AUDUSD Tests Support After the in Australian Inflation?

AUD/USD failed to hold above 0.63 last week and reversed lower, as Australian inflation misses expectations, increasing odds of a RBA rate cut in the next meeting.

AUD/USD Faces Fresh Bearish Pressure Amid Global Tariffs

The AUD/USD pair had initially shown signs of recovery last week, buoyed by the softening of the USD after the postponement of Trump’s tariffs. However, the pair is now encountering fresh negative momentum, having dropped 1 cent this week and trading below the $0.63 level. Immediate resistance appears at $0.6330 (Friday’s high) and the $0.63 mark, where the 50-day SMA is situated. On the downside, support is found around $0.62, and if selling pressure accelerates, additional support lies between $0.6150 and $0.61.

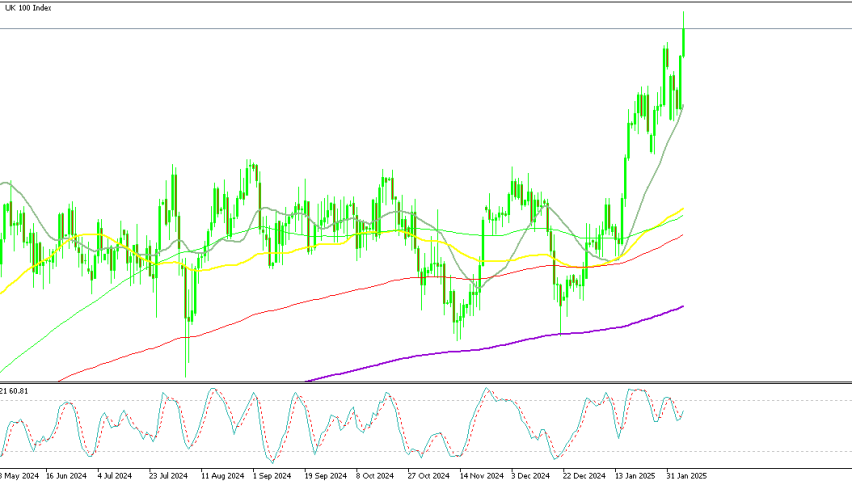

AUD/USD Chart Daily – Rejected at the 50 SMA

Since early 2021, the AUD/USD has been in a prolonged downtrend, consistently printing lower highs. The pair has shed a significant 9.5 cents since reversing below $0.70 in late September. Although it briefly stalled at the crucial support level of $0.62, the recent breach below $0.6270 (a two-year low) highlights the intensifying negative momentum. The Federal Reserve’s more hawkish tone, despite a 25-basis point rate cut, has further pressured the pair, with markets closely watching today’s FOMC announcement. This shift in global monetary policy suggests that further declines are likely, especially if key support levels give way, and the AUD/USD could be heading toward the $0.60 level.

Australian Q4 2024 Inflation Data Overview

Headline Inflation (YoY):

- 2.4% (lower than expected 2.5%, prior 2.8%)

- Continues the downward trend seen in recent quarters

- Indicates gradual disinflation, easing pressure on consumer prices

- Quarterly Inflation (QoQ):

- +0.2% (below forecast of 0.3%, prior 0.2%)

- A slower pace of price increases, reflecting weaker demand and stable costs in key sectors

Core Inflation Measures

- Trimmed Mean Inflation (Preferred Core Measure by RBA):

- 3.2% YoY (slightly below expectations of 3.3%, prior 3.5%)

- 0.5% QoQ (lower than forecast of 0.6%, prior 0.8%)

- Suggests underlying price pressures are moderating but remain elevated

- Weighted Median Inflation (Alternative Core Measure):

- 3.5% YoY (in line with expectations, prior 3.8%)

- Reflects sticky core inflation, particularly in services and essential goods

Australian inflation continued to decelerate in Q4 2024, with both headline and core inflation measures coming in softer than expected. The decline in annual inflation to 2.4% YoY and core trimmed mean to 3.2% YoY suggests that price pressures are easing. The lower-than-expected quarterly inflation figures reinforce the view that the Reserve Bank of Australia (RBA) may be nearing the end of its tightening cycle. However, with core inflation still above the RBA’s target, policymakers may remain cautious before shifting to a more accommodative stance. Markets will closely watch upcoming economic data and RBA commentary for clues on future policy direction.