nvidia stock

The 5% Surge in Nvidia Stock Helps Nasdaq End Up, After the Alphabet Crash

Skerdian Meta•Wednesday, February 5, 2025•2 min read

The price of Nvidia stock gained more than 5% today, helping Nasdaq snap a small win, despite the rout in other Tech stocks such as Tesla and Alphabet.

Following Monday’s turbulence, financial markets showed signs of stabilization, gradually shifting in favor of the bulls. However, sentiment remained fragile at the start of the session, particularly after Alphabet shares slumped, creating an initial drag on equities.

The S&P 500 managed to erase an early 30-point decline, climbing 1% higher by the session’s end, with gains continuing into after-hours trading. The Nasdaq, which was under pressure earlier, reversed course to close with a modest 0.1% gain—an impressive feat considering Alphabet shares remained down 7.5% throughout the day.

Nvidia Tech Stock in Focus

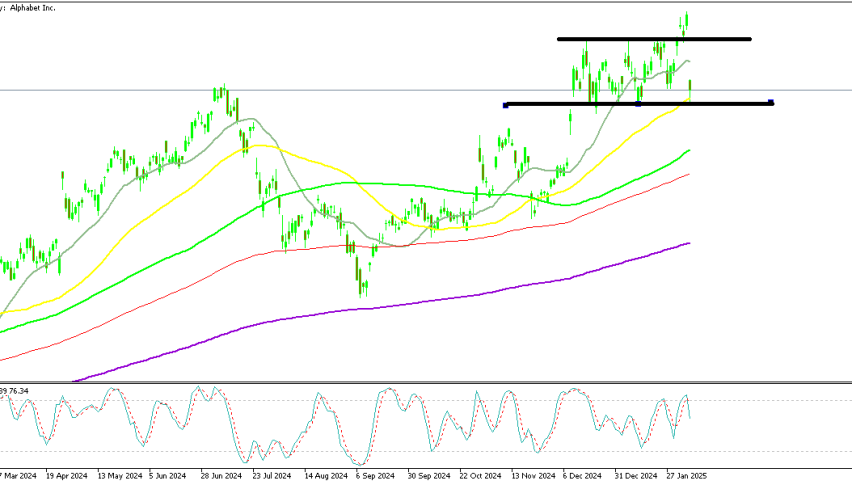

- Nvidia emerged as a standout performer, rallying 5% and adding approximately $6 per share. The stock had initially opened lower on Monday due to tariff concerns but formed a doji candlestick, signaling a potential bullish reversal.

- This week, NVDA has maintained upward momentum, bouncing off the 100-day Simple Moving Average (SMA) and now eyeing resistance near $131 at the 50-day SMA.

Market Sentiment & Trade War Developments

Investors continue to assess the latest phase of the US-China trade conflict, with markets interpreting Trump’s stance as relatively restrained, especially toward allied nations. A further drop in US Treasury yields—with 10-year yields declining by 9 basis points to 4.42%—has also provided support to equities.

Additionally, despite China filing a WTO complaint against US tariffs, its measured response helped maintain positive risk sentiment for commodity-linked currencies and stock markets. However, with the World Trade Organization losing influence, the complaint is unlikely to have immediate consequences.

With yields softening and trade tensions not escalating aggressively, investors are focusing on economic data and earnings reports for further market direction. The bullish momentum in equities remains fragile, but as long as key supports hold, further gains remain possible.

US Stock Market Performance at Close

- S&P 500: Gained 1%, continuing its upward momentum as investor sentiment remained positive.

- Nasdaq Composite: Rose by a modest 0.1%, lagging behind other indices due to mixed earnings reports from tech giants.

- Dow Jones Industrial Average (DJIA): Increased 0.7%, supported by gains in financial and consumer sectors.

- Russell 2000: Advanced 1%, reflecting strength in small-cap stocks amid improving risk appetite.

- Toronto TSX Composite: Climbed 0.8%, benefiting from higher energy and materials stocks as commodity prices held firm.

The broader market posted solid gains, with the S&P 500 and Russell 2000 leading the charge, while the Nasdaq lagged due to weakness in select tech stocks. Small-cap and cyclical stocks outperformed, indicating renewed confidence in economic growth. The Canadian TSX followed suit, as commodity-driven sectors added to the momentum. Investors continue to assess macroeconomic factors and upcoming earnings reports for further direction.

NAS100

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

The price of Nvidia stock gained more than 5% today, helping Nasdaq snap a small win, despite the rout in other Tech stocks such as Alphabet

1 d ago

Save

Save

1 d ago

Save

Save

2 ds ago

Save

Save