DAX: Mixed PMI Data Adds to Diminishing Investor Confidence

Manufacturing data showed a larger than expected contraction as market sentiment turns bearish on week’s open

- Mixed preliminary PMI data

- Market sentiment turns bearish on week open

- ECB enthusiasm diminishes

The DAX opened down 0.30% this morning as investor sentiment turns bearish on profit taking and eventless week. The main news for the week will be from the FOMC meeting on Wednesday.

The market is expecting a 0.25% interest rate cut, what may create further volatility is the post-meeting press conference.

From Germany we will get Ifo Business Climate and ZEW Economic Conditions on Tuesday, and GfK Consumer Confidence on Thursday.

DAX Live Chart

Mixed PMI Data

Preliminary PMI data today showed manufacturing still in contraction. Manufacturing PMI printed at 42.5 down from last month’s reading of 43, and lower than analysts’ expectations of 43.8.

Whereas Preliminary Services PMI data showed expansion to 51 after last month’s contraction to 49.3. Positive surprise on this one as analysts had expected another decline to 49.2.

The Composite PMI preliminary showed an overall contraction of 47.8, slightly worse than expected at 48. But also, better than last month’s reading of 47.2.

DAX Market Sentiment Languishes

Investors in the DAX index are beginning to cash in on some profits at this week’s open. The ECB decision is out of the way and the perception of loosening monetary policy is well priced into the market.

This’s week’s FOMC meeting might add some fuel to the market if Powell delivers a dovish press conference. But I have the feeling the market is lacking positive data to continue holding a rally of this strength.

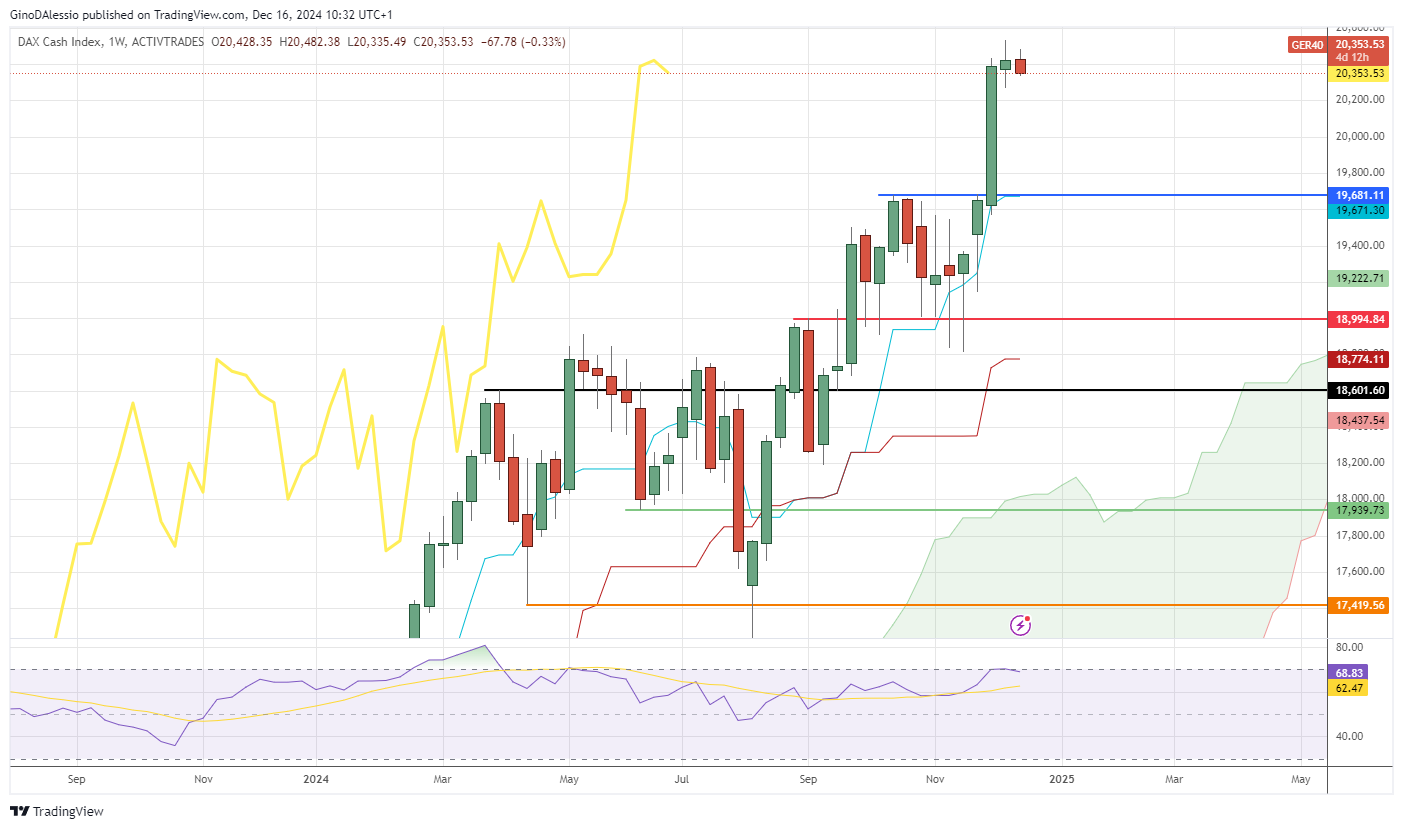

DAX Weekly Chart

The weekly chart above for the DAX shows a market undergoing a strong bullish trend. The market is above the Ichimoku cloud, and the trend is clear.

However, last week’s candle produced a baby body after the previously large green candle. Indicating the rally may be running out of steam.

The RSI also failed to break above the level of 70 for the last two green candles. Again, indicating a lack of momentum in this surge to new all-time highs. I would expect this week to close lower than today’s open.