Forex Signals Brief December 11: Another 50 bps BOC Cut and US CPI on Agenda

Today the US CPI consumer inflation is expected to tick higher again, while the Bank of Canada is expected to deliver another 50 bps rate cut.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The Reserve Bank of Australia (RBA) concluded its meeting without altering interest rates, maintaining its current policy stance. This decision follows earlier signals from the RBA that suggest a shift to a more dovish tone, which has weighed heavily on the Australian dollar. The currency approached its lowest levels of the year, exacerbated by growing concerns over Chinese stimulus measures failing to meet optimistic expectations set by policymakers. During early Tuesday trading in North America, the US dollar climbed to its highest levels of the day but weakened later in the session. These moves lacked significant fundamental drivers.

Meanwhile, the USD/JPY pair strengthened for a second consecutive day as US Treasury yields edged higher. However, the rise in both yields and the currency pair was capped after a 3-year Treasury note auction yielded slightly below market expectations. Gold continues to demonstrate robust performance, bolstered by renewed bullion purchases from China. This demand surge has provided strong support for gold prices, highlighting its appeal amid fluctuating market conditions.

Today’s Market Expectations

US CPI Expectations

The upcoming US CPI report is expected to show a slight rise in inflation. The headline CPI (Year-over-Year) is forecasted to edge up to 2.7% from 2.6%, while the Month-over-Month measure is anticipated to remain steady at 0.2%. For the Core CPI (Year-over-Year), the figure is projected to stay unchanged at 3.3%, with the Month-over-Month reading holding at 0.3%.

Federal Reserve Rate Cut Outlook

The market is heavily leaning toward the Federal Reserve implementing one rate cut at the next FOMC meeting, with an 85% probability factored in. Additionally, three rate cuts are priced in by the end of 2025. However, a particularly strong CPI report could deter the Fed from executing the December cut.

If inflation data aligns with expectations or trends lower, significant market movement is unlikely. However, such a scenario would likely result in a US dollar selloff and a rally in bond prices, further cementing the case for rate reductions in the coming months.

Bank of Canada’s Rate Decision

The Bank of Canada (BoC) is anticipated to lower interest rates by 50 basis points, bringing its policy rate down to 3.25%. Over recent weeks, market expectations have wavered between a 25 and 50 basis point reduction. A higher-than-expected CPI report briefly tilted odds toward a smaller cut, but a weaker-than-expected GDP report and a lackluster labor market update solidified the case for a 50 basis point move.

Yesterday the volatility increased particularly for commodity dollars, which declined by around 1 cent, while Gold surged higher. Yesterday we had five closed trading signals, four of which being winning forex signals, with just a loser in Dow Jones.

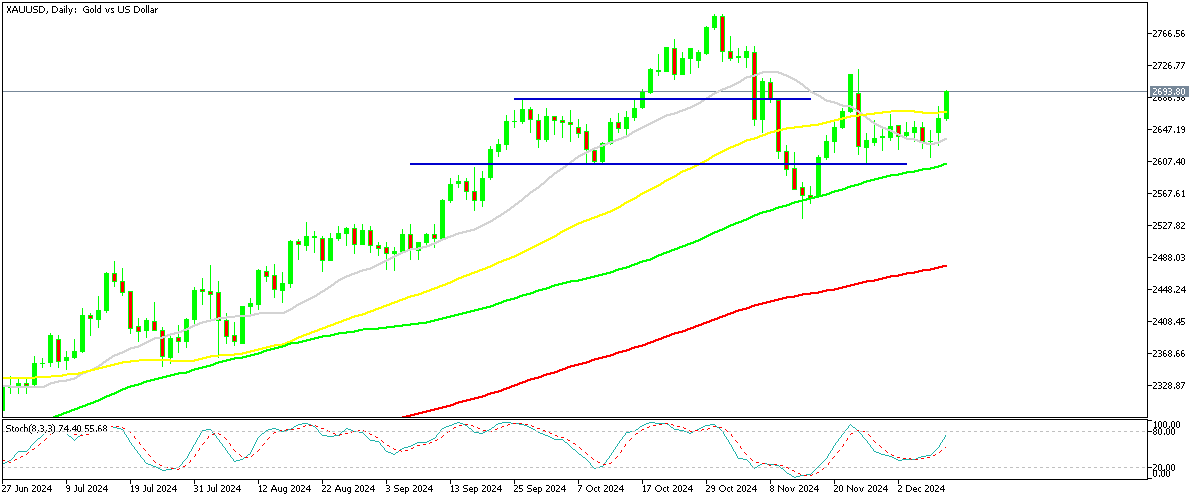

Gold Continues the Consolidation Between MAs

Gold prices climbed $60 to $2,695 as the People’s Bank of China (PBOC) resumed its gold-buying program after a pause. During trading, prices briefly rose above the 50-day Simple Moving Average (SMA) before retreating below it. This rebound follows a $100 price drop earlier this year when China halted purchases at $2,400/oz. The PBOC’s renewed buying at prices above $2,600/oz signals a strong revival in demand, suggesting bullish momentum in the gold market.

XAU/USD – Daily Chart

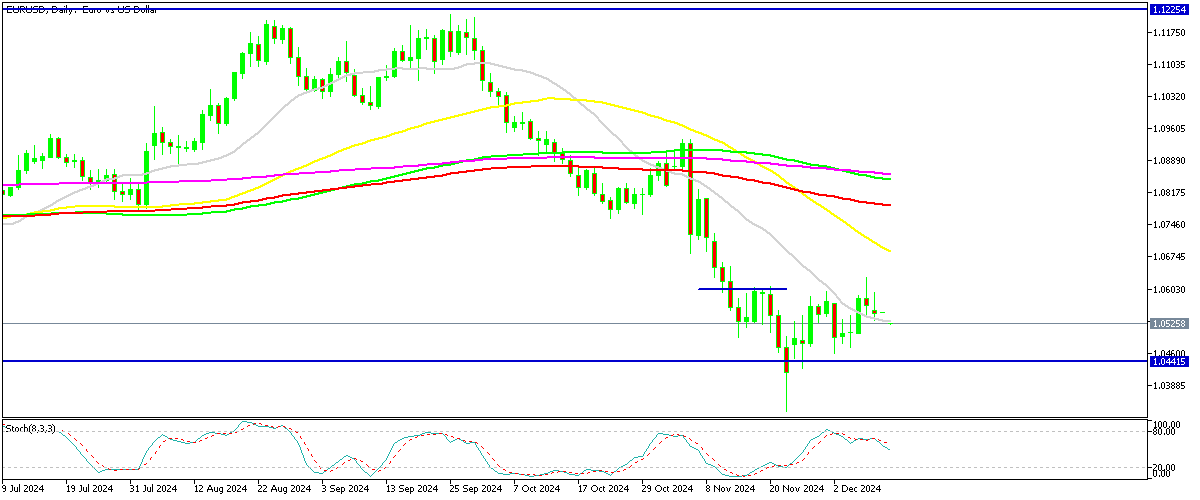

EUR/USD Returns to 1.05 Again

The EUR/USD pair remains cautious as traders await the US inflation report. The European Central Bank (ECB) is also set to announce its third consecutive rate cut this week, reducing rates by 25 basis points. Despite seller attempts, the pair has held above the critical 1.05 level. If the CPI figures come in lower than expected, EUR/USD could surge past 1.06, signaling potential upward movement.

EUR/USD – Daily Chart

Cryptocurrency Update

Bitcoin Dips Below $95K but Bounces Again

Bitcoin reached a historic milestone, closing at $102,000 in early European trading, marking its first time above $100,000. Analysts are forecasting ambitious targets of $120,000 or higher, contingent on the ability of buyers to sustain prices above the $100,000 threshold. Former President Trump’s cryptic comment, “You’re welcome,” was widely interpreted as an implicit endorsement, providing a psychological boost to the market.

BTC/USD – Daily chart

Ethereum Heads for $3,500

Ethereum mirrored Bitcoin’s volatility, initially falling below $3,000 before staging a robust recovery. It is now trading near $4,000, firmly above $3,500 and surpassing its 50-day SMA. The rally underscores growing investor confidence in the cryptocurrency space, with Ethereum leading the charge due to optimistic expectations of future price gains. This momentum reflects the broader strength and resilience of digital assets in the market.

ETH/USD – Daily chart