USDJPY Heads to 150 as Yen Gains on Hawkish BOJ, Higher Household Spending

USD/JPY has lost 4 cents this week, after the BOJ hawkish rate hike fueled the Yen, while inflation and household spending are increasing.

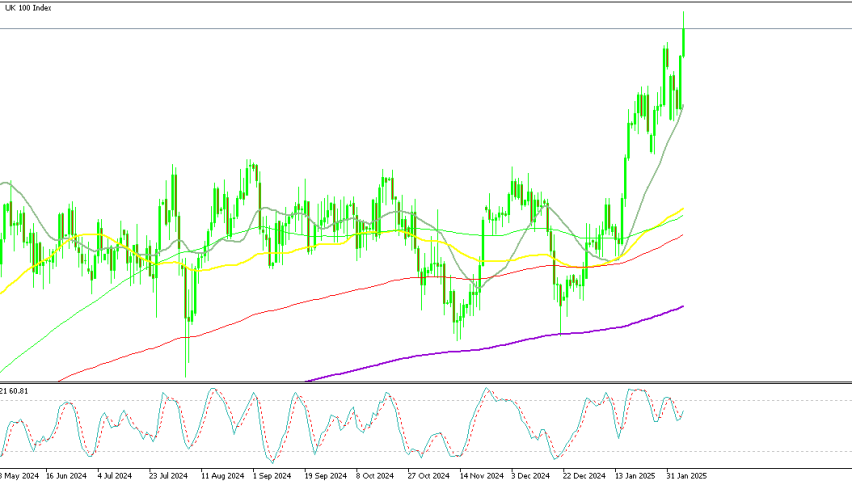

This forex pair, turned bullish in September after the 20 cent fall in summer which sent the price below 140. We saw a retrace in late November but the 50 SMA (yellow) held as support on the weekly chart and the price resumed the bullish trend. However, the USD/JPY is going through another pullback but the 50 weekly SMA held the price again. If this moving average hold, then we will see another bounce. Although, there have been some positive developments for the Yen, which might add further selling pressure to this pair, pushing it below 150. However, that will become evident once the 50 weekly SMA gets broken.

Japan Household Spending Data (December)

- Year-on-Year (YoY) Growth:

- Household spending increased by 2.7%, significantly surpassing the 0.2% forecast.

- In contrast, November saw a -0.4% decline, highlighting a sharp rebound in December.

- Month-on-Month (MoM) Growth:

- Household spending rose by 2.3%, far exceeding the expected -0.5% decline.

- November’s MoM figure stood at 0.4%, indicating a strong acceleration in consumer activity.

Key Takeaways & Market Implications

- Consumer Resilience: The substantial increase in household spending suggests stronger-than-expected consumer demand, which could support Japan’s economic growth in early 2025.

- Inflationary Impact: Higher spending levels may contribute to inflationary pressures, reinforcing the Bank of Japan’s (BOJ) cautious approach toward monetary policy.

- BOJ Policy Considerations: With signs of robust consumer activity, the BOJ may find further justification for its recent rate hikes, especially if spending trends continue into 2025.

- Potential Economic Shift: If this trend persists, Japan could move closer to a self-sustaining inflationary cycle, reducing the need for prolonged ultra-loose monetary policies.

The stronger-than-expected rebound in household spending reinforces optimism about Japan’s domestic demand recovery. If these trends continue, they may push the BOJ toward a more hawkish stance, supporting further rate hikes in the coming months. However, external factors such as global economic conditions and currency fluctuations will also play a crucial role in shaping Japan’s economic outlook.

BOJ Official Naoki Signals Rate Hikes Amid Rising Inflation

Call for Higher Interest Rates

Tamura Naoki, a board member of the Bank of Japan (BOJ), has made waves with his latest remarks regarding monetary policy. Speaking at a gathering of local leaders in Nagano, Tamura stressed the need for the BOJ to gradually increase short-term interest rates, potentially reaching 1% by the latter half of fiscal 2025. Known for his hawkish stance, he argues that inflation risks are mounting and that the central bank must take action to bring rates to levels considered neutral for economic stability.

Inflation and Wage Growth as Key Drivers

Tamura expressed confidence that by late 2025, Japan’s economy will be in a position to sustainably meet the BOJ’s long-standing 2% inflation target. This expectation is based on signs of broad-based wage growth, particularly among smaller businesses, which could provide the necessary support for inflationary momentum. Reflecting this shift, the BOJ already raised interest rates to 0.5% in January, marking the highest level since the 2008 financial crisis.

Gradual, Data-Driven Rate Adjustments

According to Tamura, rate hikes must be implemented in stages, carefully assessing economic conditions at each step. He pointed out that price pressures, driven in part by supply constraints, may have already pushed the output gap into positive territory. Inflation in Japan has exceeded 2% for nearly three years, and growing concerns over rising rice prices could dampen consumer spending. Meanwhile, inflation expectations among corporations and households have solidified around the 2% mark.

Deeply Negative Real Interest Rates

Even with a rate hike to 0.75%, Tamura cautioned that real interest rates would remain significantly negative, meaning monetary policy would still be accommodative in real terms. His remarks reinforce the notion that the BOJ may need to continue tightening policy in the coming months to keep inflation in check while ensuring economic growth remains sustainable.