Ethereum Technical Analysis Points to Gradual Recovery Despite Strong Fundamentals

Ethereum (ETH) currently trades at $3,200, showing signs of recovery after a significant 20.7% correction in mid-January that saw the price

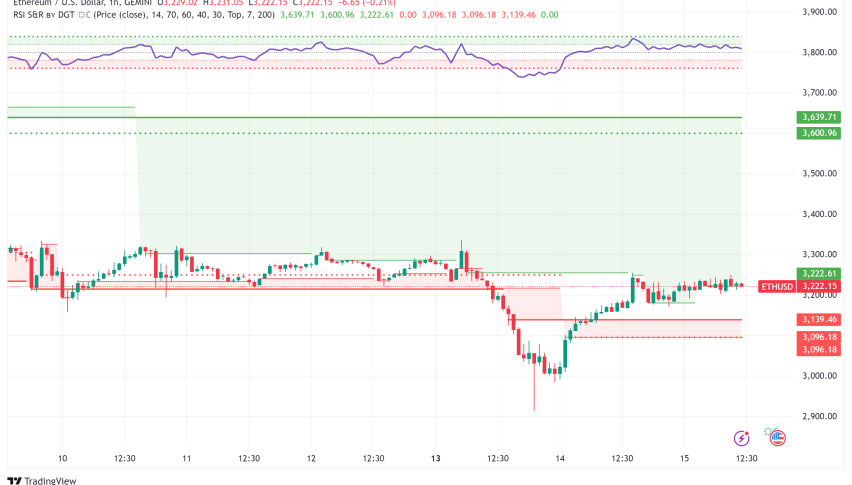

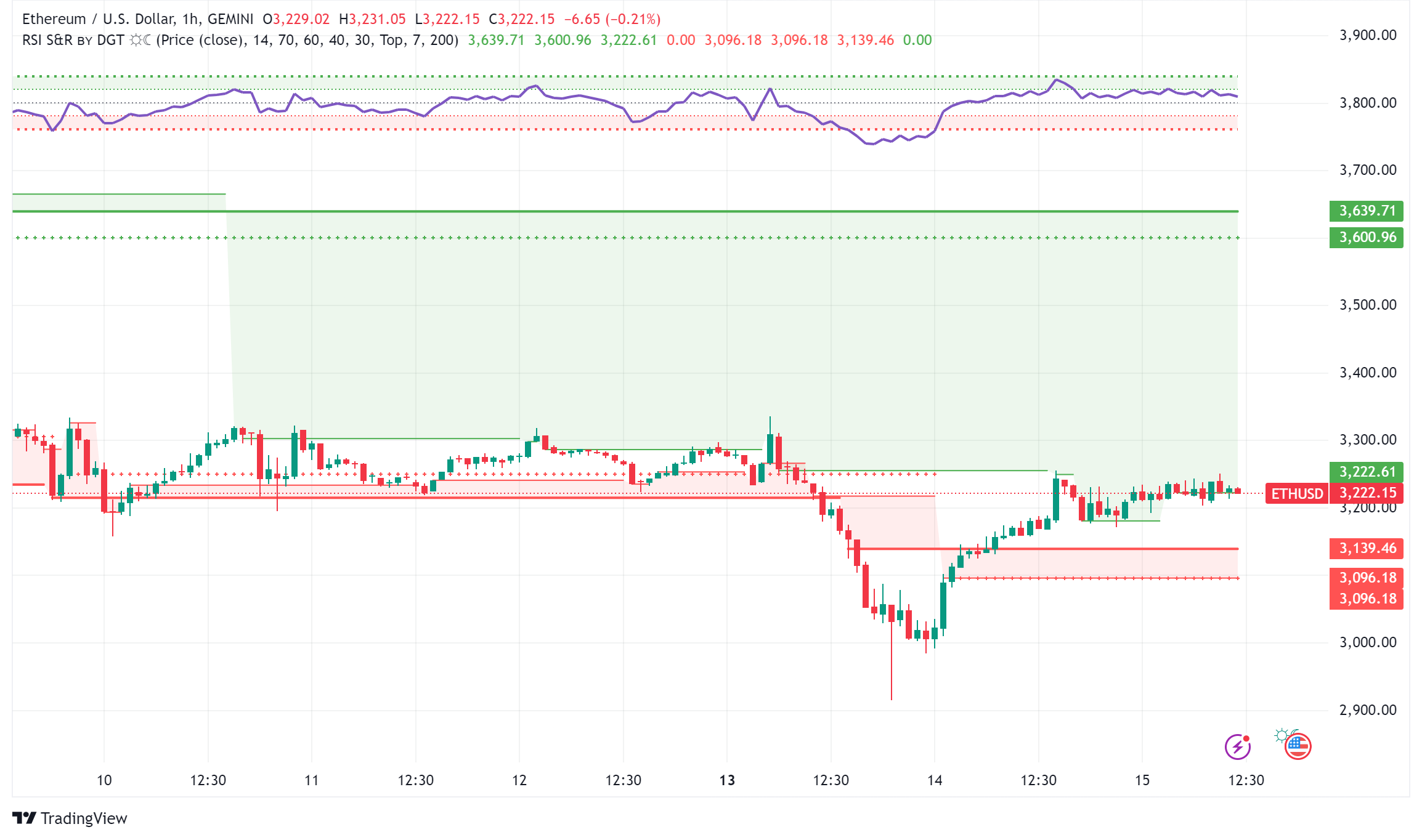

Live ETH/USD Chart

Ethereum (ETH) currently trades around $3,200, showing signs of recovery after a significant 20.7% correction in mid-January that saw the price drop to $2,924.

While derivatives data and on-chain metrics suggest underlying strength, analysts predict a measured pace of recovery for the leading altcoin.

Ethereum’s Institutional Investors Flash Mixed Signals

Recent data reveals contradicting institutional mood; ETH ETFs saw four straight days of outflows totaling $354 million. Deratives markets, on the other hand, show a different picture; open interest in ETH’s long-term prospects remains 40% greater than in November, implying ongoing institutional interest in this asset.

On-Chain Metrics Suggest ETH Accumulation

In spot markets, a clear trend has developed: over 300,000 ETH left exchanges to private wallets the previous week. Though short-term market turbulence, this notable drop in exchange reserves usually indicates long-term holding intentions from investors.

Ethereum Network’s Fundamentals and Challenges

Even although Ethereum dominates the DeFi market with $64.5 billion in total value locked (TVL), problems still exist. Still costlier than rivals like Solana and BNB Chain are network fees averaging $2.70. Furthermore affecting attitude are still issues with layer-2 security and value accrual.

ETH/USD Technical Analysis

The immediate technical picture shows ETH/USD facing significant opposition at $3,550, corresponding with several important Simple Moving Averages (SMAs). With possibility for retesting 2024’s high of $4,105, breaking this level might open the road towards $3,776. But neglect to keep support at $3,216 could cause prices to return to the psychological $3,000 barrier.

Ethereum Price Prediction and Future Outlook

Forecasts for ETH’s 2025 performance range among market analysts. Some analysts estimate possible prices by year-end to be $14,000, especially if expected institutional adoption through ETFs comes to pass. Nevertheless, this positive view mostly hinges on effective execution of intended network improvements and more general state of the market.

“While ETH derivative markets show moderate optimism, the path to sustained recovery requires clearing several technical and fundamental hurdles,” adds a well-known market analyst. “Determining Ethereum’s price path will mostly depend on its technical roadmap’s success and its capacity to solve scaling issues.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account