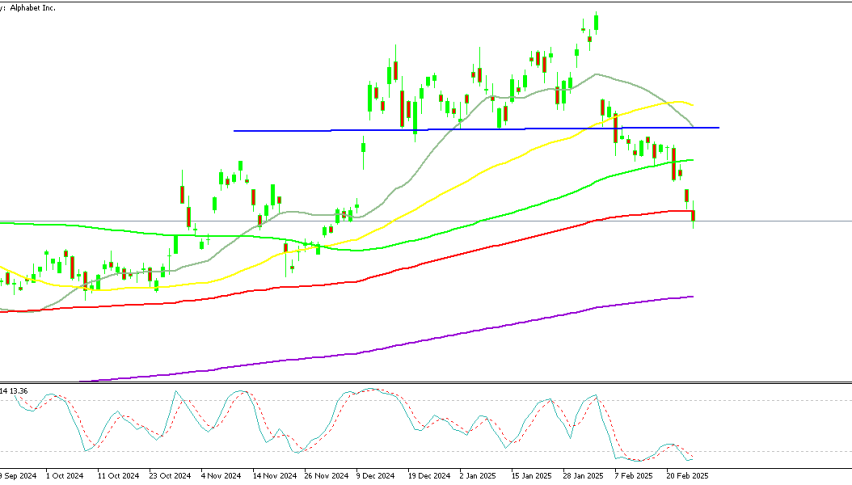

McDonald’s (NYSE: MCD) released its earnings before the market opened, and investors reacted positively. The stock surged 4.5%, holding onto its gains throughout the session, signaling strong bullish sentiment. This contrasts with Alphabet (GOOGL) and Amazon (AMZN), both of which saw significant declines of -3.30% and -4% respectively after their earnings disappointments last week. Despite ongoing tariff concerns, McDonald’s stock rose 3%, showing resilience in a market that remains focused on broader economic developments.

Technical Strength and Market Momentum

McDonald’s post-earnings chart for February reflects strong upward momentum, with the stock climbing 7% intraday and surpassing the $300 mark before settling at $307. The bullish breakout suggests that the stock could continue its uptrend, with investors eyeing further gains. With limited pullbacks in recent sessions, buying dips at key support levels may offer the best risk-reward strategy for traders looking to enter long positions.

For those looking at long-term price targets, McDonald’s shares could aim for $400 or even $500 in the coming months. While patience will be key, the strong earnings performance and overall stock momentum indicate a favorable outlook for 2025. Investors who capitalize on retracements and set multiple profit targets may find this an attractive buying opportunity as McDonald’s continues to show resilience against market headwinds.

McDonald’s Q4 2025 Earnings Report

- Earnings Per Share (EPS): Reported at $2.83, meeting market expectations.

- Revenue: Came in at $6.39 billion, slightly below the expected $6.45 billion, signaling modest underperformance.

- U.S. Comparable Sales: Declined by 1.4%, significantly weaker than the expected -0.41%, reflecting slowing consumer spending.

- Global Comparable Sales: Grew by 0.4%, outperforming estimates of a 0.93% decline, driven by international market strength.

- International Market Performance: Surpassed forecasts with a 4.1% growth rate, well above the anticipated -0.38% contraction.

- Operating Income: Increased 1% year-over-year to $2.02 billion, reinforcing stable profitability.

2025 Growth and Expansion Plans

- Operating Margin: Expected to remain within the mid-to-high 40% range, reflecting cost efficiency and pricing strategies.

- Expansion Strategy: Plans to invest $3 billion–$3.2 billion in expansion, with 600 new U.S. locations and 2,200 international openings, signaling a push for global market penetration.

- Financial Considerations: Interest costs are projected to rise by 4%-6%, while free cash flow conversion is expected to stay within the low-to-mid 80% range, maintaining financial stability.

Despite a decline in U.S. sales and a revenue miss, McDonald’s continues to show resilience through strong international performance and solid operating income growth. The company’s expansion strategy and steady margins suggest a long-term growth outlook, although rising interest costs and U.S. consumer demand weakness remain concerns. Investors will closely watch how McDonald’s balances domestic headwinds with international market strength in 2025.

Sidebar rates

82% of retail CFD accounts lose money.