Daily Crypto Signals: Bitcoin Surges Past $104K, XRP Hits $3.10 as Trump Expands Crypto Initiatives

Today, the crypto market saw notable changes as former US President Donald Trump increased his crypto presence via crypto merchandise sales

Live BTC/USD Chart

Today, the crypto market saw notable changes as former US President Donald Trump increased his crypto presence via crypto merchandise sales while the Czech National Bank deliberates on a revolutionary Bitcoin investment strategy. These events coincide with institutional interest in other digital assets and Bitcoin trading above $104,000.

Crypto Market Developments

Today’s crypto scene saw many significant changes driven by Trump’s unexpected endorsement of digital assets via his memecoin’s integration with retail transactions. Three specialized websites allow one to buy sneakers, watches, and fragrances using the Official Trump (TRUMP) token. For Trump, who had attacked the value of cryptocurrencies as “based on thin air,” this is a stunning turn-about.

The Czech National Bank’s potential $7.3 billion Bitcoin investment plan, representing 5% of its $146 billion reserves, could mark a watershed moment for institutional crypto adoption. According to Bitwise’s head of research André Dragosch, these purchases would equal approximately 5.3 months of newly mined Bitcoin supply.

Bitcoin Rallies Above $104,000

After the Federal Reserve’s FOMC meeting, Bitcoin BTC/USD showed resiliency and briefly touched $104,682 while the Fed kept present interest rates. Futures market activity drove the price movement mostly; short positions saw $15 million in liquidations over one hour. To maintain price acceleration above $105,000, analysts note, however, consistent increase in spot purchasing and the comeback of the Coinbase premium will be required.

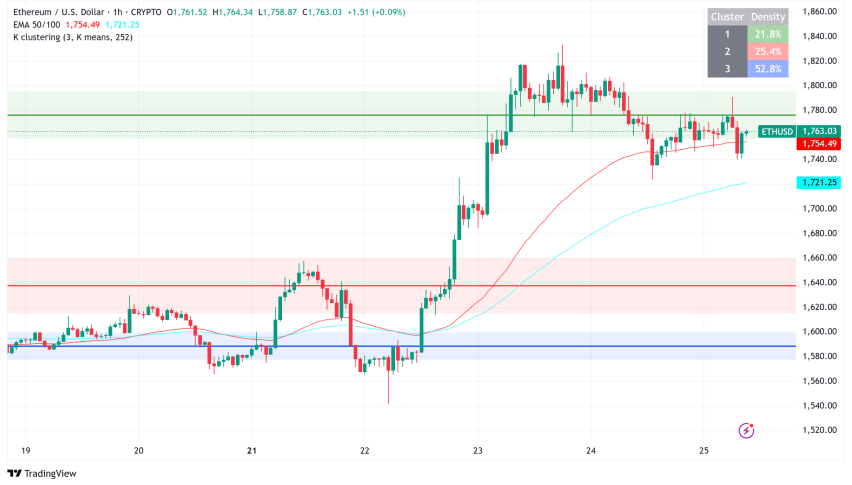

Why Ethereum Remains Under $3,500

Ethereum ETH/USD still finds difficulties keeping momentum above $3,500. Underperforming the larger market, the bitcoin has dropped 8% within the past thirty days. This flaw exists even with the Pectra update scheduled and expectation of spot ETF releases. The difficulties Ethereum faces come from more onchain activity, especially from Solana in the DEX area and Tron in the stablecoin market.

XRP Facing Bull Trap Under $3?

Since January 15, XRP XRP/USD has showed remarkable resilience keeping values above $3. Set to end its biggest monthly candle, the altcoin exceeds its previous high of $2.07 by more than forty percent. Although recent rallies have been fueled by retail investors, technical study points to a possible liquidity trap beneath $3, with chances for a 45% upswing to $4.50-$5.00 range following a bull flag pattern breakout.

Solana’s DEX Share on the Rise

Rising to around 89.7% of the DEX market’s share in late December and keeping over 50% share in recent weeks, Solana SOL/USD has become a major player in this market. The low prices, rapid transaction speeds, and developer-friendly tools of the blockchain help to explain its success. About 70% of Solana’s volume comes from Jupiter, the primary DEX platform; meanwhile, new memecoin releases—including the Official Trump token—have increased network activity even further.

Top Altcoins to Watch Today

Key altcoins showing significant technical setups include:

- BNB BNB/USD defending $635 support with resistance at $745, suggesting potential range-bound trading

- Dogecoin DOGE/USD testing critical $0.30 support after breaking below its ascending channel pattern

- Cardano ADA/USD maintaining its $0.80-$1.18 range with strong buying interest at support levels

- Chainlink LINK/USD consolidating near moving averages with potential breakout target at $27.41

- Avalanche testing crucial support between $30.59-$32.31, with bears pushing for further downside

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account