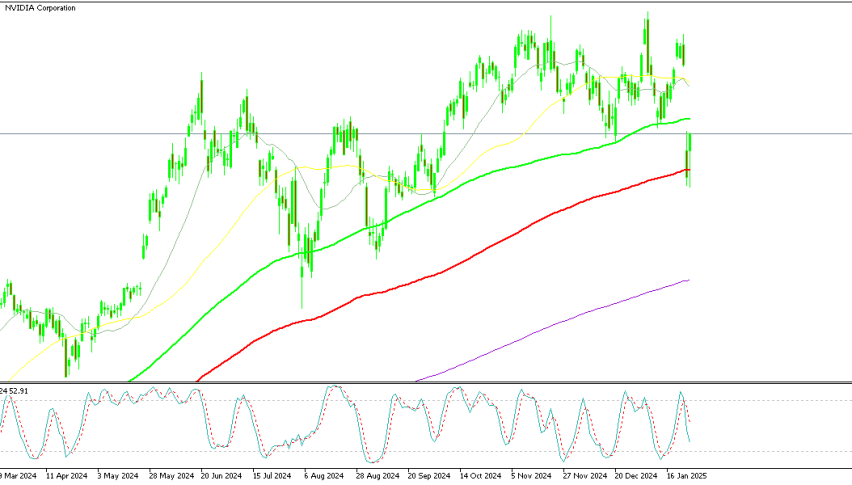

Nvidia Falls Again, Enters Correction Phase

Nvidia’s stock fell in the first trading session of the week officially placing the AI chip darling in correction territory.

The stock has recently experienced a slow period. The blue-chip stock is 11% below its closing high of $148.88 last month. A market correction can be defined in a variety of ways. For most people, it represents a decline of at least 10% from a record-high close.

Nvidia’s recent poor performance may indicate some Wall Street profit-taking following another spectacular year. Data center demand has increased since ChatGPT’s late 2022 launch, which helped Nvidia’s fortune.

The chipmaker and de facto artificial intelligence trade has risen 166% in 2024 amid interest in the popular technology trend continues to grow.

The $125–$130 mark is a crucial test for the stock and the market as a whole. Other chipmakers’ stocks have done well despite Nvidia’s difficulties, with Broadcom hitting new highs on Monday. The stock jumped about 11% on Monday following a strong earnings report, continuing its 24 percent rally from Friday, which saw it surpass $1 trillion in market capitalization.

In addition, other semiconductor stocks saw a strong Monday, with Micron Technology rising roughly 6% ahead of this week’s quarterly results. On Semiconductor and Taiwan Semiconductor each saw an increase of about 1%, while Marvell Technology and Lam Research saw gains of 3% and 2%, respectively.