Forex Signals Brief January 31: All Markets Under Risk Due to PCE Inflation and Tariffs

Tomorrow real tariffs will start, so there might be some wild moves today, considering the PCE report as well, so all markets are at risk, although Gold seems to be a beneficiary.

ECB President Christine Lagarde reaffirmed the central bank’s data-dependent approach, emphasizing that policymakers are not pre-committing to any specific rate trajectory. She clarified that there was no discussion about halting rate cuts or considering a larger 50 basis point reduction. Lagarde noted that most underlying inflation indicators are trending toward the ECB’s target, with inflation expected to stabilize after some near-term fluctuations. She also highlighted the resilience of the labor market and the presence of conditions for economic recovery, though downside risks to growth remain. Markets had already priced in an 84% probability of a rate cut in March, and European equities welcomed the dovish stance, with the German DAX closing at record highs.

Meanwhile, the U.S. economy expanded at an annualized rate of 2.3% in Q4, matching the Atlanta Fed’s GDPNow estimate. However, growth momentum softened toward the end of the quarter, as reflected in weaker-than-expected pending home sales, which fell by 5.5% against forecasts of no change. Adding to market volatility, President Trump announced plans for a 25% tariff on imports from Canada and Mexico, citing concerns over border security and fentanyl smuggling. He remained uncertain about whether oil imports would be included in the policy.

The U.S. dollar strengthened against all major currencies except the Japanese yen, as tariff-driven inflation concerns fueled expectations of further dollar appreciation. The forex market ended the day with the greenback broadly higher, reflecting investor sentiment that trade restrictions could lead to inflationary pressures and potential shifts in monetary policy expectations.

Today’s Market Expectations

The U.S. Personal Consumption Expenditures (PCE) report is expected to show annual inflation at 2.6%, up from the previous 2.4%, while the month-over-month figure is projected at 0.3%, higher than the prior 0.1%. Core PCE, which excludes food and energy, is forecast to remain steady at 2.8% year-over-year, with a slight monthly increase of 0.2% compared to 0.1% prior. Given that forecasters can accurately estimate PCE after CPI and PPI data are released, market reaction should remain muted unless the actual figures significantly deviate from expectations.

The U.S. Q4 Employment Cost Index (ECI) is anticipated to rise by 0.9%, up from the previous 0.8%. While this is the most comprehensive measure of labor costs, it lags behind the more current Average Hourly Earnings data. Nonetheless, the Federal Reserve closely tracks this indicator as it provides insights into wage-driven inflation pressures.

In addition to inflation data, fresh labor market figures showed continued strength, with the unemployment rate dropping to 2.4% from 2.6%, surpassing expectations of 2.5%. This further reinforces the narrative of a resilient job market, which could influence the Fed’s policy outlook and expectations for future rate adjustments.

Risk assets, including stock markets and commodity-linked currencies, saw strong buying momentum last week, leading to a volatile but ultimately weaker U.S. dollar. Across 26 forex trades, we secured 19 wins and 7 losses, maintaining a predominantly long stance on equities and gold.

Gold Reaches Another Milestone on the Way toe $3,000

GOLD continues to exhibit strong bullish momentum, setting a new all-time high of $2,798.40 earlier today and holding above the previous peak of $2,790. Buyers remain firmly in control, signaling a likely move above $2,800 and potentially toward the $3,000 mark. The global economic and political climate remains supportive of safe-haven assets, reinforcing gold’s bullish outlook. The US GDP report provided a catalyst for XAU/USD, pushing it above the late October high near $2,790.

XAU/USD – H4 Chart

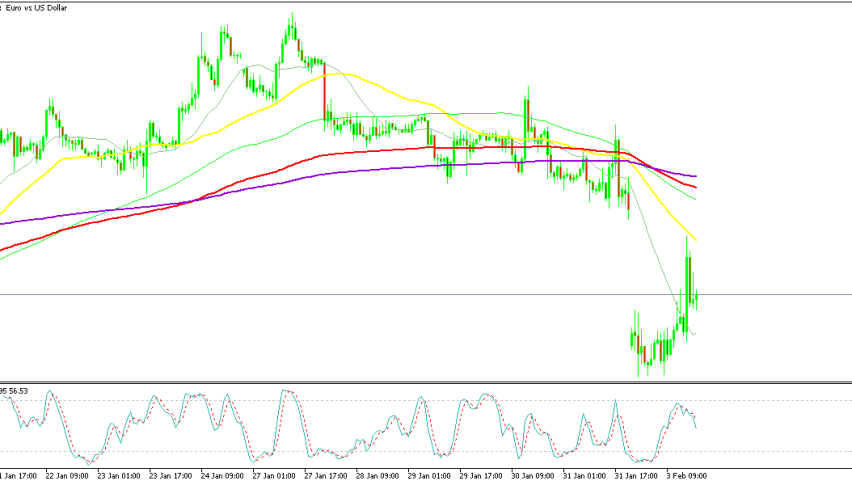

EUR/USD Falls Below 1.04

Meanwhile, the European Central Bank’s latest rate decision aligned with its December stance, delivering another dovish cut. This boosted the DAX to a new record and lifted broader European stock markets, though the euro saw only a temporary spike. EUR/USD briefly jumped 60 pips to 1.0460 but quickly retreated, later falling below 1.04 following tariff-related comments from Donald Trump.

EUR/USD – Daily Chart

Cryptocurrency Update

Bitcoin Remains Supported by MAs

BITCOIN also experienced heightened volatility, dipping to the low $90,000s after the ECB’s rate cut and briefly dropping below $90,000. A rebound toward $95,000 met resistance at the 20-day SMA, but overall, Bitcoin has surged 10% in the past week, peaking near $110,000 before stabilizing around $100,000. Positive sentiment has been reinforced by remarks from Republican Senator Cynthia Lummis, who remains optimistic about crypto regulation.

BTC/USD – Daily chart

Ethereum Faces the 50 SMA Again

ETHEREUM mirrored Bitcoin’s fluctuations, initially finding support near its 50-day SMA before slipping below $3,500 and later under $3,200. A broad crypto sell-off briefly pushed ETH below $3,000, but strong buying lifted it back above $3,500. Despite resistance at the 20-day SMA, broader crypto market strength has helped Ethereum stabilize, with the potential for further gains if buying pressure sustains.

ETH/USD – Daily Chart