Looking to Buy the Pullback in USDCAD After Miss in Canada Retail Sales

USDCAD retreated 1 cent lower on Friday after soft US PCE inflation, but the bullish trend is strong and the Canadian economy is pretty weak

USDCAD retreated 1 cent lower on Friday after soft US PCE inflation, but the bullish trend is strong and the Canadian economy is pretty weak, so we are looking to open a buy USD/CAD signal.

The latest retail sales report from Canada released on Friday came in below expectations, though the prior month’s figures were revised higher. Despite this, core sales and ex-auto performance remained notably weak. In the forex market, USD/CAD reacted to softer-than-expected PCE data from the U.S., which initially pressured the USD and this pair lower, but found support on the H4 chart, keeping the lager bullish trend on.

USD/CAD Chart H4 – The 20 SMA Held As Support

After spiking 1.5 cents on the back of the Federal Reserve’s hawkish tone, USD/CAD dropped over 1 cent on Thursday but found support around the 1.4340 level. From there, the pair rebounded, driven by strong U.S. economic data, including positive home sales and unemployment claims, which underscored resilience in the U.S. economy. The 20SMA provided technical support, enabling USD/CAD to close slightly higher despite Friday’s dip following weak PCE inflation data, while the softer retail sales data from Canada helped the buyers somewhat.

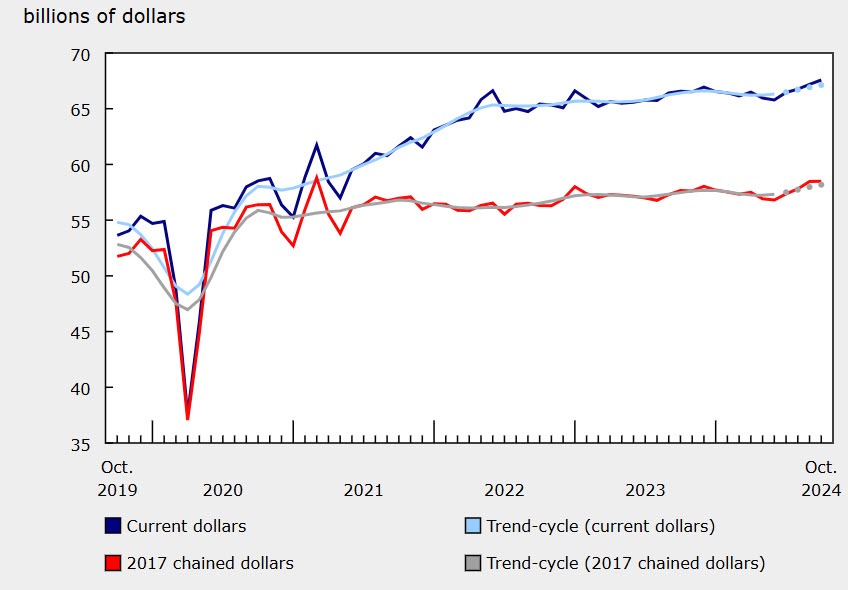

Canada Retail Sales Report for October 2024![Canada retail sales]()

- Headline Retail Sales: +0.6% vs +0.7% expected (prior month revised up from +0.4% to +0.6%).

- Excluding Auto: +0.1% vs +0.5% expected (prior month revised up to +1.1% from +0.9%).

- Core Retail Sales: +0.2% (excludes gasoline stations, fuel vendors, and motor vehicle/parts dealers).

- Sector Performance: Sales rose in 5 of 9 subsectors, led by motor vehicle and parts dealers.

Details of October Report:

- Motor Vehicle & Parts Dealers: Largest increase at +2.0%, driven by new and used car dealers (+2.5% each).

- Automotive Parts, Accessories & Tire Retailers: Declined by -3.3%.

- Gasoline Stations & Fuel Vendors: Decreased by -0.5%, marking six consecutive months of declines.

- Volume Sales at Gasoline Stations: Fell -4.7% after a +4.1% increase in September.

Advanced Estimate for November:

- Retail Sales: Estimated to remain relatively unchanged.

- Caveats:

- Advance figure is unofficial and subject to revision.

- Based on responses from 50.6% of surveyed companies (final average survey response rate is 88.7%).

Looking ahead, the pair remains in a strong uptrend. Expectations for renewed buying momentum are bolstered by the Bank of Canada’s challenges, particularly after a weaker-than-expected Canadian CPI inflation report earlier this week, which has increased pressure to ease rates further. Buyers may look to reenter positions on Monday, given the favorable market dynamics.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account