Staying Short on EUR/GBP as ECB Cuts GDP and HICP Inflation Forecasts

EUR/GBP jumped 50 pips higher yesterday after the ECB cut, but looking deeper into the details, the ECB remains dovish on the Eurozone econo

EUR/GBP jumped 50 pips higher yesterday after the ECB cut, but looking deeper into the details, the ECB remains dovish on the Eurozone economy, which should keep the Euro on the back foot and EUR/GBP bearish.

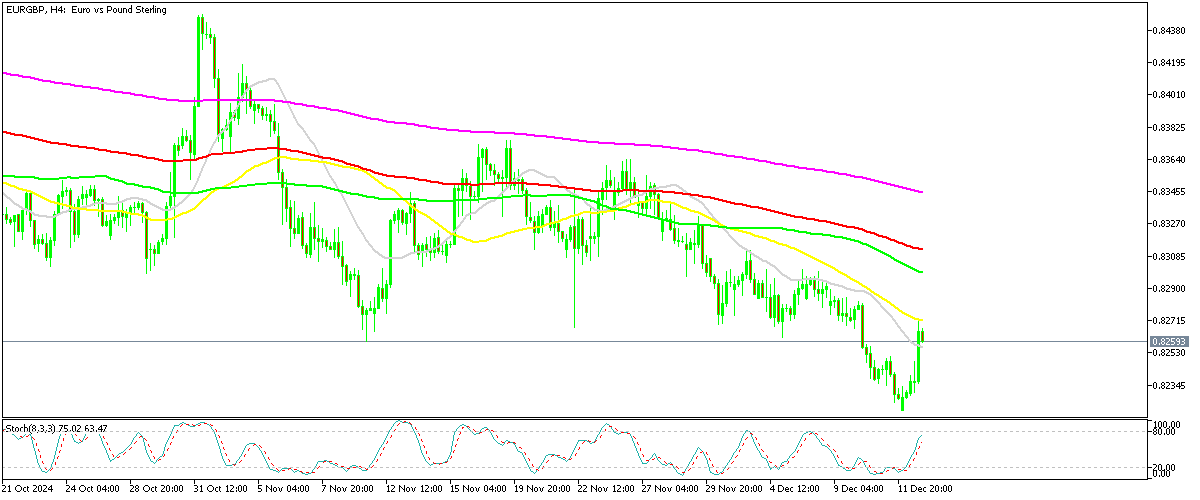

The EUR/GBP has been in a persistent downtrend since 2022, reflecting sustained weakness in the euro relative to the pound. This week, the pair hit a two-year low of 0.8220 before rebounding by 50 pips following the European Central Bank’s widely expected 25 basis point rate cut.

Despite the brief recovery, the downward trend remains intact. The pair is now approaching an eight-year low near the 0.8200 mark, with its latest upward move halted at the 50 SMA on the H4 chart. The technical setup underscores continued bearish momentum for the pair.

Drivers of Price Action in EUR/GBP

- ECB Rate Decision: The ECB lowered its benchmark interest rate from 3.25% to 3.0%, aligning with market expectations.

- Lagarde’s Economic Outlook: During the post-meeting press conference, ECB President Christine Lagarde painted a bleak picture of the Eurozone economy, highlighting ongoing challenges and political instability in the bloc’s largest economies. This dovish tone further pressured the euro.

- Inflation and Growth Forecasts: The ECB revised down its GDP and HICP inflation projections, signaling a more cautious stance on monetary policy despite inflation remaining above target.

Eurozone Economic Context

The Eurozone faces significant headwinds, with sluggish growth and political uncertainties, particularly in France and Germany, amplifying economic pressures. The ECB’s decision to lower borrowing costs reflects these challenges and underscores the need for accommodative measures to support the region’s fragile recovery.

HICP Inflation Forecasts (Headline Inflation):

- 2024: Revised down to 2.4% (from 2.5%).

- 2025: Revised down to 2.1% (from 2.2%).

- 2026: Revised down to 1.9% (from 2.0%).

- 2027: Introduced a new forecast at 2.1%.

Core HICP Forecasts (Excluding Energy & Food):

- 2024: Unchanged at 2.9%.

- 2025: Unchanged at 2.3%.

- 2026: Revised down to 1.9% (from 2.0%).

- 2027: Introduced a new forecast at 1.9%.

GDP Growth Forecasts:

- 2024: Revised down to 0.7% (from 0.8%).

- 2025: Revised down to 1.1% (from 1.3%).

- 2026: Revised down to 1.4% (from 1.5%).

- 2027: Introduced a new forecast at 1.3%.

The revised forecasts reflect the ECB’s cautious outlook for both inflation and growth, underscoring the challenges facing the Eurozone. Persistent softness in GDP growth coupled with the gradual normalization of inflation points to an environment where policy adjustments remain necessary to balance economic recovery with price stability. These trends suggest room for further monetary easing, leaving the ECB in a predominantly accommodative stance for the foreseeable future, with markets already pricing in two more 25 bps cuts to come.

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account